Question: Using the Journal Entries below please solve question #2 and explain it in detail. Journal Entries 1. Material Account Dr. 68000 To Account Payable Account

Using the Journal Entries below please solve question #2 and explain it in detail.

Journal Entries

1. Material Account Dr. 68000

To Account Payable Account 68000

( Material Purchased on account)

2. Factory Wages Dr. 34000

Selling and administrative Expenses Dr .5000

To Cash 39000

( Salaries paid in Cash )

3. Depreciation on Building Dr 6630

To Building Account 6630

( Depreciation charged on building)

4. Depreciation on Factory Equipment Dr.10800

Depreciation on Office Equipment Dr.2000

To Factory Equipment 10800

To Office Equipment 2000

(Depreciation charged on Factory and office equipment)

5. Other Expenses Dr. 5200

To Outstanding expenses account 5200

( Expenses incurred on account)

6. Account receivable Account Dr.128000

To Sales 128000

( Sales recorded on account)

7. Cash Account Dr. 105000

To Account receivable account 105000

( Amount collected from receivables )

8. Account payable account Dr.55000

To Cash Account 55000

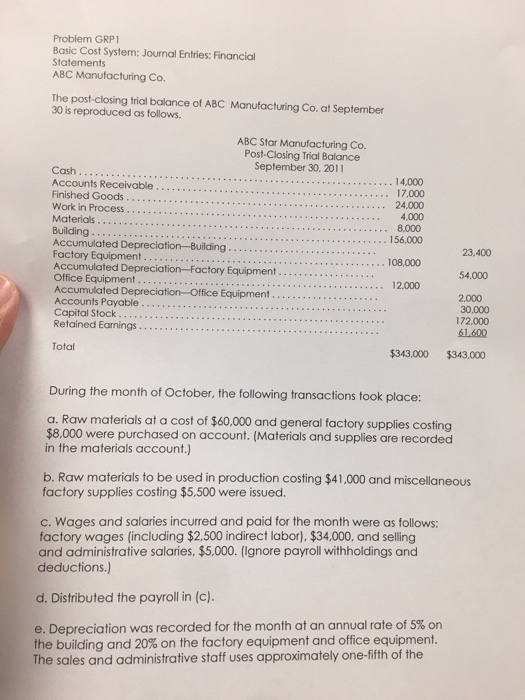

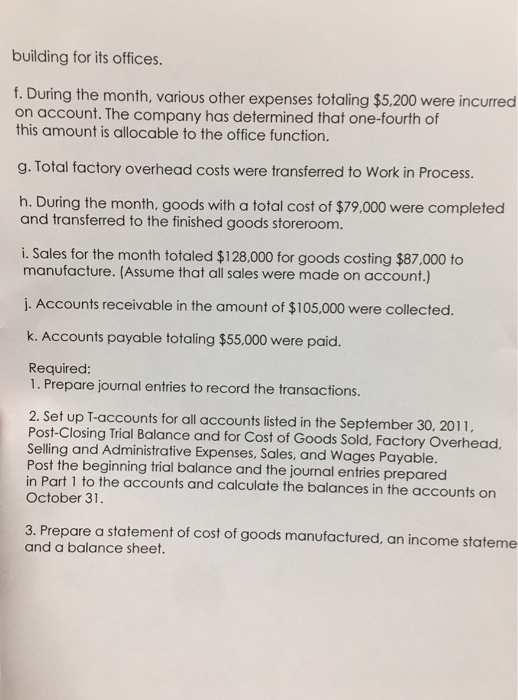

Problem GRP1 Basic Cost System: Journal Entries: Financial Statements ABC Manufacturing Co. The post-closing trial balance of ABC Manufacturing Co. at September 30 is reproduced as follows. ABC Star Manufacturing Co. Post-Closing Trial Balance September 30, 2011 Cash 14,000 Accounts Receivable 17,000 Finished Goods 24,000 Work in Process 4,000 Materials Building 156,000 Accumulated Depreciation--Building Factory Equipment 108,000 Accumulated Depreciation-Factory Equipment.... Office Equipment 12,000 Accumulated Depreciation-Office Equipment Accounts Payable Capital Stock 172,000 Retained Earnings Total $343.000 $343.000 During the month of October, the following transactions took place: a. Raw materials at a cost of $60,000 and general factory supplies costing $8,000 were purchased on account. (Materials and supplies are recorded in the materials account.) b. Raw materials to be used in production costing $41,000 and miscellaneous factory supplies costing $5.500 were issued. c. Wages and salaries incurred and paid for the month were as follows: factory wages (including $2,500 indirect labor), $34,000, and selling and administrative salaries, $5,000. (lgnore payroll withholdings and deductions.) d. Distributed the payroll in (c). e. Depreciation was recorded for the month at an annual rate of 5% on the building and on the equipment and office of the The and administrative staff uses approximately one-fifth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts