Question: Using the journal entries provided, prepare the Stockholder's Equity section of the Balance Sheet. Using Excel for stockholders' equity transactions and preparing financial statements Naxion

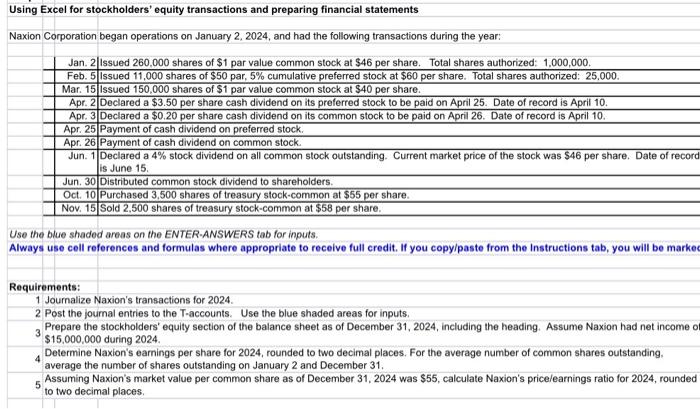

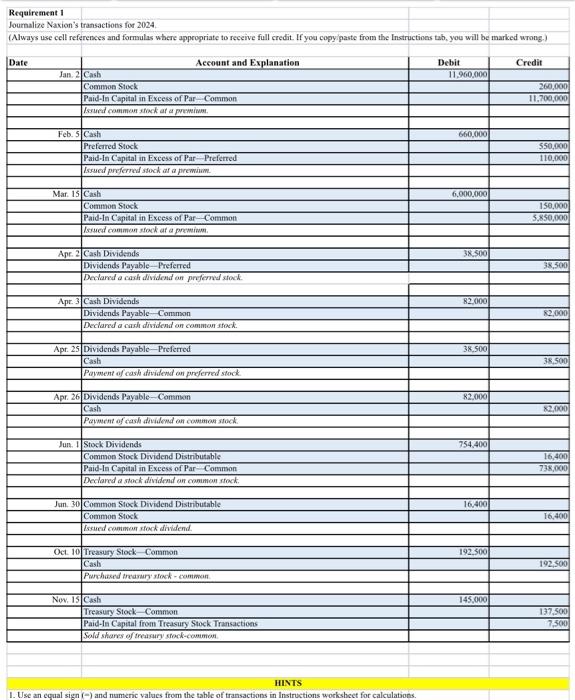

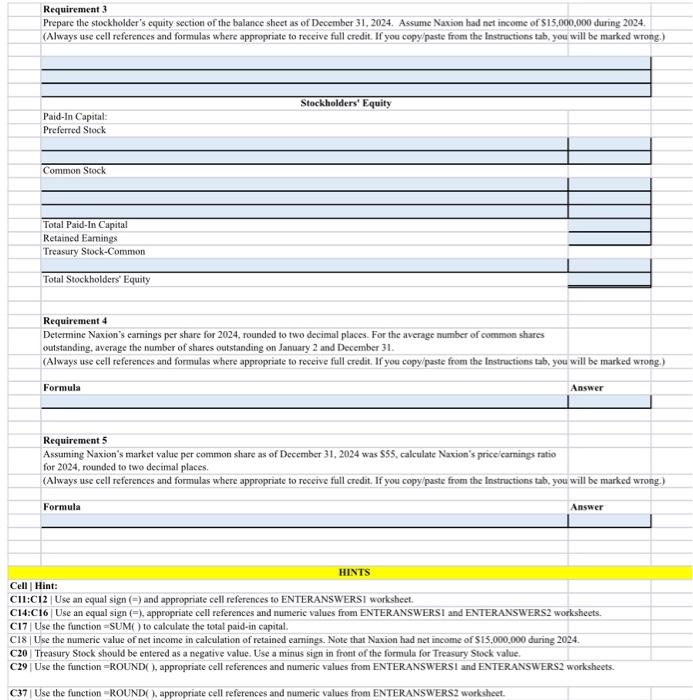

Using Excel for stockholders' equity transactions and preparing financial statements Naxion Corporation began operations on January 2, 2024, and had the following transactions during the year: Jan. 2 Issued 260,000 shares of $1 par value common stock at $46 per share. Total shares authorized: 1,000,000. Feb. 5 Issued 11,000 shares of $50 par, 5% cumulative preferred stock at $60 per share. Total shares authorized: 25,000. Mar. 15 Issued 150,000 shares of $1 par value common stock at $40 per share. Apr. 2 Declared a $3.50 per share cash dividend on its preferred stock to be paid on April 25. Date of record is April 10. Apr. 3 Declared a $0.20 per share cash dividend on its common stock to be paid on April 26. Date of record is April 10. Apr. 25 Payment of cash dividend on preferred stock. Apr. 26 Payment of cash dividend on common stock. Jun. 1 Declared a 4% stock dividend on all common stock outstanding. Current market price of the stock was $46 per share. Date of record is June 15. Jun. 30 Distributed common stock dividend to shareholders. Oct. 10 Purchased 3,500 shares of treasury stock-common at $55 per share. Nov. 15 Sold 2,500 shares of treasury stock-common at $58 per share. Use the blue shaded areas on the ENTER-ANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab, you will be marked Requirements: 1 Journalize Naxion's transactions for 2024. 2 Post the journal entries to the T-accounts. Use the blue shaded areas for inputs. 3 Prepare the stockholders' equity section of the balance sheet as of December 31, 2024, including the heading. Assume Naxion had net income of $15,000,000 during 2024. 4 Determine Naxion's earnings per share for 2024, rounded to two decimal places. For the average number of common shares outstanding. average the number of shares outstanding on January 2 and December 31. 5 Assuming Naxion's market value per common share as of December 31, 2024 was $55, calculate Naxion's price/earnings ratio for 2024, rounded to two decimal places. Requirement 1 Journalize Naxion's transactions for 2024. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab, you will be marked wrong.) Date Account and Explanation Debit Credit Jan. 2 Cash 11,960,000 Common Stock Paid-In Capital in Excess of Par Common Issued common stock at a premium. 660,000 Preferred Stock Paid-In Capital in Excess of Par-Preferred Issued preferred stock at a premium. Mar. 15 Cash 6,000,000 Common Stock Paid-In Capital in Excess of Par-Common Issued common stock at a premium. Apr. 2 Cash Dividends 38,500 Dividends PayablePreferred Declared a cash dividend on preferred stock Apr. 3 Cash Dividends 82,000 Dividends Payable Common Declared a cash dividend on common stock. Apr. 25 Dividends Payable-Preferred 38,500 Cash Payment of cash dividend on preferred stock Apr. 26 Dividends Payable-Common 82,000 Cash Payment of cash dividend on common stock. Jun. 1 Stock Dividends 754,400 Common Stock Dividend Distributable Paid-In Capital in Excess of Par Common Declared a stock dividend on common stock. 16,400 192,500 145,000 Feb. 5 Cash Jun. 30 Common Stock Dividend Distributable Common Stock Issued common stock dividend. Oct. 10 Treasury Stock Common Cash Purchased treasury stock-common Nov, 15 Cash Treasury Stock Common Paid-In Capital from Treasury Stock Transactions Sold shares of treasury stock-common HINTS 1. Use an equal sign (-) and numeric values from the table of transactions in Instructions worksheet for calculations. 260,000 11,700,000 550,000 110,000 150,000 5,850,000 38,500 82,000 38,500 82,000 16,400 738,000 16,400 192,500 137,500 7,500 Requirement 3 Prepare the stockholder's equity section of the balance sheet as of December 31, 2024. Assume Naxion had net income of $15,000,000 during 2024. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab, you will be marked wrong.) Stockholders' Equity Paid-In Capital: Preferred Stock Common Stock Total Paid-In Capital Retained Earnings Treasury Stock-Common Total Stockholders' Equity Requirement 4 Determine Naxion's earnings per share for 2024, rounded to two decimal places. For the average number of common shares outstanding, average the number of shares outstanding on January 2 and December 31. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab, you will be marked wrong.) Formula Answer Requirement 5 Assuming Naxion's market value per common share as of December 31, 2024 was $55, calculate Naxion's price/earnings ratio for 2024, rounded to two decimal places. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab, you will be marked wrong.) Formula Answer HINTS Cell | Hint: CII:C12 | Use an equal sign (=) and appropriate cell references to ENTERANSWERSI worksheet. C14:C16 Use an equal sign (-), appropriate cell references and numeric values from ENTERANSWERSI and ENTERANSWERS2 worksheets. C17 Use the function -SUM( ) to calculate the total paid-in capital. C18 | Use the numeric value of net income in calculation of retained earnings. Note that Naxion had net income of $15,000,000 during 2024. C20 Treasury Stock should be entered as a negative value. Use a minus sign in front of the formula for Treasury Stock value. C29 | Use the function -ROUND(), appropriate cell references and numeric values from ENTERANSWERSI and ENTERANSWERS2 worksheets. C37 | Use the function -ROUND( ), appropriate cell references and numeric values from ENTERANSWERS2 worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts