Question: Using the latest financial statements on the form 10-K (found on sec.gov) for Nvidia Corporation (NVDA) (fiscal year ending January 29, 2023) and the budgetary

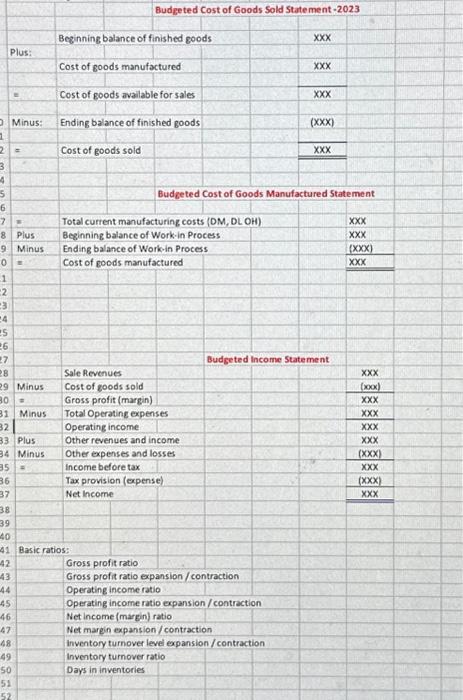

Using the latest financial statements on the form 10-K (found on sec.gov) for Nvidia Corporation (NVDA) (fiscal year ending January 29, 2023) and the budgetary criteria presented below, prepare the budgeted financial statements for the fiscal year 2023 using the format in the picture below.

Budgetary Criteria:

1. The net sale is expected to increase by 15% in 2023.

2. 25% of 2022 cost of goods sold is fixed, which is expected to increase by $8,000,000 in 2023. The rest of the cost of goods sold is a variable cost.

3. The company would like to reduce the ending inventories of finished goods and work-in-process for 2023 by 10%.

4. 80% of operating expenses are fixed and they are expected to increase by $4,000,000 in 2023. The rest of the operation expenses are variable.

5. The company expects interest expenses to decrease by 5% in the year 2023, no other income or gain is expected, and other expenses (other than interest expenses) to be 30% of the budgeted interest expense.

6. The tax rate is expected to be 20% of income before tax.

Format:

Budgeted Cost of Goods Sold Statement -2023 Beginning balance of finished goods xX Plus: Cost of goods manufactured = Cost of goods avallable for sales xxxxxx Minus: Ending balance of finished goods (XXX)XXX Budgeted Cost of Goods Manufactured Statement Total current manufacturing costs (DM, DLOH) \begin{tabular}{l} xx \\ xxx \\ (xx) \\ xxx \\ \hline \end{tabular} Budgeted Income Statement Basic ratios: Gross profit ratio Gross profit ratio expansion/contraction Operating income ratio Operating income ratio expansion / contraction Net income (margin) ratio Net marein expansion/contraction inventory tumover level expansion/contraction Inventory turnover ratio Days in inventories Budgeted Cost of Goods Sold Statement -2023 Beginning balance of finished goods xX Plus: Cost of goods manufactured = Cost of goods avallable for sales xxxxxx Minus: Ending balance of finished goods (XXX)XXX Budgeted Cost of Goods Manufactured Statement Total current manufacturing costs (DM, DLOH) \begin{tabular}{l} xx \\ xxx \\ (xx) \\ xxx \\ \hline \end{tabular} Budgeted Income Statement Basic ratios: Gross profit ratio Gross profit ratio expansion/contraction Operating income ratio Operating income ratio expansion / contraction Net income (margin) ratio Net marein expansion/contraction inventory tumover level expansion/contraction Inventory turnover ratio Days in inventories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts