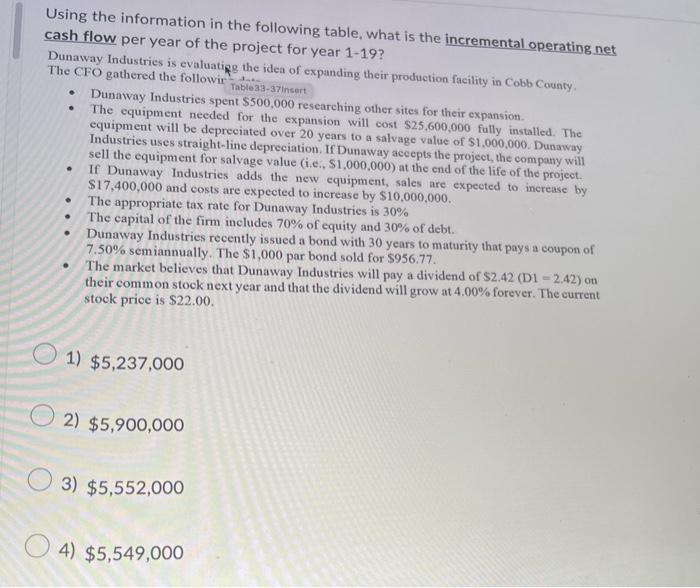

Question: Using the information in the following table, what is the incremental operating net cash flow per year of the project for year 119 ? Dunaway

Using the information in the following table, what is the incremental operating net cash flow per year of the project for year 119 ? Dunaway Industries is evaluatigg the idea of expanding their production facility in Cobb County. The CFO gathered the followir Table33-37insert - Dunaway Industries spent $500,000 researching other sites for their expansion. - The equipment needed for the expansion will cost $25,600,000 fully installed. The equipment will be depreciated over 20 years to a salvage value of $1,000,000. Dunaway sell the equipment for salvage value (i.e, $1,000,000 ) at the end project, the company will - If Dunaway Industries adds the new equipment, sales are expected to increase by $17,400,000 and costs are expected to increase by $10,000,000. - The appropriate tax rate for Dunaway Industries is 30% - The capital of the firm includes 70% of equity and 30% of debt. - Dunaway Industries recently issued a bond with 30 years to maturity that pays a coupon of 7.50% semiannually. The $1,000 par bond sold for $956.77. - The market believes that Dunaway Industries will pay a dividend of $2.42 (D1 =2.42 ) on their common stock next year and that the dividend will grow at 4.00% forever. The current stock price is $22.00. 1) $5,237,000 2) $5,900,000 3) $5,552,000 4) $5,549,000 1) $5,237,000 $5,900,000 $5,552,000 $5,549,000 $5,567,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts