Question: Using the information in the tables single-factor model. please calculate the expected excess return for this security using a Claythorne International Rogers and Rogers

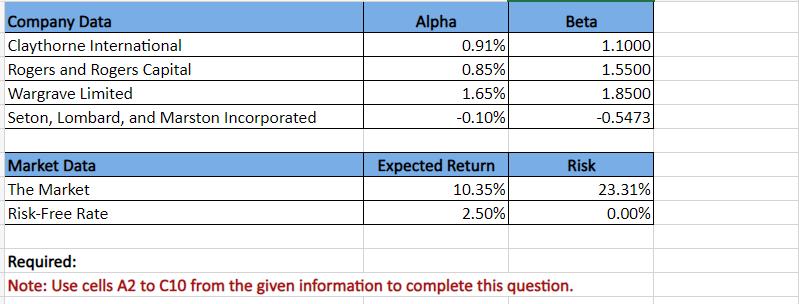

Using the information in the tables single-factor model. please calculate the expected excess return for this security using a Claythorne International Rogers and Rogers Capital Wargrave Limited Seton, Lombard, and Marston Incorporated Expected Return Company Data Claythorne International Rogers and Rogers Capital Wargrave Limited Seton, Lombard, and Marston Incorporated Market Data The Market Risk-Free Rate Required: Alpha Beta 0.91% 1.1000 0.85% 1.5500 1.65% 1.8500 -0.10% -0.5473 Expected Return Risk 10.35% 23.31% 2.50% 0.00% Note: Use cells A2 to C10 from the given information to complete this question.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts