Question: Using the information provided below, estimate the appropriate WACC for use in an NPV project acceptance analysis for the VitaMed acquisition. When you have completed

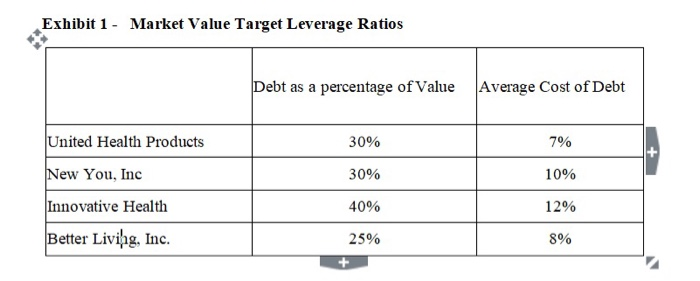

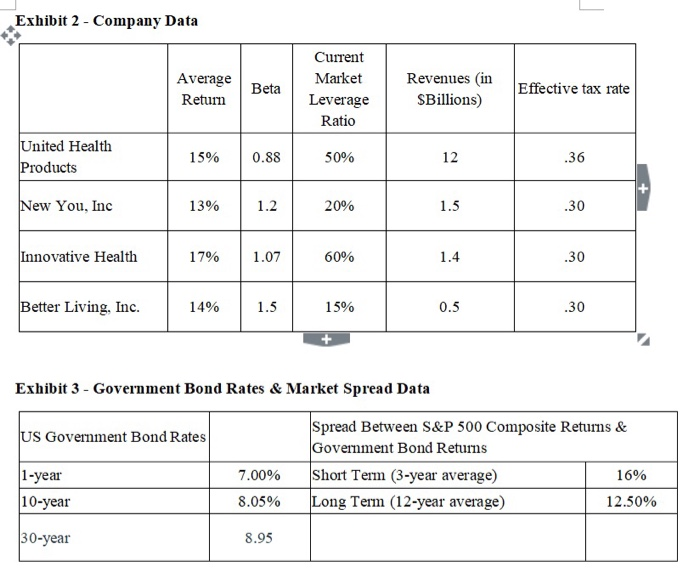

Exhibit 1- Market Value Target Leverage Ratios ebt as a percentage of value Average Cost of De bt United Health Products New You, Inc Innovative Health Better Livihg, Inc. 30% 3090 40% 2590 7% 10% 12% 890 Exhibit 2 - Company Data Current Average Beta Leverage Return Market Revenues (in Effective tax rate SBillions) Ratio United Health Products 15% | 0.88 50% 12 .36 ew You, Inc 13% 1.2 20% .30 novative Health 1796 | 1.07 60% .30 etter Living. Inc. 14% 15% 0.5 .30 Exhibit 3 Government Bond Rates & Market Spread Data Spread Between S&P 500 Composite Retums & Government Bond Returns US Govenment Bond Rates 1-year 10-year 30-year 7.00% 8.05% 8.95 16% 12.50% Short Term (3-year average) ong Term (12-year average)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts