Question: Using the legend provided below, classify each statement as to the taxpayer for dependency exemption purposes. Assume a 2019 tax year. Legend QC Could be

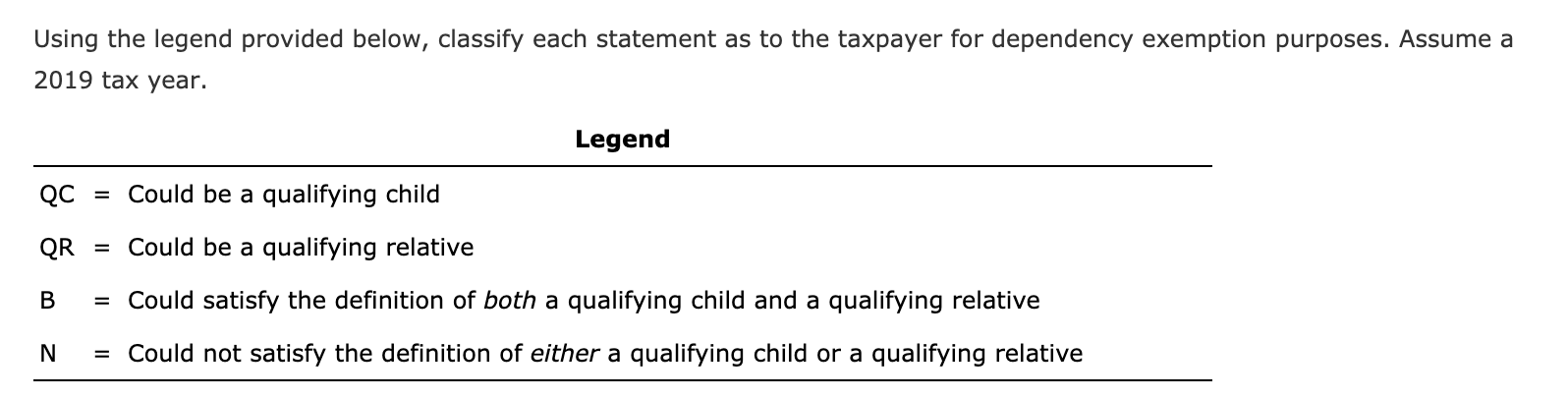

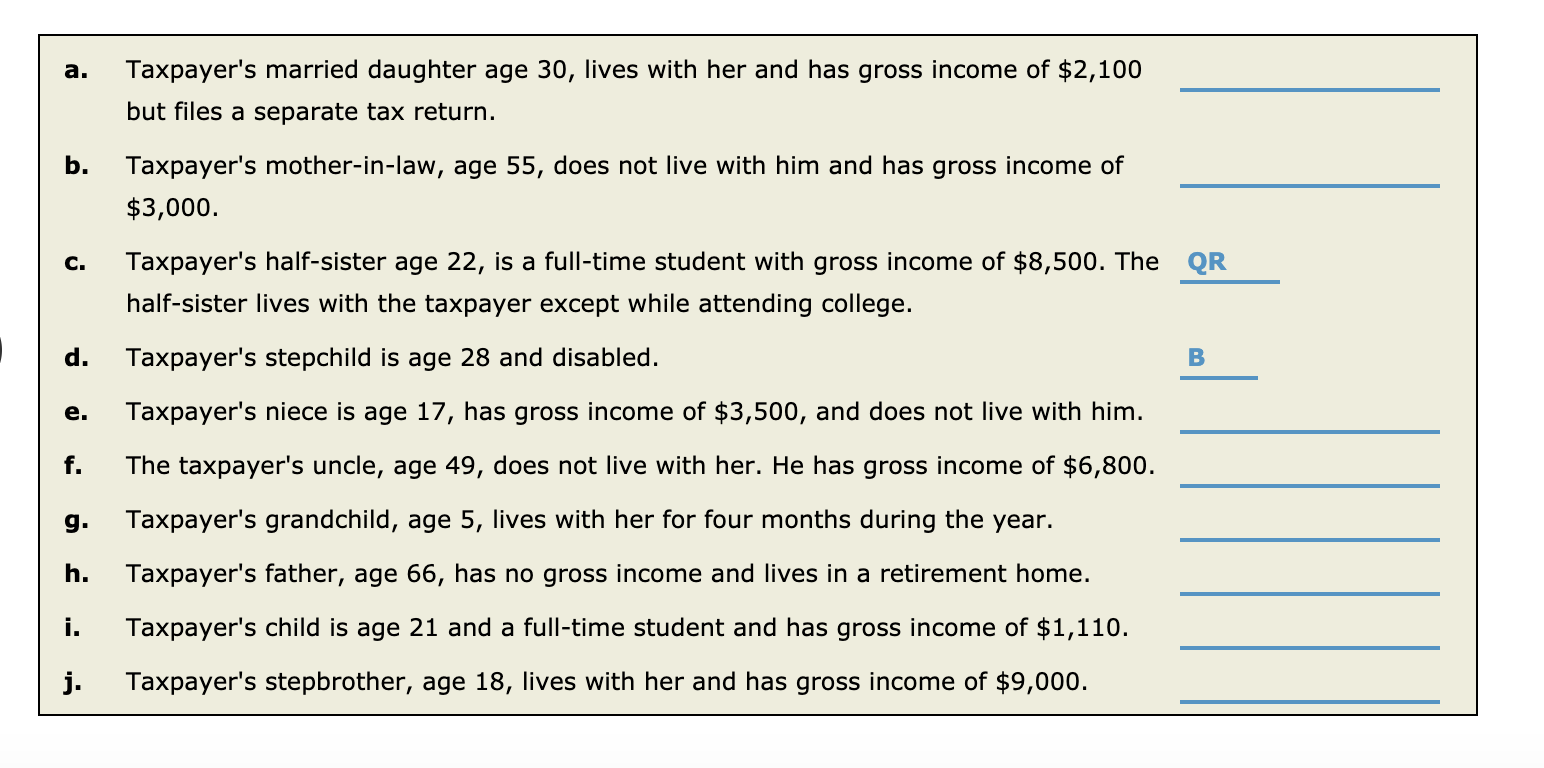

Using the legend provided below, classify each statement as to the taxpayer for dependency exemption purposes. Assume a 2019 tax year. Legend QC Could be a qualifying child QR = Could be a qualifying relative B = Could satisfy the definition of both a qualifying child and a qualifying relative N = Could not satisfy the definition of either a qualifying child or a qualifying relative a. Taxpayer's married daughter age 30, lives with her and has gross income of $2,100 but files a separate tax return. b. Taxpayer's mother-in-law, age 55, does not live with him and has gross income of $3,000. C. Taxpayer's half-sister age 22, is a full-time student with gross income of $8,500. The QR half-sister lives with the taxpayer except while attending college. d. Taxpayer's stepchild is age 28 and disabled. B e. Taxpayer's niece is age 17, has gross income of $3,500, and does not live with him. f. The taxpayer's uncle, age 49, does not live with her. He has gross income of $6,800. g. Taxpayer's grandchild, age 5, lives with her for four months during the year. Taxpayer's father, age 66, has no gross income and lives in a retirement home. h. i. Taxpayer's child is age 21 and a full-time student and has gross income of $1,110. j. Taxpayer's stepbrother, age 18, lives with her and has gross income of $9,000. Using the legend provided below, classify each statement as to the taxpayer for dependency exemption purposes. Assume a 2019 tax year. Legend QC Could be a qualifying child QR = Could be a qualifying relative B = Could satisfy the definition of both a qualifying child and a qualifying relative N = Could not satisfy the definition of either a qualifying child or a qualifying relative a. Taxpayer's married daughter age 30, lives with her and has gross income of $2,100 but files a separate tax return. b. Taxpayer's mother-in-law, age 55, does not live with him and has gross income of $3,000. C. Taxpayer's half-sister age 22, is a full-time student with gross income of $8,500. The QR half-sister lives with the taxpayer except while attending college. d. Taxpayer's stepchild is age 28 and disabled. B e. Taxpayer's niece is age 17, has gross income of $3,500, and does not live with him. f. The taxpayer's uncle, age 49, does not live with her. He has gross income of $6,800. g. Taxpayer's grandchild, age 5, lives with her for four months during the year. Taxpayer's father, age 66, has no gross income and lives in a retirement home. h. i. Taxpayer's child is age 21 and a full-time student and has gross income of $1,110. j. Taxpayer's stepbrother, age 18, lives with her and has gross income of $9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts