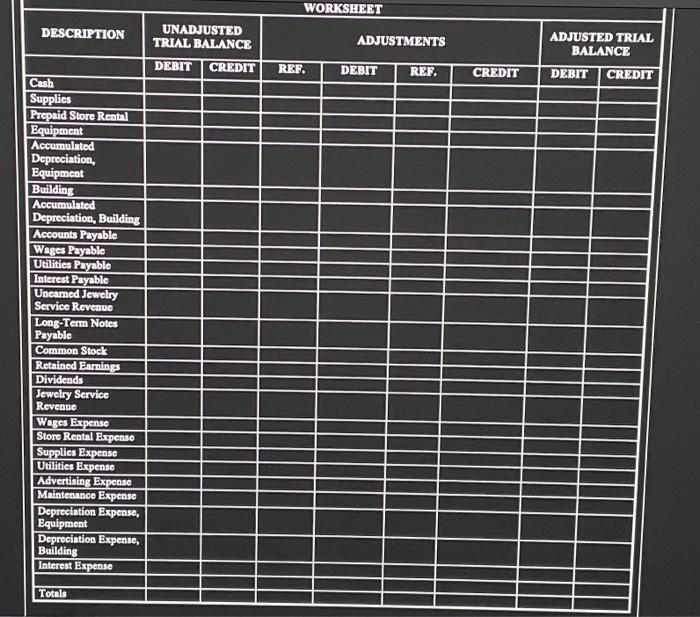

Question: using the information provided finish the adjusting entries sheet then using the finished informatjon create general ledgar T-accounts then a worksheet using all the information

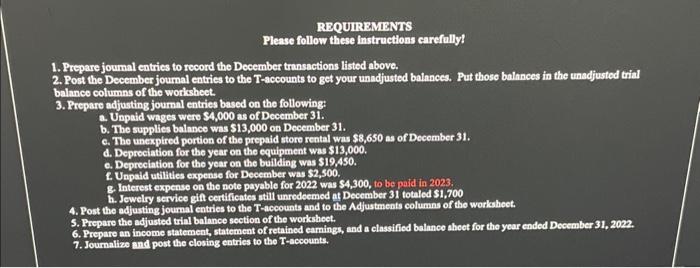

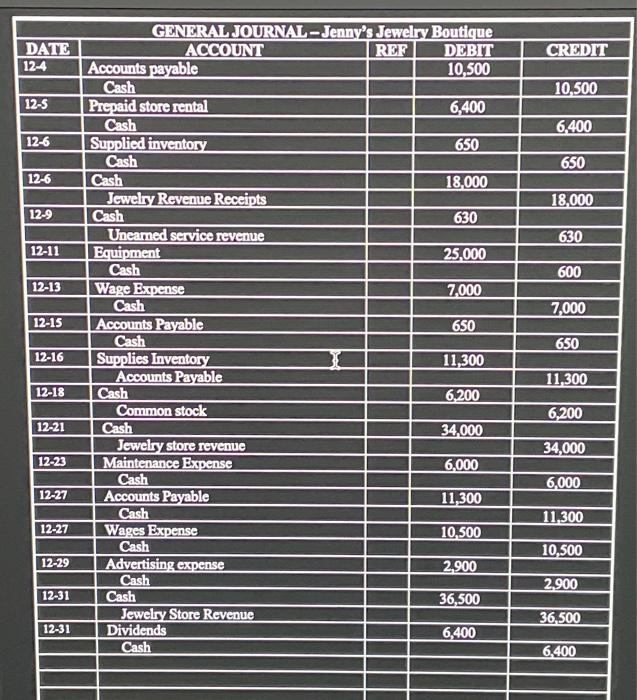

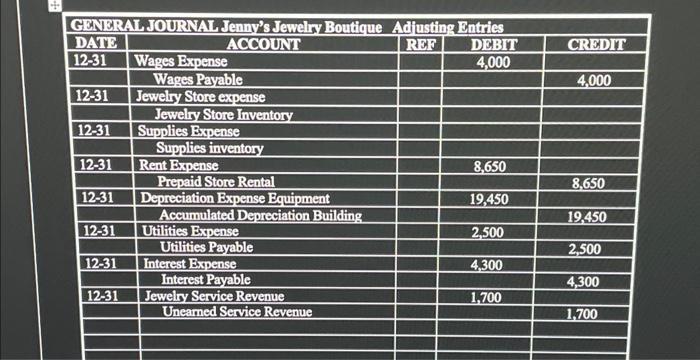

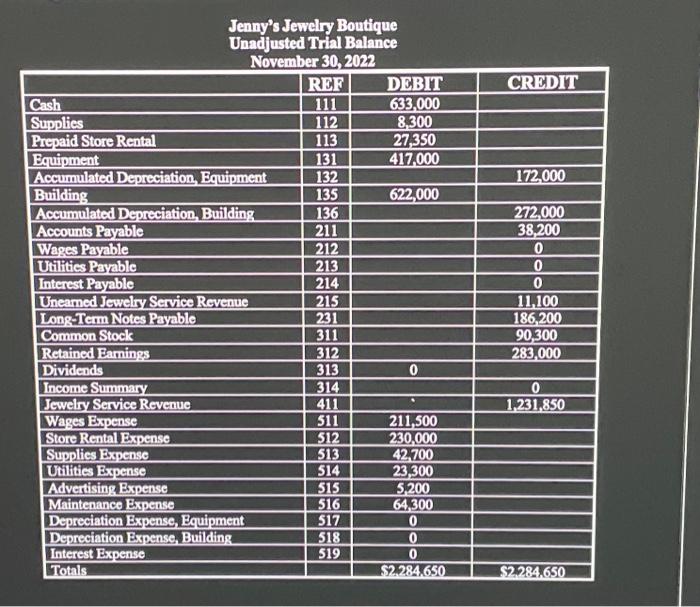

\begin{tabular}{|c|c|c|c|c|} \hline 1 & K.JOUPNAKJenny's Jeweing Boutique & Adiustin & Bntries & \\ \hline DATS & ACCOUNI & & DMBTT & \\ \hline 1231 & Wages Expense & & 4,000 & \\ \hline & Wages Payable & & & 4,000 \\ \hline 1231 & Jewelry Store expense & & & \\ \hline & Jewelry Store Inventory & & & \\ \hline 1231 & Supplies Expense & & & \\ \hline & Supplies inventory & & & \\ \hline 1231 & Rent Expense & & 8,650 & \\ \hline & Prepaid Store Rental & & & 8,650 \\ \hline 12-31 & Depreciation Expense Equipment & & 19,450 & \\ \hline & Accumulated Depreciation Building & & & 19,450 \\ \hline 1231 & Utilities Expense & & 2,500 & \\ \hline & Utilities Payable & & & 2,500 \\ \hline 1231 & Interest Expense & & 4,300 & \\ \hline & Interest Payable & & & 4,300 \\ \hline 1231 & Jewelry Service Revenue & & 1,700 & \\ \hline & Uneamed Service Revenue & & & 1,700 \\ \hline & & & & \\ \hline \end{tabular} RBQUTRMINTS Please follow these instructions carefallyt 1. Prepare joumal entries to record the December transactions listed above. 2. Post the December joumal entries to the T-accounts to get your unadjusted balanees. Put those balances in the unadjusted trial balance columns of the worksheet. 3. Prepare adjusting journal entries based on the following: 2. Unpaid wages wero 54,000 as of December 31. b. The supplies balnnce was 513,000 on December 31. c. The unekpired portion of the prepaid store rental was $8,650 as of December 31 . d. Depreciation for the year on the equipment was $13,000. c. Depreciation for the year on the building was $19,450. f. Unpalid utilities expense for December was $2,500. s. Interest expense on the note payable for 2022 was $4,300, to be paid in 2023 . h. Jewelry service gin certificates stili unredoemed at December 31 totaled $1,700 4. Post the edfusting joumal entrics to the T-accounts and to the Adjustments columns of the workahoet. 5. Prepare the adjusted trial balance section of the workshect. 6. Prepare an income statement, statement of retained earnings, and a classified balance ahoet for the your ended December 31, 2022. 7. Joumalize end post the closing entries to the T-accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts