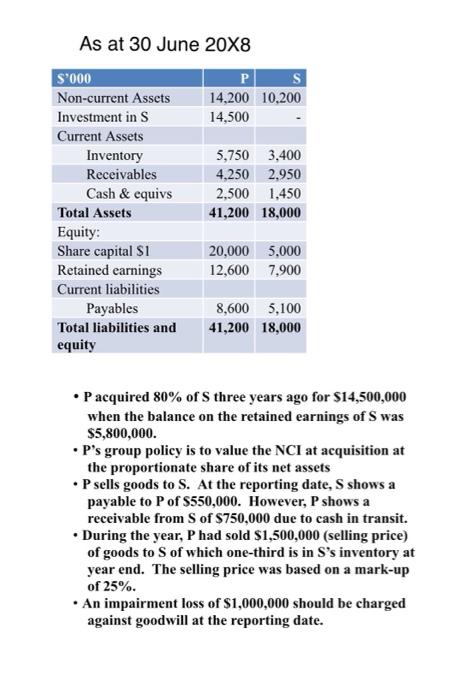

Question: Using the Information provided below, prepare consolidated financial statements As at 30 June 20X8 S'000 S Non-current Assets 14,200 10.200 Investment in S 14,500 Current

As at 30 June 20X8 S'000 S Non-current Assets 14,200 10.200 Investment in S 14,500 Current Assets Inventory 5,750 3,400 Receivables 4,250 2,950 Cash & equivs 2,500 1,450 Total Assets 41,200 18,000 Equity: Share capital S1 20,000 5,000 Retained earnings 12,600 7.900 Current liabilities Payables 8,600 5.100 Total liabilities and 41,200 18,000 equity Pacquired 80% of Sthree years ago for $14,500,000 when the balance on the retained earnings of Swas $5,800,000. P's group policy is to value the NCI at acquisition at the proportionate share of its net assets Psells goods to S. At the reporting date. S shows a payable to P of $550,000. However, P shows a receivable from S of $750,000 due to cash in transit. . During the year, P had sold $1,500,000 (selling price) of goods to S of which one-third is in S's inventory at year end. The selling price was based on a mark-up of 25%. An impairment loss of $1,000,000 should be charged against goodwill at the reporting date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts