Question: Using the information provided for 2017, calculate the net realizable value of accounts receivable at December 31, 2016, and prepare the appropriate balance sheet presentation

Using the information provided for 2017, calculate the net realizable value of accounts receivable at December 31, 2016, and prepare the appropriate balance sheet presentation for Carr Co., as of that point in time

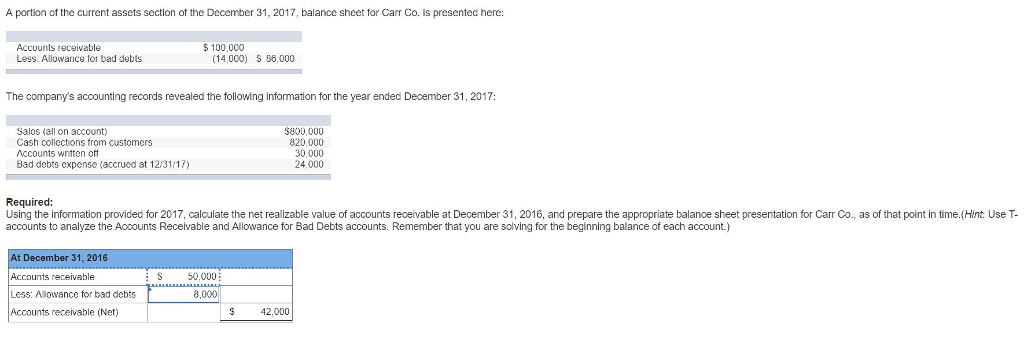

A portion of the current assets section of the December 31, 2017, balance sheet tor Carr Co. is presented here: $ 100,000 Accounts receivable Less. Allowance for bad debts (14,000) 6,000 The company's accounting records revealed the following information for the year ended December 31, 2017: Salos (all on account) Cash collections trom customers Accounts wntten off Bad debts expense (accrued at 12/31 17) $800,000 820,000 30,000 24,000 Required: Using the information provided for 2017, calculate the net realizable value of accounts receivable at December 31, 2016, and prepare the appropriate balance sheet presentation for Carr Co., as of that point in time.(Hint: Use T accounts to analyze the Accounts Recelvable and Allowance for Bad Debts accounts. Remember that you are solving for the beginning balance of each account.) At December 31, 2016 Accounts receivable Less: Allowance for bad debts Accounts receivable (Net) 50,000 8,000 42,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts