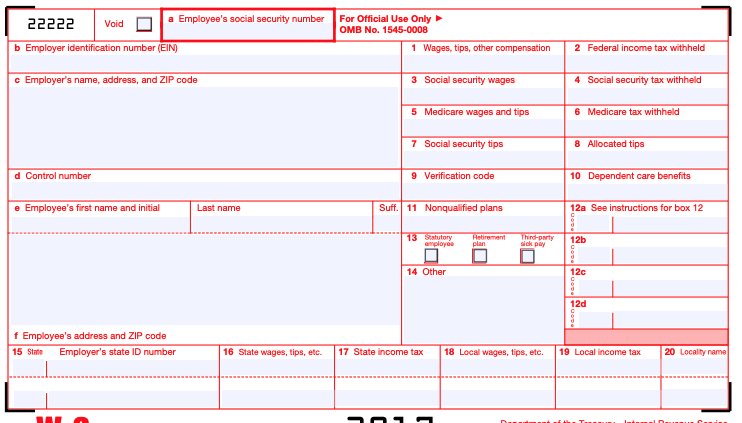

Question: Using the information provided, COMPLETE the fillable W-2 form provided and the tax tables from the year 2019. Carmen Garcia 4900 Gladwynne Terrace Brownsville, TX

Using the information provided, COMPLETE the fillable W-2 form provided and the tax tables from the year 2019.

Carmen Garcia 4900 Gladwynne Terrace Brownsville, TX 87330

Married, 3 allowances $820 per week SS# 111-22-5771 Union Dues withheld: $102

Social Security Withheld $2643.68 Medicare tax withheld $618.28 State Income tax withheld $1308.84 Local Income tax withheld $1654.64 TX State Unemployment tax withheld $25.48

Label state unemployment as TX SUI

22222 Void a Employee's social security number b Employer identification number (EIN) For Official Use Only OMB No. 1545-0008 1 Wages, tips, other compensation 2 Federal income tax withheld c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withhold 5 Medicare wages and tips 6 Medicare tax withheld 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 13 Statutory employe Hetirement plan Third-party sick pay 12b 14 Other 12c 12d f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 22222 Void a Employee's social security number b Employer identification number (EIN) For Official Use Only OMB No. 1545-0008 1 Wages, tips, other compensation 2 Federal income tax withheld c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withhold 5 Medicare wages and tips 6 Medicare tax withheld 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 13 Statutory employe Hetirement plan Third-party sick pay 12b 14 Other 12c 12d f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts