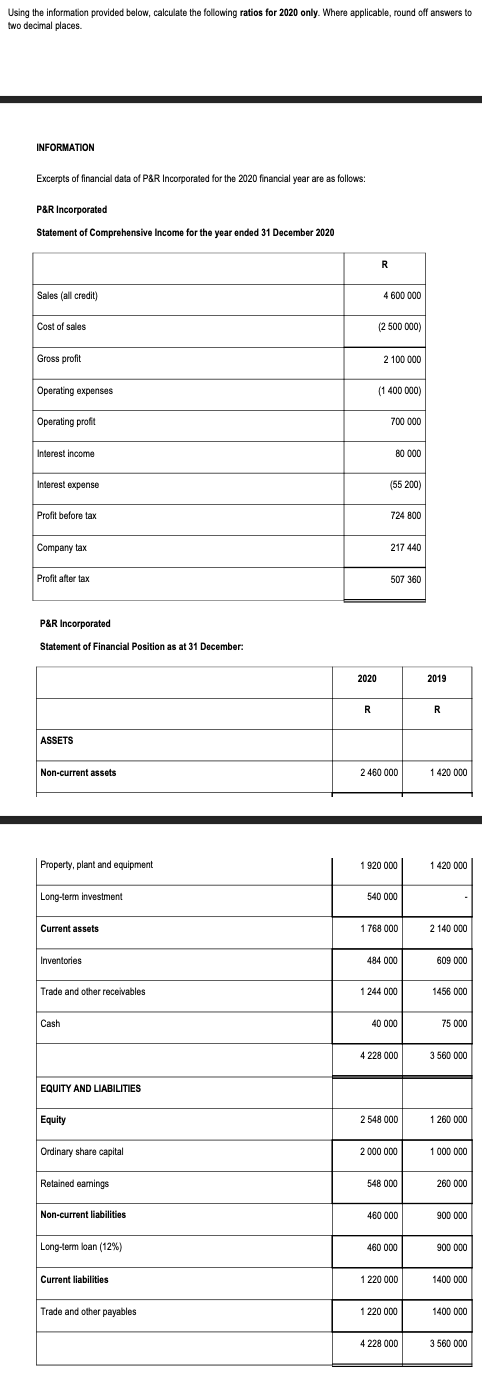

Question: Using the information provided below, calculate the following ratios for 2020 only. Where applicable, round off answers to two decimal places. INFORMATION Excerpts of financial

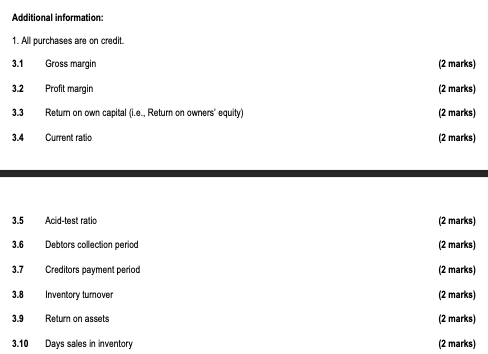

Using the information provided below, calculate the following ratios for 2020 only. Where applicable, round off answers to two decimal places. INFORMATION Excerpts of financial data of P&R Incorporated for the 2020 financial year are as follows: P&R Incorporated Statement of Comprehensive Income for the year ended 31 December 2020 R Sales (all credit) 4 600 000 Cost of sales 2 (2 500 000) Gross profit 2 100 000 Operating expenses (1 400 000) Operating profit 700 000 Interest income 80 000 Interest expense (55 200) Profit before tax 724 800 Company tax 217 440 Profit after tax 507 360 P&R Incorporated Statement of Financial Position as at 31 December: 2020 2019 R R R R ASSETS Non-current assets 2 460 000 1 420 000 Property, plant and equipment 1 920 000 1 420 000 Long-term investment 540 000 Current assets 1 768 000 2 140 000 Inventories 484 000 609 000 Trade and other receivables 1 244 000 1456 000 Cash 40 000 75 000 4 228 000 3560 000 EQUITY AND LIABILITIES Equity 2 548 000 1 260 000 Ordinary share capital 2 000 000 1 000 000 Retained earnings 548 000 260 000 Non-current liabilities 460 000 900 000 Long-term loan (12%) -% 460 000 900 000 Current liabilities 1 220 000 1400 000 Trade and other payables 1 220 000 1400 000 4228 000 3560 000 Additional information: 1. All purchases are on credit 3.1 Gross margin (2 marks) 3.2 Profit margin (2 marks) 3.3 Retum on own capital (i.e., Return on owners' equity) (2 marks) 3.4 Current ratio (2 marks) 3.5 Acid-test ratio (2 marks) 3.6 (2 marks) 3.7 Debtors colection period Creditors payment period Inventory tumover (2 marks) 3.8 (2 marks) 3.9 Return on assets (2 marks) 3.10 Days sales in inventory (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts