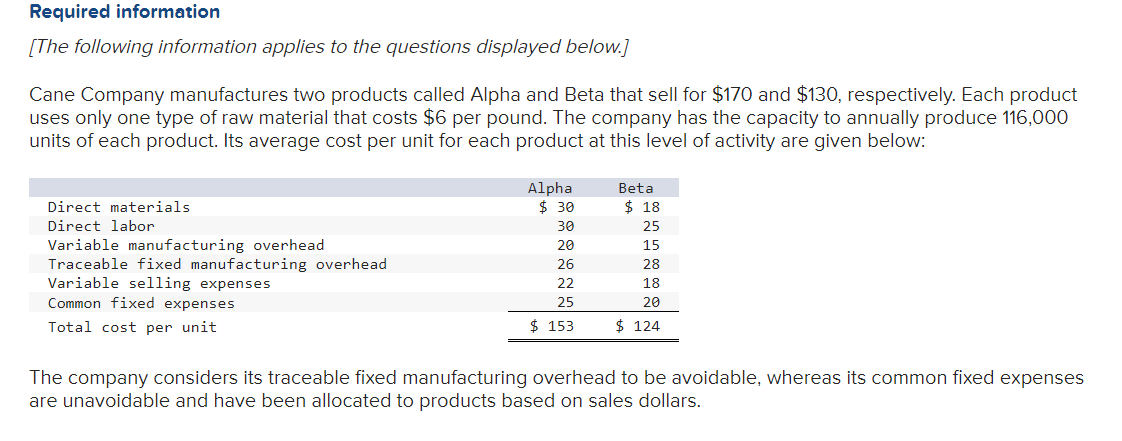

Question: Using the information on the table above, please answer the following: 6 . Assume that Cane normally produces and sells 1 0 0 , 0

Using the information on the table above, please answer the following:

Assume that Cane normally produces and sells Betas per year. What is the financial advantage disadvantage of discontinuing the Beta product line?

Assume that Cane normally produces and sells Betas per year. What is the financial advantage disadvantage of discontinuing the Beta product line?

Assume that Cane expects to produce and sell Alphas during the current year. A supplier has offered to manufacture and deliver Alphas to Cane for a price of $ per unit. What is the financial advantage disadvantage of buying units from the supplier instead of making those units?

How many pounds of raw material are needed to make one unit of each of the two products?

What contribution margin per pound of raw material is earned by each of the two products?

Assume that Canes customers would buy a maximum of units of Alpha and units of Beta. Also assume that the raw material available for production is limited to pounds. How many units of each product should Cane produce to maximize its profits?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock