Question: Using the INtro information below the pic, I need help with the setup of the excel. I'm sure I can get the formulas entered, but

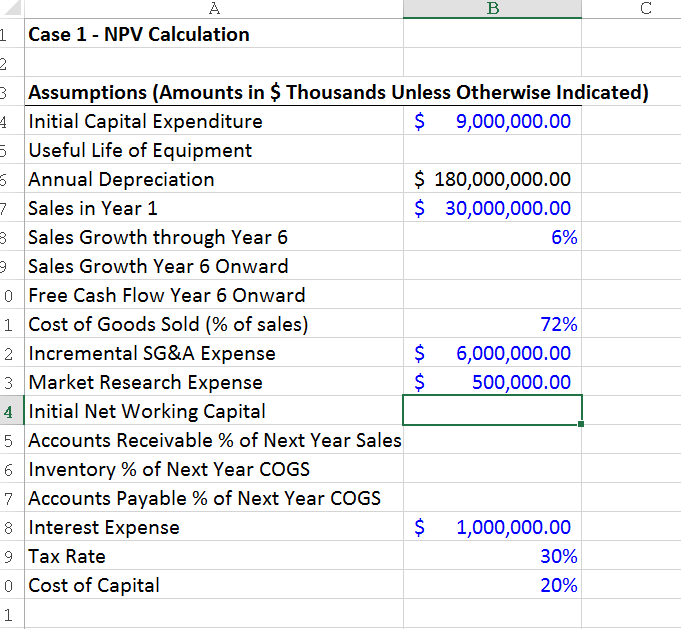

Using the INtro information below the pic, I need help with the setup of the excel. I'm sure I can get the formulas entered, but I'm lost on what goes in the blanks (SEE PICTURE: the assumptions should be in blue, and IDK if I'm right but I know I'm missing some). Once I get those, I think I can enter the calculations. I just need to make sure the blue spaces in the pictures are fille din properly. Sales growth onward is blank but I think it should be 2%. THANKS!

Introduction Canyon Buff Corp. has developed a new construction chemical that greatly improves the durability and weatherability of cement-based materials. After spending $500,000 on the research of the potential market for the new chemical, Canyon Buff is considering a project that requires an initial investment of $9,000,000 in manufacturing equipment. The equipment must be purchased before the chemical production can begin. For tax purposes, the equipment is subject to a 5-year straight-line depreciation schedule, with a projected zero salvage value. For simplicity, however, we will continue to assume that the asset can actually be used out into the indefinite future (i.e., the actual useful life is effectively infinite). Canyon Buff anticipates that the sales will be $30,000,000 in the first year (Year 1). They expect that sales will initially grow at an annual rate of 6% until the end of sixth year. After that, the sales will grow at the estimated 2% annual rate of inflation in perpetuity. The cost of goods sold is estimated to be 72% of sales. The accounting department also estimates that at introduction in Year 0, the new product's required initial net working capital will be $6,000,000. In future years accounts receivable are expected to be 15% of the next year sales, inventory is expected to be 20% of the next years cost of goods sold and accounts payable are expected to be 15% of the next years cost of goods sold. The selling, general and administrative expense is estimated to be $6,000,000 per year, but $1 million of this amount is the overhead expense that will be incurred even if the project is not accepted.

The market research to support the product was completed last month at a cost of $500,000 to be paid by the end of next year.

The annual interest expense tied to the project is $1,000,000. Canyon Buff has a cost of capital of 20% and faces a marginal tax rate of 30% and an average tax rate is 20%.

B A Case 1 - NPV Calculation 1 3 Assumptions (Amounts in $ Thousands Unless otherwise Indicated) 4 Initial Capital Expenditure $ 9,000,000.00 5 Useful Life of Equipment 5 Annual Depreciation $ 180,000,000.00 7 Sales in Year 1 $ 30,000,000.00 8 Sales Growth through Year 6 6% 9 Sales Growth Year 6 Onward 0 Free Cash Flow Year 6 Onward 1 Cost of Goods Sold (% of sales) 72% 2 Incremental SG&A Expense $ 6,000,000.00 3 Market Research Expense $ 500,000.00 4 Initial Net Working Capital 5 Accounts Receivable % of Next Year Sales 6 Inventory % of Next Year COGS 7 Accounts Payable % of Next Year COGS 8 Interest Expense $ 1,000,000.00 9 Tax Rate 30% o Cost of Capital 20% 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts