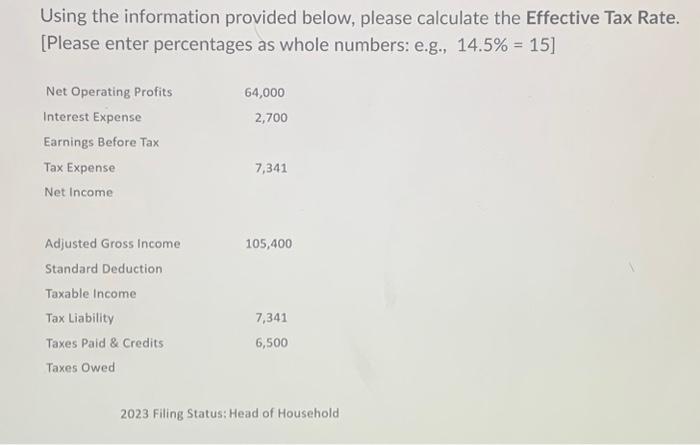

Question: Using the information provided below, please calculate the Effective Tax Rate. [Please enter percentages as whole numbers: e.g., 14.5% = 15] Net Operating Profits Interest

Using the information provided below, please calculate the Effective Tax Rate. [Please enter percentages as whole numbers: e.g., 14.5%=15 ] 2023 Filing Status: Head of Household

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts