Question: Using the information provided in the Buildrite Limited case study: In your role as a management consultant, prepare a business report for submission to the

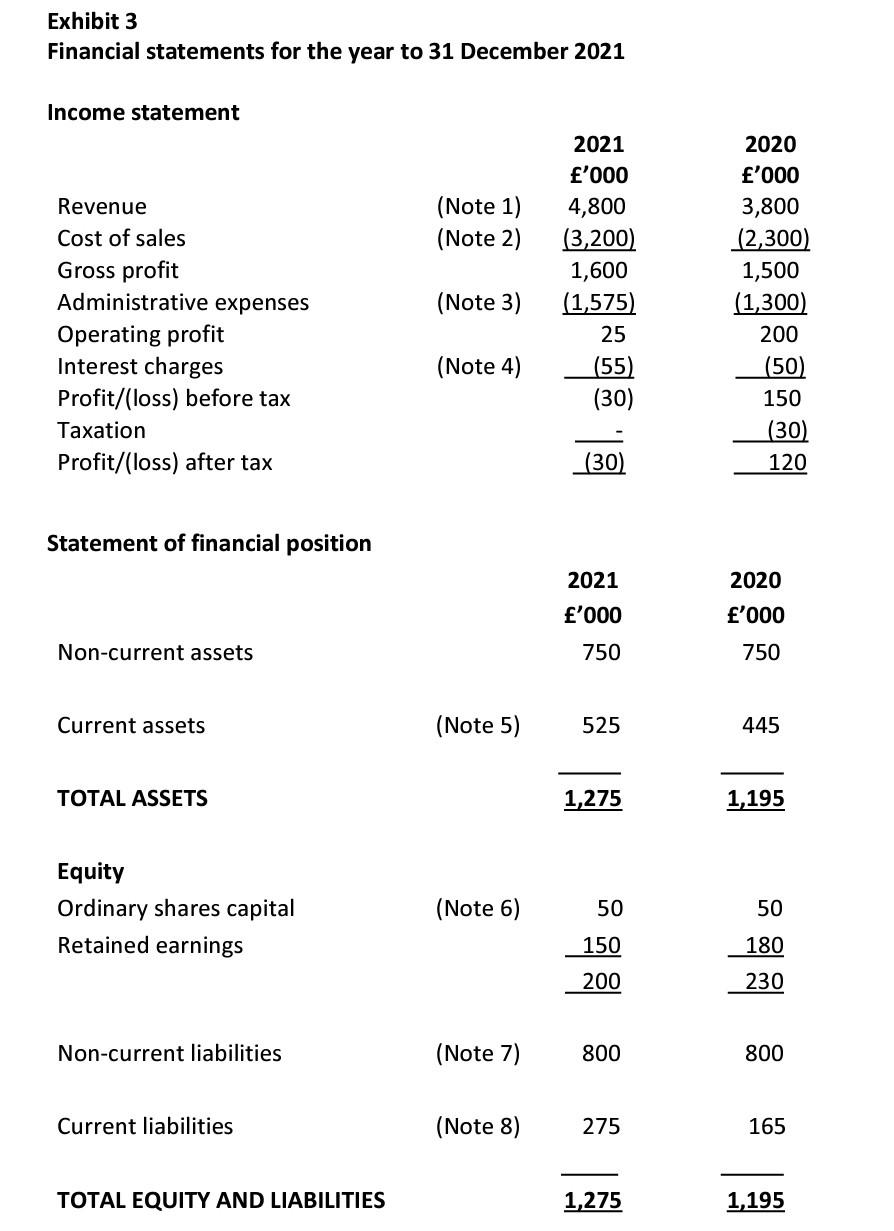

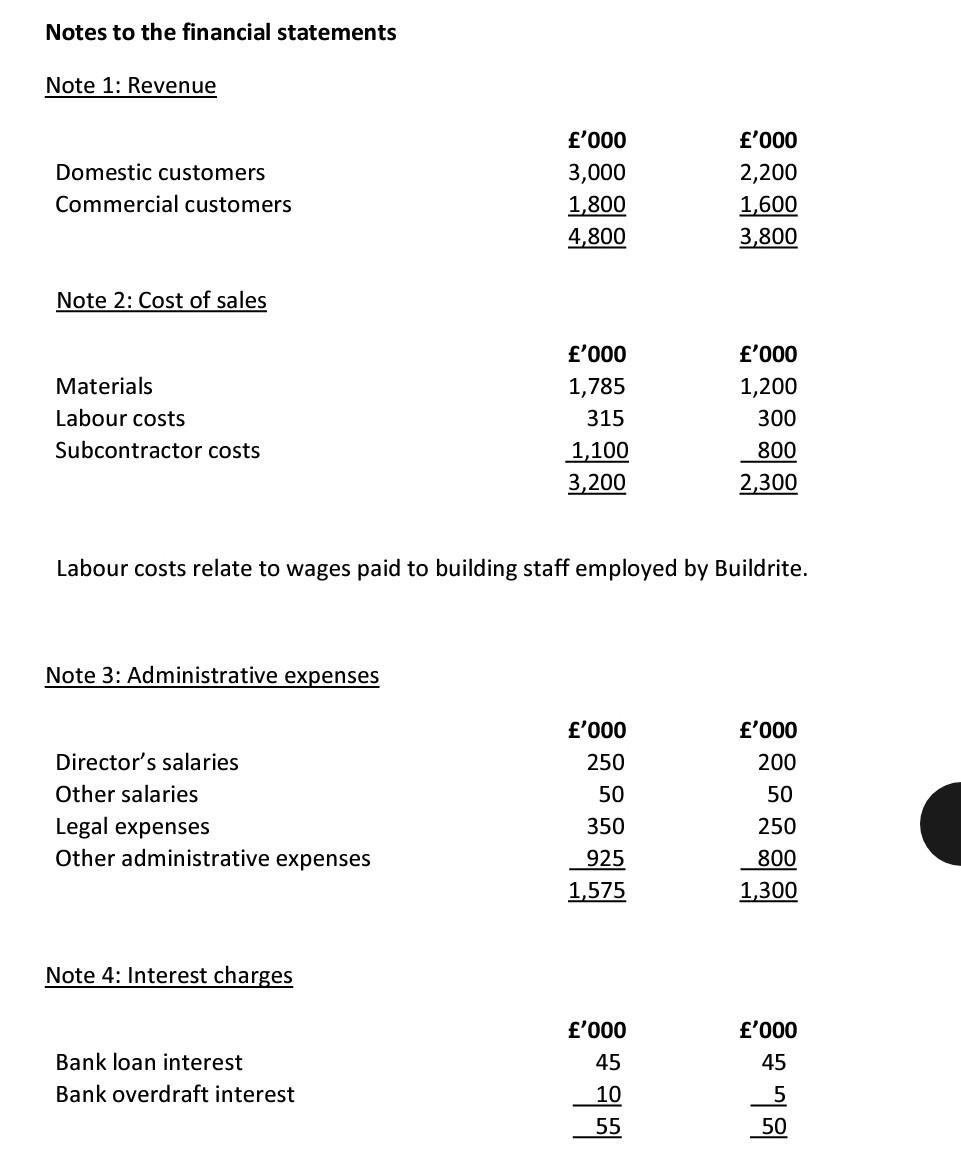

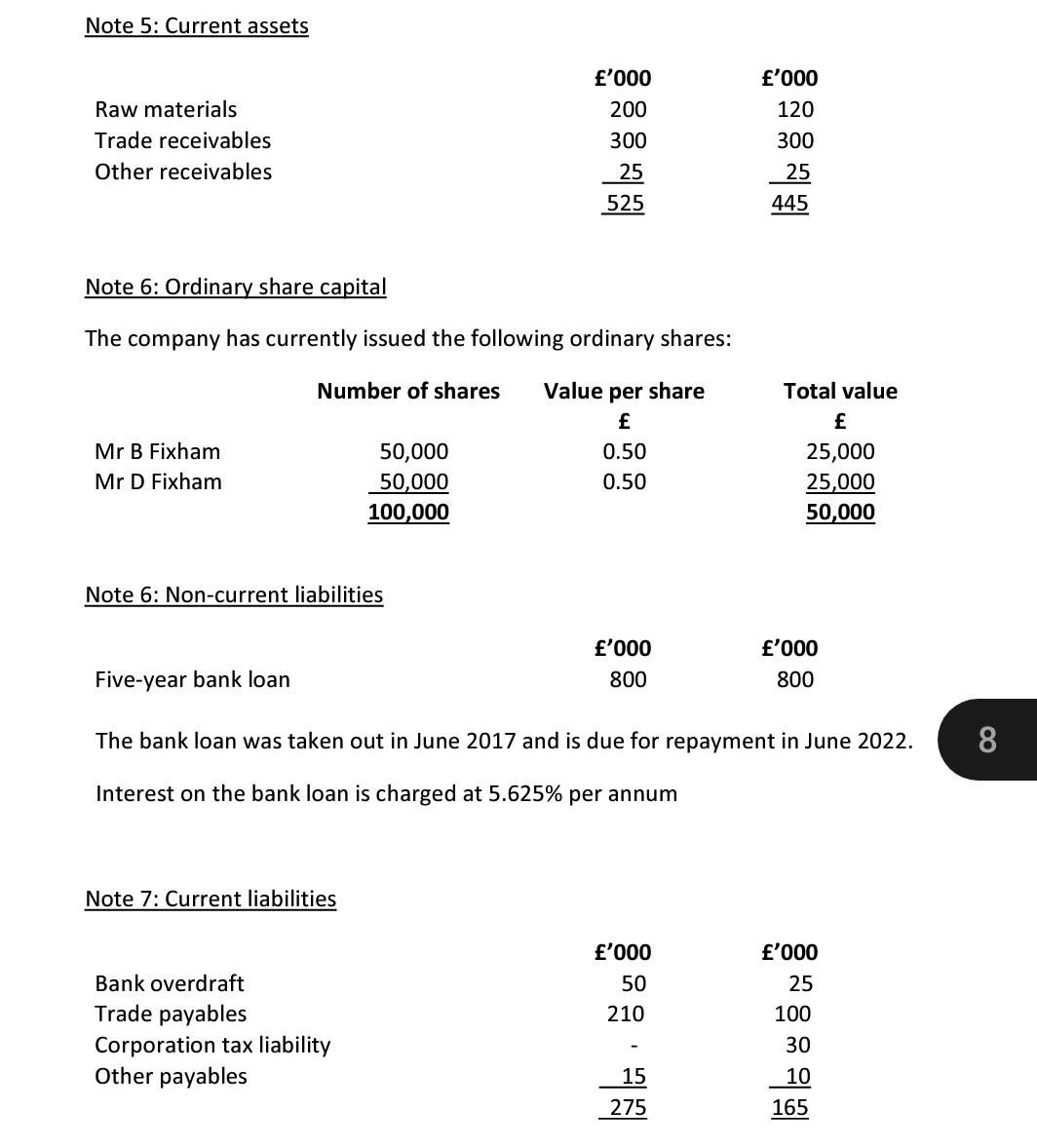

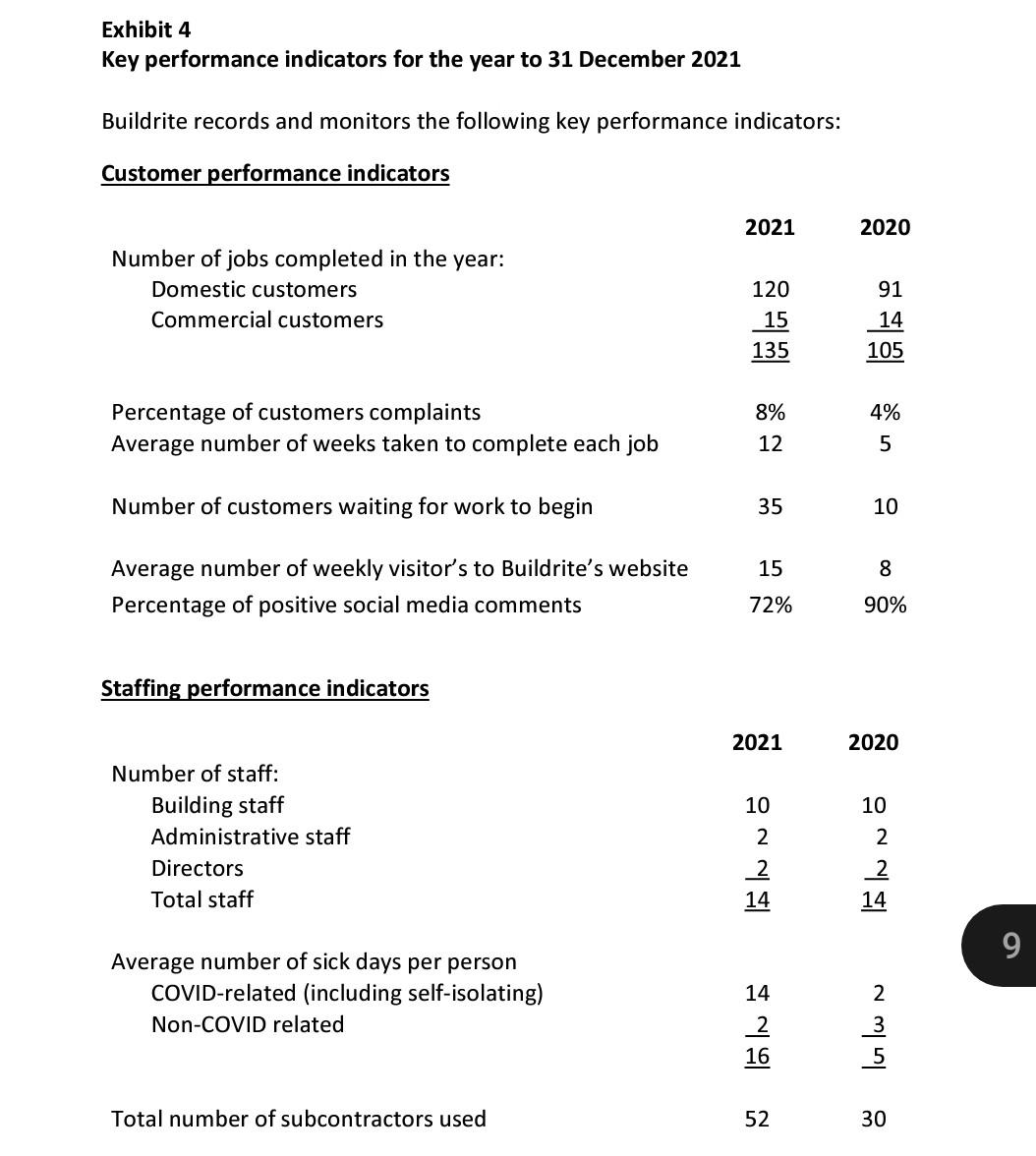

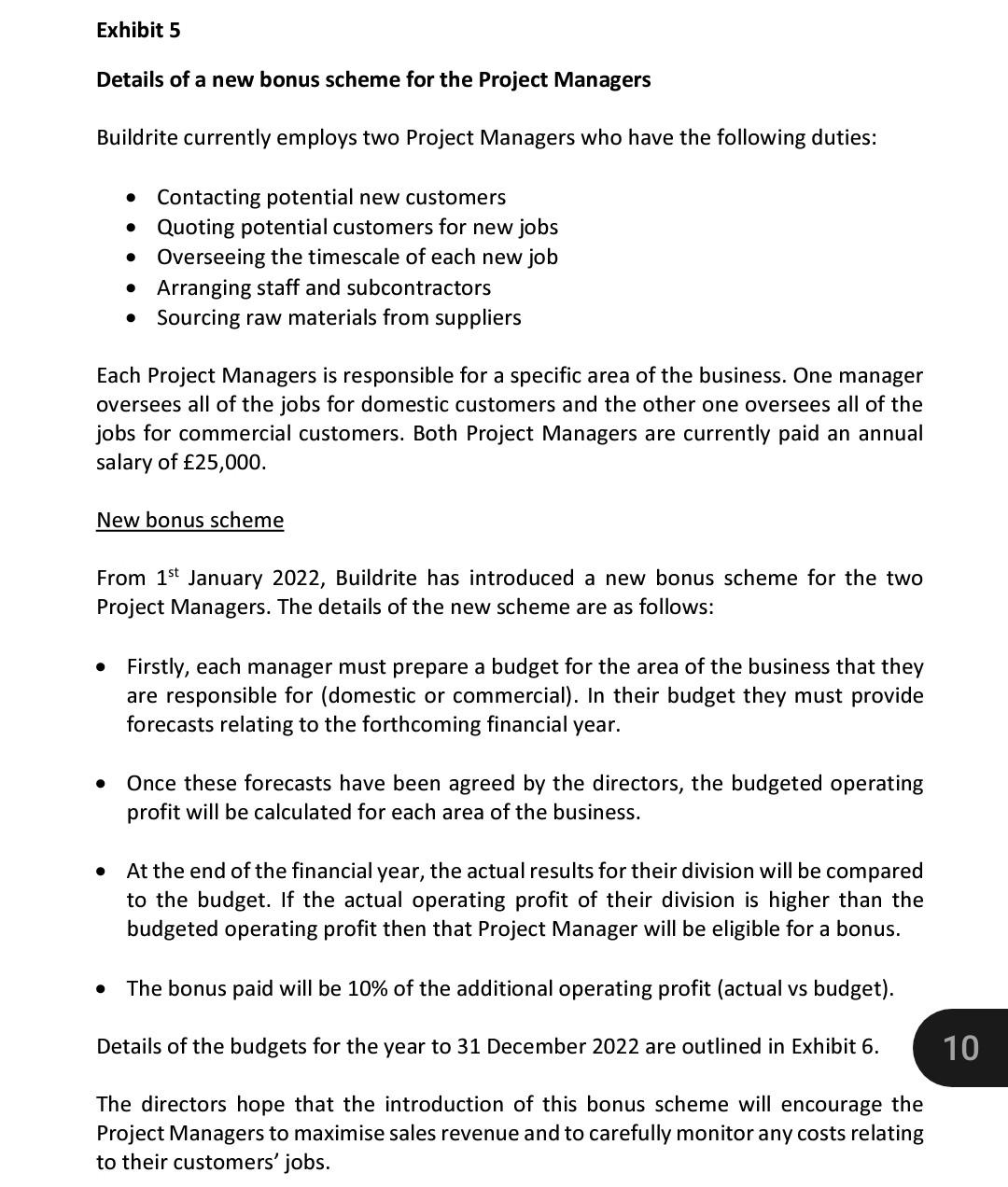

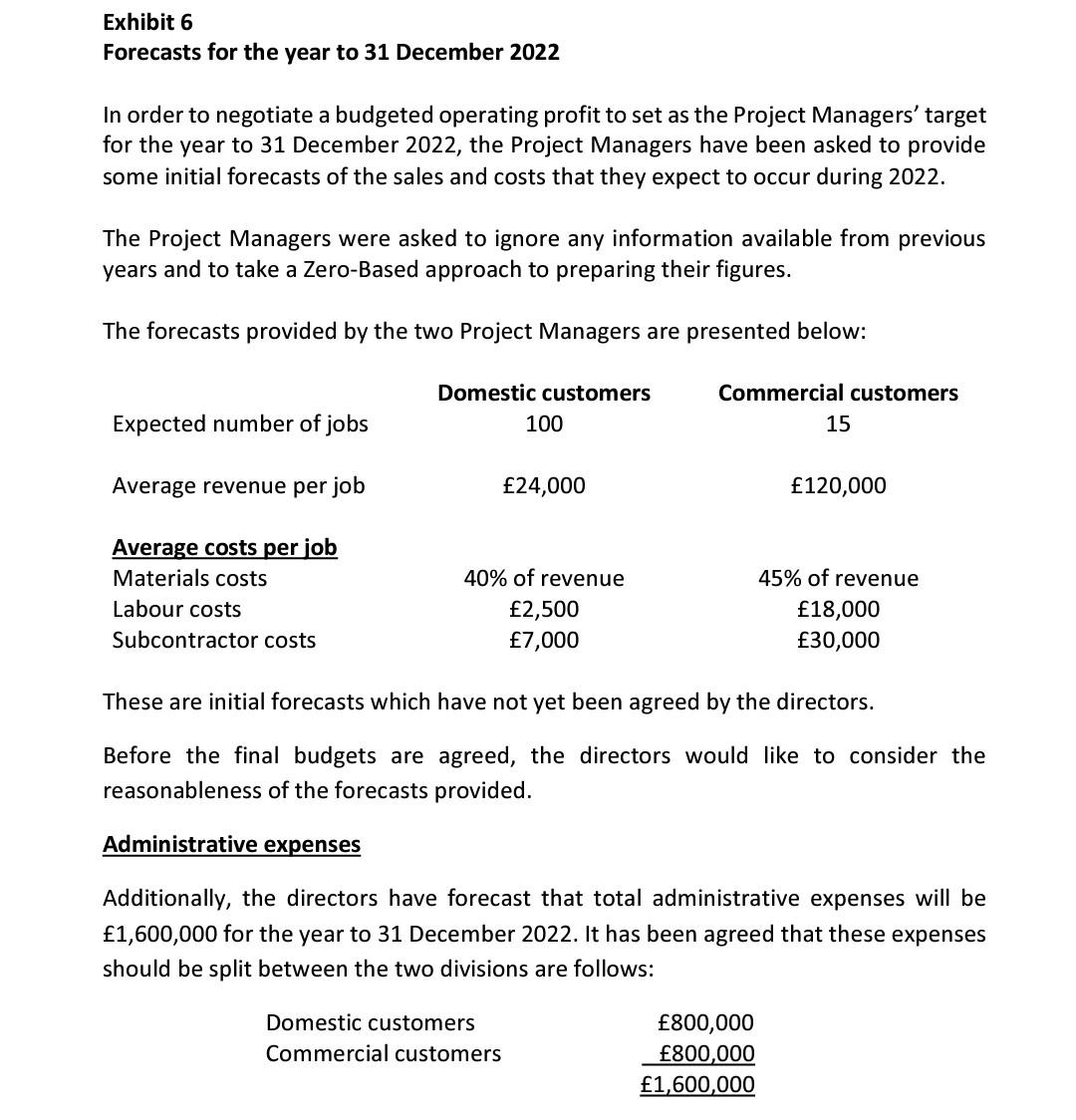

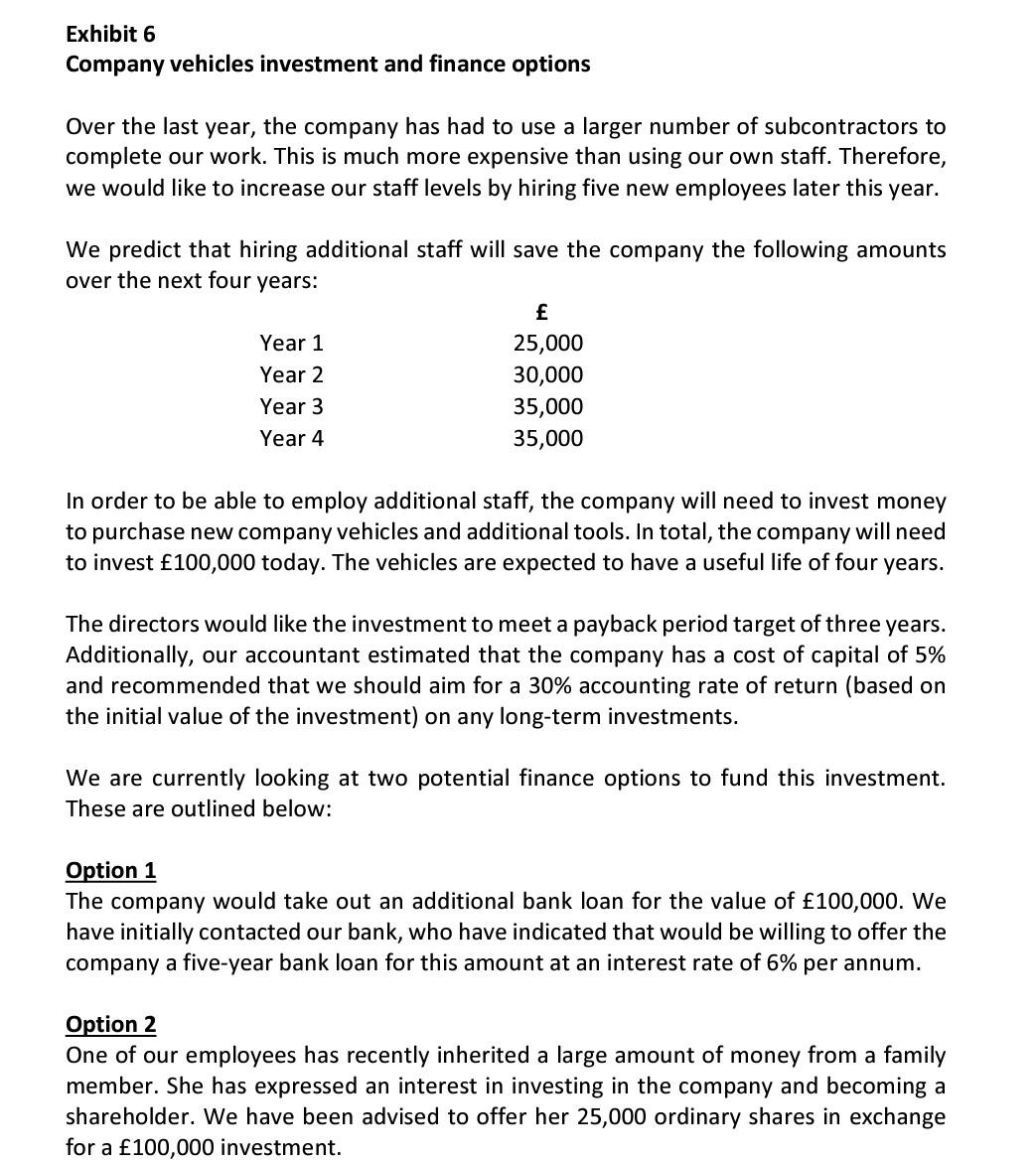

Using the information provided in the Buildrite Limited case study: In your role as a management consultant, prepare a business report for submission to the board of directors of Buildrite Limited which contains the following: 3 Maximum word count: 3,000 words Section 1 (30%) Provide an analysis of the company's financial and non-financial performance for the year to 31 December 2021, in comparison with the previous year. Section 2 (30%) Calculate the budgeted operating profit (or loss) from domestic and commercial customers for the year to 31 December 2022. Additionally, you should evaluate the reasonableness of the forecasts and assumptions provided and consider the impact of changes in these estimates and assumptions. Section 3 (30%) Prepare a selection of investment appraisal calculations for the planned investment in new company vehicles and advise the directors whether to proceed with the investment. Additionally, you should evaluate the two finance options that the company is considering to fund this investment. 10% of marks will be awarded for the professional presentation of your report. Please note that this is a business report rather than an academic report. As a result, the main focus of your report should be to provide practical analysis and information to the company's directors. Discussion of academic theories and reference to the work of academic writers should be minimal and only included if you believe that they would be of relevance or interest to the directors. Exhibit 1 Company background Buildrite Limited (Buildrite) is a building company that specialises small and medium sized building projects for domestic and commercial customers. The company was formed ten years ago by two brothers who were both experienced professional builders. They now employ twelve other full time members of staff (ten building staff and two project managers). Additionally, Buildrite regularly hires sub- contractors to complete specialist work on their jobs, such as bricklaying, plastering and electrics. Sub-contactors are also used to cover any staff shortages. 4 Originally, the company focused on building extensions, bathroom renovations and fitting new kitchens for domestic customers. A lot of the work that the company get comes from customer referrals and testimonials which are shared on social media. Fol this reason, Buildrite have always ensured that they pay close attention to the quality of their work and have built up a good reputation in Warrington and other nearby areas. They also closely monitor social media activity and activities levels of the company's website. Four years ago, the company also started to take on some larger contracts for building work in the commercial section. As a result of this additional work, and due to Buildrite's strong reputation with domestic customers, the company's revenue grew steadily until 2019. (The company reported total sales of 5.5m for the year to 31 December 2019.) However, like most industries, the construction industry was heavily affected by the impact of the COVID 19 pandemic. Between March 2020 and June 2020, many UK firms experienced significant levels of disruption to their work with many domestic and commercial building projects put on hold during the first UK lockdown. Despite further lockdowns and continuing periods of restrictions, most building firms have experienced much stronger demand during 2021 and industry experts have predicted growth of between 5% and 10% for the industry. However, some parts of the industry are expected to perform better than others. One of the highest areas of growth is expected to be domestic renovations and extensions. This is due to many households saving significant sums of money during the COVID pandemic as a result of restrictions of foreign holidays and other leisure activities. Exhibit 2 Strategic review for the year to 31 December 2021 The directors present their strategic report for the year ended 31 December 2021. Principal activity The principal activity of the company is a professional building firm. Fair review of the business This has been an extremely busy year for the company with a huge upturn in demand for domestic extensions and kitchen renovations. Throughout the year we were contacted by a large number of potential new customers. The demand was so high that each new customer had to wait at least three months before we could start their building projects because we were booked up so far in advance. Additionally, we have also been hired to complete a small number of commercial contracts. However, thi area of work still has not returned to pre-COVID levels as there has been continuing uncertainty about the future of many office premises. 5 Due to the extremely high level of demand for domestic building work, it has been a challenging year for the building industry in general. In particular, there have been widespread shortages of some materials such as roof tiles and timber. This led to delays on many of our jobs. However, due to the volume of work that we had taken on we were able to switch between different jobs while we waited for supplies to arrive. As a result of the strains on our supply chain, many of our suppliers have been forced to make significant increases to the prices that they charge. For example, the price of timber has doubled in the space 12 months. In many cases, we have been unable to pass these price increases on to our customers because we had already quoted them for their building projects three or four months earlier. Luckily, we have a good relationship with many of our suppliers and they were able to warn us before the price rises so that we could buy additional stock in advance before the prices were changed. In addition to the challenges that we had sourcing materials, we also had labour shortages with many of our staff unable to work at various times of the year as they were ill or were required to self-isolate. We increasingly relied on using subcontractors. This is not ideal, as the daily rate paid to subcontractors is more expensive than paying our own staff and we have less control over the quality of the work performed. Additionally, many of the subcontractors that we usually use were already booked up in advance. So we had to find new subcontractors that we had not previously hired. Exhibit 3 Financial statements for the year to 31 December 2021 Income statement (Note 1) (Note 2) 2021 '000 4,800 (3,200) 1,600 (1,575) 25 (55) (30) Revenue Cost of sales Gross profit Administrative expenses Operating profit Interest charges Profit/(loss) before tax Taxation Profit/(loss) after tax (Note 3) 2020 '000 3,800 (2,300) 1,500 (1,300) 200 (50) 150 (30) 120 (Note 4) (30) Statement of financial position 2021 2020 '000 '000 Non-current assets 750 750 Current assets (Note 5) 525 445 TOTAL ASSETS 1,275 1,195 Equity Ordinary shares capital Retained earnings (Note 6) 50 50 150 180 200 230 Non-current liabilities (Note 7) 800 800 Current liabilities (Note 8) 275 165 TOTAL EQUITY AND LIABILITIES 1,275 1,195 Notes to the financial statements Note 1: Revenue Domestic customers Commercial customers '000 3,000 1,800 4,800 f'000 2,200 1,600 3,800 Note 2: Cost of sales Materials Labour costs Subcontractor costs '000 1,785 315 1,100 3,200 '000 1,200 300 800 2,300 Labour costs relate to wages paid to building staff employed by Buildrite. Note 3: Administrative expenses '000 250 Director's salaries Other salaries Legal expenses Other administrative expenses 50 350 '000 200 50 250 800 1,300 925 1,575 Note 4: Interest charges Bank loan interest Bank overdraft interest '000 45 10 55 '000 45 5 50 Note 5: Current assets Raw materials Trade receivables Other receivables '000 200 300 25 525 '000 120 300 25 445 Note 6: Ordinary share capital The company has currently issued the following ordinary shares: Number of shares Value per share f 0.50 0.50 Mr xham Mr D Fixham 50,000 50,000 100,000 Total value 25,000 25,000 50,000 Note 6: Non-current liabilities '000 800 f'000 800 Five-year bank loan The bank loan was taken out in June 2017 and is due for repayment in June 2022. 8 Interest on the bank loan is charged at 5.625% per annum Note 7: Current liabilities f'000 50 210 Bank overdraft Trade payables Corporation tax liability Other payables '000 25 100 30 10 165 15 275 | Exhibit 4 Key performance indicators for the year to 31 December 2021 Buildrite records and monitors the following key performance indicators: Customer performance indicators 2021 2020 Number of jobs completed in the year: Domestic customers Commercial customers 120 15 135 91 14 105 | 4% Percentage of customers complaints Average number of weeks taken to complete each job 8% 12 5 Number of customers waiting for work to begin 35 10 15 8 Average number of weekly visitor's to Buildrite's website Percentage of positive social media comments 72% 90% Staffing performance indicators 2021 2020 10 Number of staff: Building staff Administrative staff Directors Total staff 2 Elon 2 14 9 Average number of sick days per person COVID-related (including self-isolating) Non-COVID related 14 Blne | 16 Total number of subcontractors used 52 30 Exhibit 5 Details of a new bonus scheme for the Project Managers Buildrite currently employs two Project Managers who have the following duties: . Contacting potential new customers Quoting potential customers for new jobs Overseeing the timescale of each new job Arranging staff and subcontractors Sourcing raw materials from suppliers . Each Project Managers is responsible for a specific area of the business. One manager oversees all of the jobs for domestic customers and the other one oversees all of the jobs for commercial customers. Both Project Managers are currently paid an annual salary of 25,000. New bonus scheme From 1st January 2022, Buildrite has introduced a new bonus scheme for the two Project Managers. The details of the new scheme are as follows: Firstly, each manager must prepare a budget for the area of the business that they are responsible for (domestic or commercial). In their budget they must provide forecasts relating to the forthcoming financial year. . Once these forecasts have been agreed by the directors, the budgeted operating profit will be calculated for each area of the business. . At the end of the financial year, the actual results for their division will be compared to the budget. If the actual operating profit of their division is higher than the budgeted operating profit then that Project Manager will be eligible for a bonus. The bonus paid will be 10% of the additional operating profit (actual vs budget). Details of the budgets for the year to 31 December 2022 are outlined in Exhibit 6. 10 The directors hope that the introduction of this bonus scheme will encourage the Project Managers to maximise sales revenue and to carefully monitor any costs relating to their customers' jobs. Exhibit 6 Forecasts for the year to 31 December 2022 In order to negotiate a budgeted operating profit to set as the Project Managers' target for the year to 31 December 2022, the Project Managers have been asked to provide some initial forecasts of the sales and costs that they expect to occur during 2022. The Project Managers were asked to ignore any information available from previous years and to take a Zero-Based approach to preparing their figures. The forecasts provided by the two Project Managers are presented below: Domestic customers 100 Commercial customers 15 Expected number of jobs Average revenue per job 24,000 120,000 Average costs per job Materials costs Labour costs Subcontractor costs 40% of revenue 2,500 7,000 45% of revenue 18,000 30,000 These are initial forecasts which have not yet been agreed by the directors. Before the final budgets are agreed, the directors would like to consider the reasonableness of the forecasts provided. Administrative expenses Additionally, the directors have forecast that total administrative expenses will be 1,600,000 for the year to 31 December 2022. It has been agreed that these expenses should be split between the two divisions are follows: Domestic customers Commercial customers 800,000 800,000 1,600,000 Exhibit 6 Company vehicles investment and finance options Over the last year, the company has had to use a larger number of subcontractors to complete our work. This is much more expensive than using our own staff. Therefore, we would like to increase our staff levels by hiring five new employees later this year. We predict that hiring additional staff will save the company the following amounts over the next four years: Year 1 25,000 Year 2 30,000 Year 3 35,000 Year 4 35,000 In order to be able to employ additional staff, the company will need to invest money to purchase new company vehicles and additional tools. In total, the company will need to invest 100,000 today. The vehicles are expected to have a useful life of four years. The directors would like the investment to meet a payback period target of three years. Additionally, our accountant estimated that the company has a cost of capital of 5% and recommended that we should aim for a 30% accounting rate of return (based on the initial value of the investment) on any long-term investments. We are currently looking at two potential finance options to fund this investment. These are outlined below: Option 1 The company would take out an additional bank loan for the value of 100,000. We have initially contacted our bank, who have indicated that would be willing to offer the company a five-year bank loan for this amount at an interest rate of 6% per annum. Option 2 One of our employees has recently inherited a large amount of money from a family member. She has expressed an interest in investing in the company and becoming a shareholder. We have been advised to offer her 25,000 ordinary shares in exchange for a 100,000 investment. Using the information provided in the Buildrite Limited case study: In your role as a management consultant, prepare a business report for submission to the board of directors of Buildrite Limited which contains the following: 3 Maximum word count: 3,000 words Section 1 (30%) Provide an analysis of the company's financial and non-financial performance for the year to 31 December 2021, in comparison with the previous year. Section 2 (30%) Calculate the budgeted operating profit (or loss) from domestic and commercial customers for the year to 31 December 2022. Additionally, you should evaluate the reasonableness of the forecasts and assumptions provided and consider the impact of changes in these estimates and assumptions. Section 3 (30%) Prepare a selection of investment appraisal calculations for the planned investment in new company vehicles and advise the directors whether to proceed with the investment. Additionally, you should evaluate the two finance options that the company is considering to fund this investment. 10% of marks will be awarded for the professional presentation of your report. Please note that this is a business report rather than an academic report. As a result, the main focus of your report should be to provide practical analysis and information to the company's directors. Discussion of academic theories and reference to the work of academic writers should be minimal and only included if you believe that they would be of relevance or interest to the directors. Exhibit 1 Company background Buildrite Limited (Buildrite) is a building company that specialises small and medium sized building projects for domestic and commercial customers. The company was formed ten years ago by two brothers who were both experienced professional builders. They now employ twelve other full time members of staff (ten building staff and two project managers). Additionally, Buildrite regularly hires sub- contractors to complete specialist work on their jobs, such as bricklaying, plastering and electrics. Sub-contactors are also used to cover any staff shortages. 4 Originally, the company focused on building extensions, bathroom renovations and fitting new kitchens for domestic customers. A lot of the work that the company get comes from customer referrals and testimonials which are shared on social media. Fol this reason, Buildrite have always ensured that they pay close attention to the quality of their work and have built up a good reputation in Warrington and other nearby areas. They also closely monitor social media activity and activities levels of the company's website. Four years ago, the company also started to take on some larger contracts for building work in the commercial section. As a result of this additional work, and due to Buildrite's strong reputation with domestic customers, the company's revenue grew steadily until 2019. (The company reported total sales of 5.5m for the year to 31 December 2019.) However, like most industries, the construction industry was heavily affected by the impact of the COVID 19 pandemic. Between March 2020 and June 2020, many UK firms experienced significant levels of disruption to their work with many domestic and commercial building projects put on hold during the first UK lockdown. Despite further lockdowns and continuing periods of restrictions, most building firms have experienced much stronger demand during 2021 and industry experts have predicted growth of between 5% and 10% for the industry. However, some parts of the industry are expected to perform better than others. One of the highest areas of growth is expected to be domestic renovations and extensions. This is due to many households saving significant sums of money during the COVID pandemic as a result of restrictions of foreign holidays and other leisure activities. Exhibit 2 Strategic review for the year to 31 December 2021 The directors present their strategic report for the year ended 31 December 2021. Principal activity The principal activity of the company is a professional building firm. Fair review of the business This has been an extremely busy year for the company with a huge upturn in demand for domestic extensions and kitchen renovations. Throughout the year we were contacted by a large number of potential new customers. The demand was so high that each new customer had to wait at least three months before we could start their building projects because we were booked up so far in advance. Additionally, we have also been hired to complete a small number of commercial contracts. However, thi area of work still has not returned to pre-COVID levels as there has been continuing uncertainty about the future of many office premises. 5 Due to the extremely high level of demand for domestic building work, it has been a challenging year for the building industry in general. In particular, there have been widespread shortages of some materials such as roof tiles and timber. This led to delays on many of our jobs. However, due to the volume of work that we had taken on we were able to switch between different jobs while we waited for supplies to arrive. As a result of the strains on our supply chain, many of our suppliers have been forced to make significant increases to the prices that they charge. For example, the price of timber has doubled in the space 12 months. In many cases, we have been unable to pass these price increases on to our customers because we had already quoted them for their building projects three or four months earlier. Luckily, we have a good relationship with many of our suppliers and they were able to warn us before the price rises so that we could buy additional stock in advance before the prices were changed. In addition to the challenges that we had sourcing materials, we also had labour shortages with many of our staff unable to work at various times of the year as they were ill or were required to self-isolate. We increasingly relied on using subcontractors. This is not ideal, as the daily rate paid to subcontractors is more expensive than paying our own staff and we have less control over the quality of the work performed. Additionally, many of the subcontractors that we usually use were already booked up in advance. So we had to find new subcontractors that we had not previously hired. Exhibit 3 Financial statements for the year to 31 December 2021 Income statement (Note 1) (Note 2) 2021 '000 4,800 (3,200) 1,600 (1,575) 25 (55) (30) Revenue Cost of sales Gross profit Administrative expenses Operating profit Interest charges Profit/(loss) before tax Taxation Profit/(loss) after tax (Note 3) 2020 '000 3,800 (2,300) 1,500 (1,300) 200 (50) 150 (30) 120 (Note 4) (30) Statement of financial position 2021 2020 '000 '000 Non-current assets 750 750 Current assets (Note 5) 525 445 TOTAL ASSETS 1,275 1,195 Equity Ordinary shares capital Retained earnings (Note 6) 50 50 150 180 200 230 Non-current liabilities (Note 7) 800 800 Current liabilities (Note 8) 275 165 TOTAL EQUITY AND LIABILITIES 1,275 1,195 Notes to the financial statements Note 1: Revenue Domestic customers Commercial customers '000 3,000 1,800 4,800 f'000 2,200 1,600 3,800 Note 2: Cost of sales Materials Labour costs Subcontractor costs '000 1,785 315 1,100 3,200 '000 1,200 300 800 2,300 Labour costs relate to wages paid to building staff employed by Buildrite. Note 3: Administrative expenses '000 250 Director's salaries Other salaries Legal expenses Other administrative expenses 50 350 '000 200 50 250 800 1,300 925 1,575 Note 4: Interest charges Bank loan interest Bank overdraft interest '000 45 10 55 '000 45 5 50 Note 5: Current assets Raw materials Trade receivables Other receivables '000 200 300 25 525 '000 120 300 25 445 Note 6: Ordinary share capital The company has currently issued the following ordinary shares: Number of shares Value per share f 0.50 0.50 Mr xham Mr D Fixham 50,000 50,000 100,000 Total value 25,000 25,000 50,000 Note 6: Non-current liabilities '000 800 f'000 800 Five-year bank loan The bank loan was taken out in June 2017 and is due for repayment in June 2022. 8 Interest on the bank loan is charged at 5.625% per annum Note 7: Current liabilities f'000 50 210 Bank overdraft Trade payables Corporation tax liability Other payables '000 25 100 30 10 165 15 275 | Exhibit 4 Key performance indicators for the year to 31 December 2021 Buildrite records and monitors the following key performance indicators: Customer performance indicators 2021 2020 Number of jobs completed in the year: Domestic customers Commercial customers 120 15 135 91 14 105 | 4% Percentage of customers complaints Average number of weeks taken to complete each job 8% 12 5 Number of customers waiting for work to begin 35 10 15 8 Average number of weekly visitor's to Buildrite's website Percentage of positive social media comments 72% 90% Staffing performance indicators 2021 2020 10 Number of staff: Building staff Administrative staff Directors Total staff 2 Elon 2 14 9 Average number of sick days per person COVID-related (including self-isolating) Non-COVID related 14 Blne | 16 Total number of subcontractors used 52 30 Exhibit 5 Details of a new bonus scheme for the Project Managers Buildrite currently employs two Project Managers who have the following duties: . Contacting potential new customers Quoting potential customers for new jobs Overseeing the timescale of each new job Arranging staff and subcontractors Sourcing raw materials from suppliers . Each Project Managers is responsible for a specific area of the business. One manager oversees all of the jobs for domestic customers and the other one oversees all of the jobs for commercial customers. Both Project Managers are currently paid an annual salary of 25,000. New bonus scheme From 1st January 2022, Buildrite has introduced a new bonus scheme for the two Project Managers. The details of the new scheme are as follows: Firstly, each manager must prepare a budget for the area of the business that they are responsible for (domestic or commercial). In their budget they must provide forecasts relating to the forthcoming financial year. . Once these forecasts have been agreed by the directors, the budgeted operating profit will be calculated for each area of the business. . At the end of the financial year, the actual results for their division will be compared to the budget. If the actual operating profit of their division is higher than the budgeted operating profit then that Project Manager will be eligible for a bonus. The bonus paid will be 10% of the additional operating profit (actual vs budget). Details of the budgets for the year to 31 December 2022 are outlined in Exhibit 6. 10 The directors hope that the introduction of this bonus scheme will encourage the Project Managers to maximise sales revenue and to carefully monitor any costs relating to their customers' jobs. Exhibit 6 Forecasts for the year to 31 December 2022 In order to negotiate a budgeted operating profit to set as the Project Managers' target for the year to 31 December 2022, the Project Managers have been asked to provide some initial forecasts of the sales and costs that they expect to occur during 2022. The Project Managers were asked to ignore any information available from previous years and to take a Zero-Based approach to preparing their figures. The forecasts provided by the two Project Managers are presented below: Domestic customers 100 Commercial customers 15 Expected number of jobs Average revenue per job 24,000 120,000 Average costs per job Materials costs Labour costs Subcontractor costs 40% of revenue 2,500 7,000 45% of revenue 18,000 30,000 These are initial forecasts which have not yet been agreed by the directors. Before the final budgets are agreed, the directors would like to consider the reasonableness of the forecasts provided. Administrative expenses Additionally, the directors have forecast that total administrative expenses will be 1,600,000 for the year to 31 December 2022. It has been agreed that these expenses should be split between the two divisions are follows: Domestic customers Commercial customers 800,000 800,000 1,600,000 Exhibit 6 Company vehicles investment and finance options Over the last year, the company has had to use a larger number of subcontractors to complete our work. This is much more expensive than using our own staff. Therefore, we would like to increase our staff levels by hiring five new employees later this year. We predict that hiring additional staff will save the company the following amounts over the next four years: Year 1 25,000 Year 2 30,000 Year 3 35,000 Year 4 35,000 In order to be able to employ additional staff, the company will need to invest money to purchase new company vehicles and additional tools. In total, the company will need to invest 100,000 today. The vehicles are expected to have a useful life of four years. The directors would like the investment to meet a payback period target of three years. Additionally, our accountant estimated that the company has a cost of capital of 5% and recommended that we should aim for a 30% accounting rate of return (based on the initial value of the investment) on any long-term investments. We are currently looking at two potential finance options to fund this investment. These are outlined below: Option 1 The company would take out an additional bank loan for the value of 100,000. We have initially contacted our bank, who have indicated that would be willing to offer the company a five-year bank loan for this amount at an interest rate of 6% per annum. Option 2 One of our employees has recently inherited a large amount of money from a family member. She has expressed an interest in investing in the company and becoming a shareholder. We have been advised to offer her 25,000 ordinary shares in exchange for a 100,000 investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts