Question: Using the information provided below, please answer these following questions. The income tax due for the year is ___ a.) 453,000 b.) 423,000 c.) 366,000

Using the information provided below, please answer these following questions.

The income tax due for the year is ___

a.) 453,000

b.) 423,000

c.) 366,000

d.) 426,000

The total capital gains taxes for the year is _____

a.) 138,000

b.) 127,000

c.) 121,750

d.) 37,000

The total final taxes on passive income for the year is

a.) 17,000

b.) 13,000

c.) 9,875

d.) 11,750

P.S. Kindly show me how you compute it so I can learn how to do it myself. Thank you!!

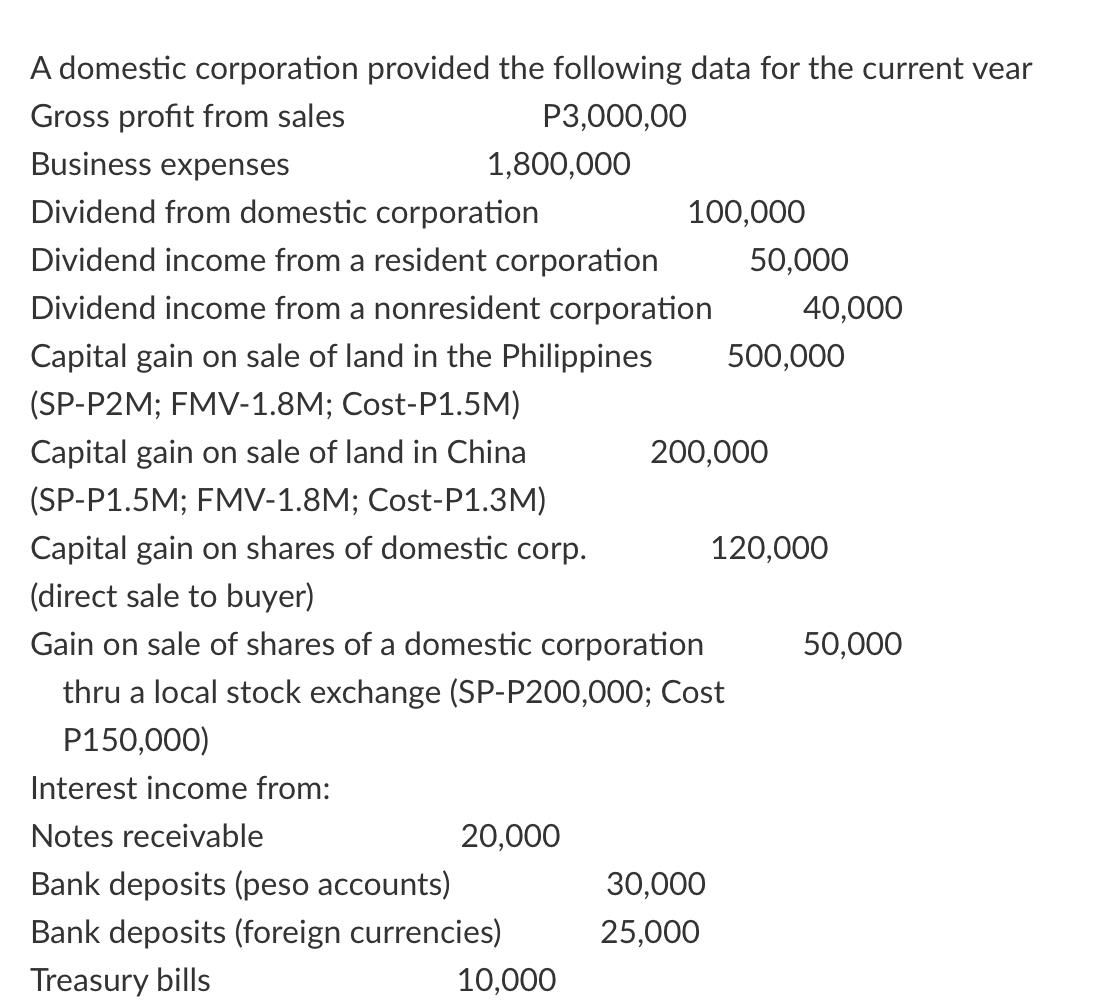

A domestic corporation provided the following data for the current vear Gross profit from sales P3,000,00 Business expenses 1,800,000 Dividend from domestic corporation 100,000 Dividend income from a resident corporation 50,000 Dividend income from a nonresident corporation 40,000 Capital gain on sale of land in the Philippines 500,000 (SP-P2M; FMV-1.8M; Cost-P1.5M) Capital gain on sale of land in China 200,000 (SP-P1.5M; FMV-1.8M; Cost-P1.3M) Capital gain on shares of domestic corp. 120,000 (direct sale to buyer) Gain on sale of shares of a domestic corporation 50,000 thru a local stock exchange (SP-P200,000; Cost P150,000) Interest income from: Notes receivable 20,000 Bank deposits (peso accounts) 30,000 Bank deposits (foreign currencies) 25,000 Treasury bills 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts