Question: Shirley, a recent college graduate, excitedly described to her older sister the $1,830 sofa, table, and chairs she found today. However, when asked she

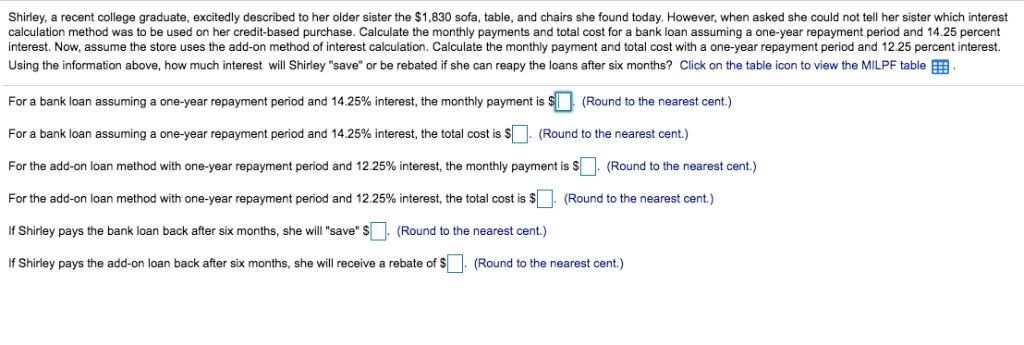

Shirley, a recent college graduate, excitedly described to her older sister the $1,830 sofa, table, and chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 14.25 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 12.25 percent interest. Using the information above, how much interest will Shirley "save" or be rebated if she can reapy the loans after six months? Click on the table icon t view the MILPF table For a bank loan assuming a one-year repayment period and 14.25% interest, the monthly payment is $ (Round to the nearest cent.) For a bank loan assuming a one-year repayment period and 14.25% interest, the total cost is $. (Round to the nearest cent.) For the add-on loan method with one-year repayment period and 12.25% interest, the monthly payment is $. (Round to the nearest cent.) For the add-on loan method with one-year repayment period and 12.25% interest, the total cost is $. (Round to the nearest cent.) If Shirley pays the bank loan back after six months, she will "save" $. (Round to the nearest cent.) If Shirley pays the add-on loan back after six months, she will receive a rebate of $. (Round to the nearest cent.)

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

ANSWER Explanation B 12680 a 16453 12681 b 197431 12682 c 17118 1... View full answer

Get step-by-step solutions from verified subject matter experts