Question: using the information provided solve for part c. In early January 2024, Sarasota Corporation applied for a trade name, incurring legal costs of $17,200. In

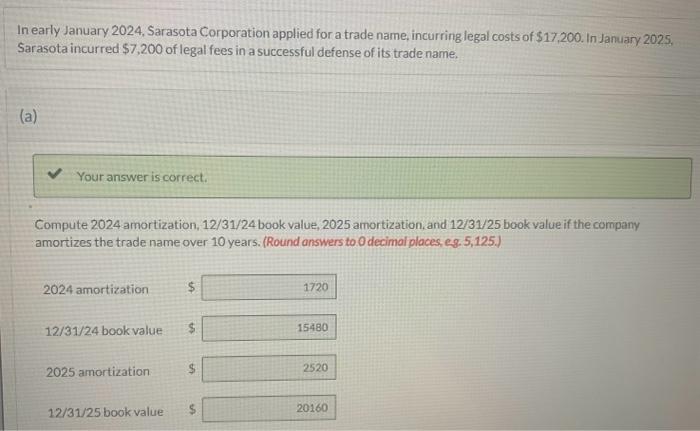

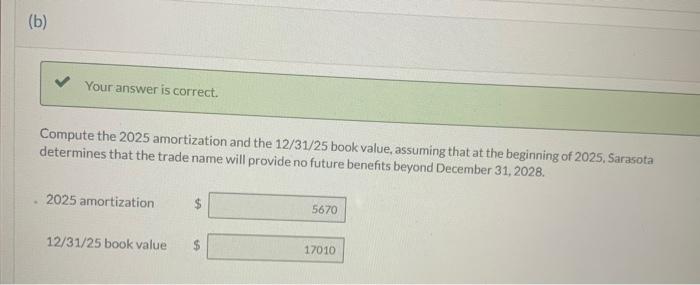

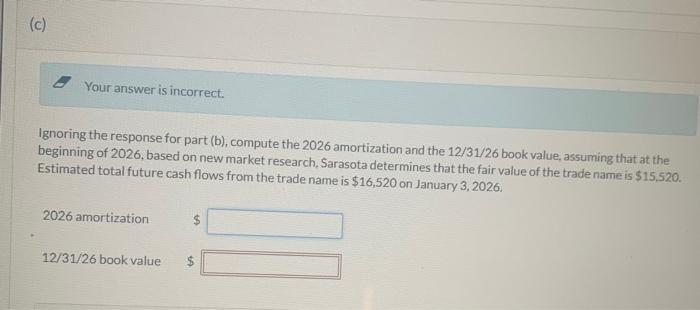

In early January 2024, Sarasota Corporation applied for a trade name, incurring legal costs of $17,200. In January 2025, Sarasota incurred $7,200 of legal fees in a successful defense of its trade name. (a) Compute 2024 amortization, 12/31/24 book value, 2025 amortization, and 12/31/25 book value if the company amortizes the trade name over 10 years. (Round answers to 0 decimol places, e8. 5,125.) 2024 amortization $ 12/31/24 book value 2025 amortization $ 12/31/25 bookvalue $ Compute the 2025 amortization and the 12/31/25 book value, assuming that at the beginning of 2025 , Sarasota determines that the trade name will provide no future benefits beyond December 31,2028 . 2025 amortization 12/31/25 book value Ignoring the response for part (b), compute the 2026 amortization and the 12/31/26 book value, assuming that at the beginning of 2026 , based on new market research, Sarasota determines that the fair value of the trade name is $15,520. Estimated total future cash flows from the trade name is $16,520 on January 3,2026 . 2026 amortization 12/31/26 book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts