Question: Using the information in the table provided with part B of this question, please compute the t-statistics for the slope coefficients associated with the book-to-market

Using the information in the table provided with part B of this question, please compute the t-statistics for the slope coefficients associated with the book-to-market and size variables. If the critical values for the t-test of statistical significance are +/- 1.669, are either of these coefficients significantly different from zero at the 10% level?

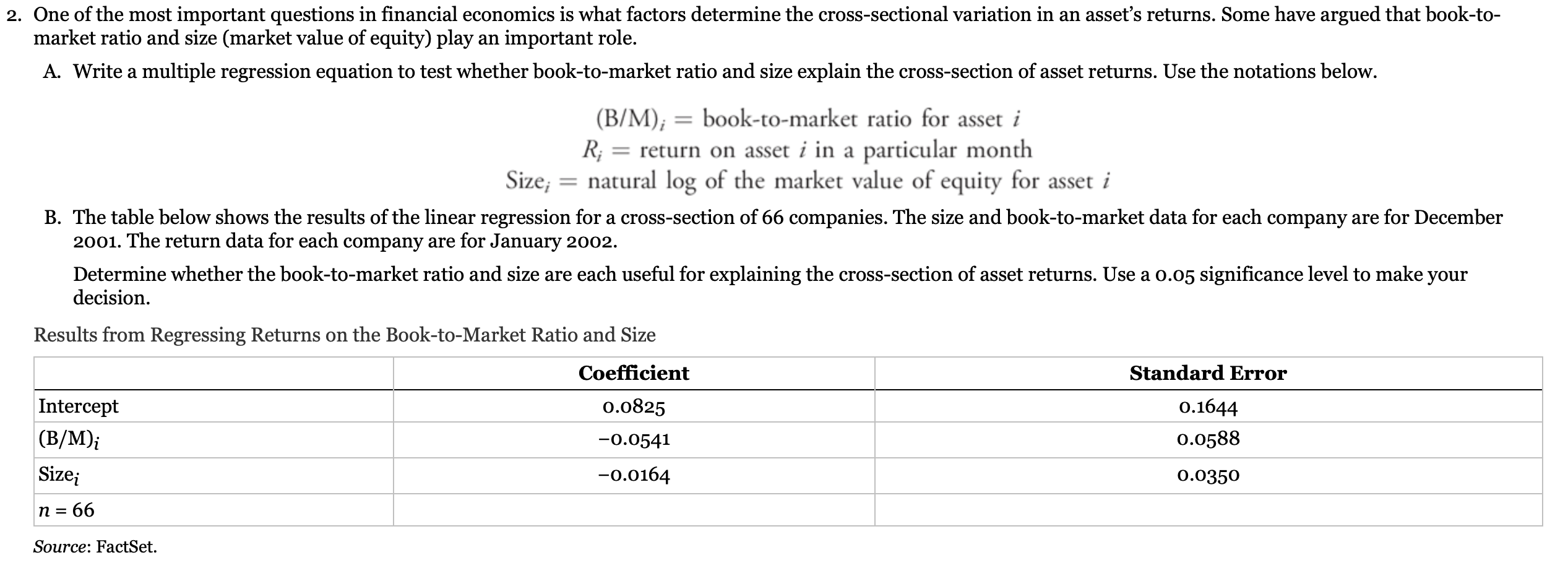

One of the most important questions in financial economics is what factors determine the cross-sectional variation in an asset's returns. Some have argued that book-tomarket ratio and size (market value of equity) play an important role. A. Write a multiple regression equation to test whether book-to-market ratio and size explain the cross-section of asset returns. Use the notations below. (B/M)i=book-to-marketratioforassetiRi=returnonassetiinaparticularmonthSizei=naturallogofthemarketvalueofequityforasseti B. The table below shows the results of the linear regression for a cross-section of 66 companies. The size and book-to-market data for each company are for December 2001. The return data for each company are for January 2002. Determine whether the book-to-market ratio and size are each useful for explaining the cross-section of asset returns. Use a 0.05 significance level to make your decision. Results from Regressing Returns on the Book-to-Market Ratio and Size

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts