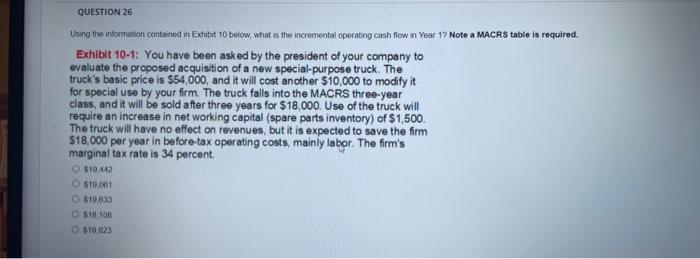

Question: Using the informetion contaned in Exhibit 10 below, what is the incremental operating cash flow in Year 17 Note a MACRS table is required. Exhibit

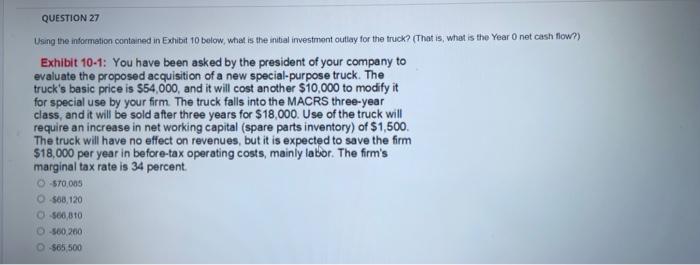

Using the informetion contaned in Exhibit 10 below, what is the incremental operating cash flow in Year 17 Note a MACRS table is required. Exhibit 10-1: You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck. The truck's basic price is $54,000, and it will cost another $10,000 to modify it for special use by your firm. The truck falls into the MACRS three-year class, and it will be sold after three years for $18,000. Use of the truck will require an increase in net working capital (spare parts inventory) of $1,500. The truck will have no effect on revenues, but it is expected to save the firm $18,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 34 percent. 510.442 1510061 sin633 311100 sin1023 Using the information contained in Exhibit 10 below, what is the initial investmont outlay for the truck? (That is, what is the Year 0 net cash flow?) Exhibit 10-1: You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck. The truck's basic price is $54,000, and it will cost another $10,000 to modify it for special use by your firm. The truck falls into the MACRS three-year class, and it will be sold after three years for $18,000. Use of the truck will require an increase in net working capital (spare parts inventory) of $1,500. The truck will have no effect on revenues, but it is expected to save the firm $18,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 34 percent. 5 ro.005 508,120 sec3+31+20.200 500,200 565,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts