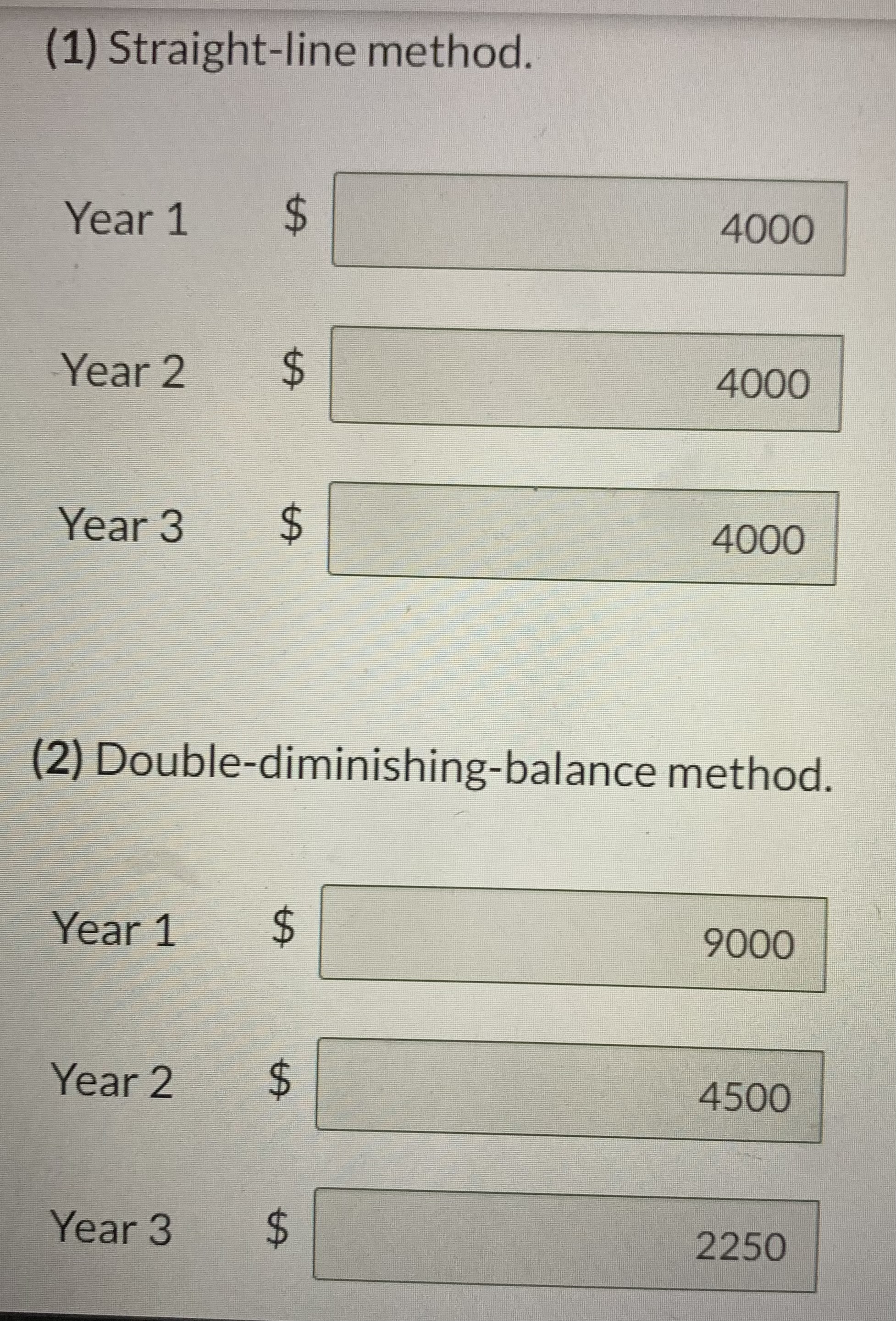

Question: Using the information in the images, can someone please help me Determine the impact on Net Income (total depreciation of the table plus any loss

Using the information in the images, can someone please help me Determine the impact on Net Income (total depreciation of the table plus any loss on disposal or less any gain on disposal) of each method over the entire three year period?

THANK YOU

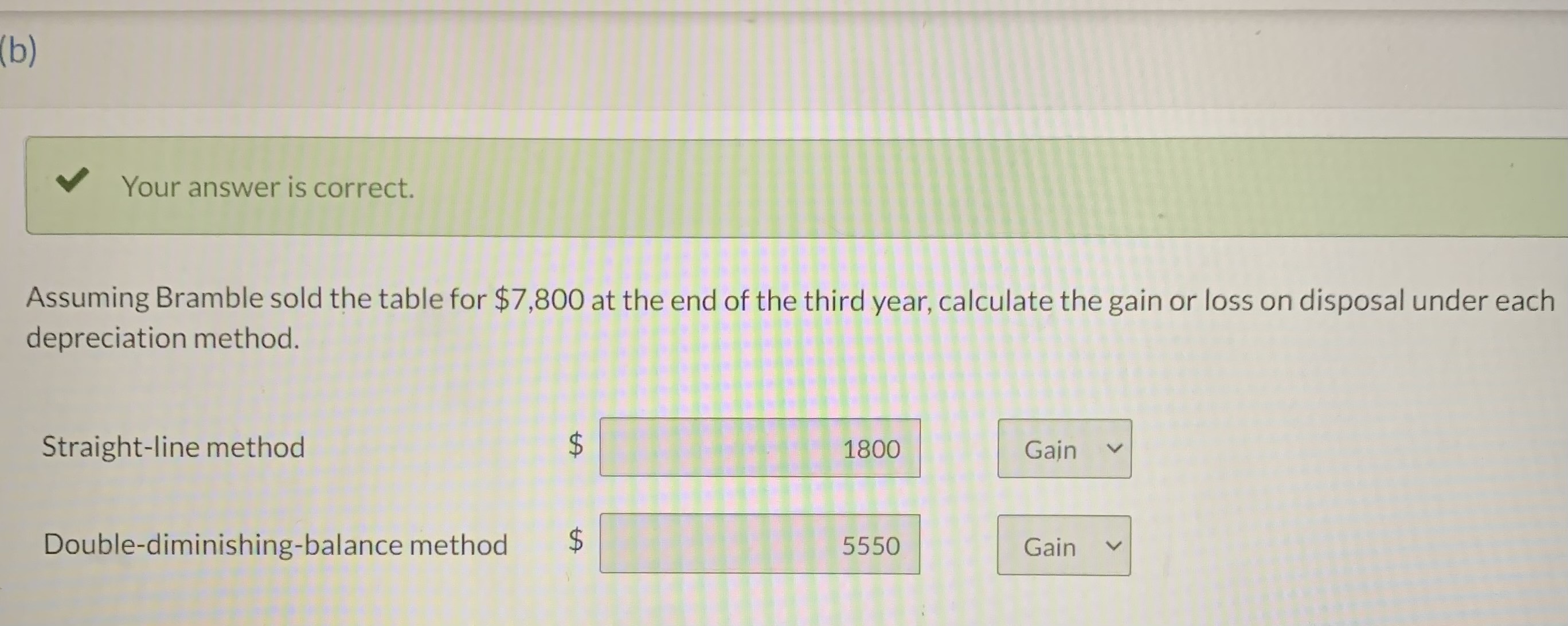

Bramble Corporation purchased a boardroom table for $18,000. The company planned to keep it for four years, after which it wa expected to be sold for $2,000. (a) Your answer is correct. Calculate the depreciation expense for each of the first three years under (1) the straight-line method, and (2) the doublediminishing-balance method, assuming the company purchased the table early in the first month of the first year. (1) Straight-line method. Your answer is correct. Assuming Bramble sold the table for $7,800 at the end of the third year, calculate the gain or loss on disposal under each depreciation method. Straight-line method $ Double-diminishing-balance method $ (1) Straight-line method. Year 1$ Year 2$ Year 3$ (2) Double-diminishing-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts