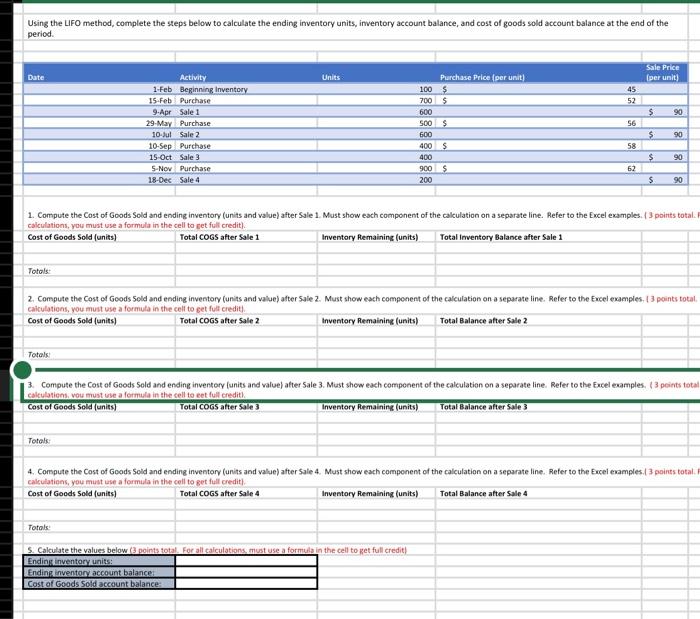

Question: Using the LIFO method, complete the steps below to calculate the ending inventory units, inventory account balance, and cost of goods sold account balance at

Using the LIFO method, complete the steps below to calculate the ending inventory units, inventory account balance, and cost of goods sold account balance at the end of the period. Date: Activity 1.feb Beginning Inventory 15.Feb Purchase 9.Apr Sale 1 29-May Purchase 10-Jul Sale 2 10-5ep Purchase 15 -Oct Sale 3 5-Nor Purchase 18-Des Sale 4 Units Purchase Price (per unit) 100700$$ 600 500$ 600 4005 400 900$ 200 200 6. 5 Sale Price (per unit) 52. 56 $ 90. 5 58 $ 90 90 90. 590 calculations, you must use a formula in the cell to cet full credit). Cost of Goods Sold (units) Total COGS after Sale 1 Inventory Remaining (units) Total Imventory Balance after Sale 1 Totols: calculations, you must use a formula in the cell to get fult credit). Cost of Goods Sold (units) Total coGs after Sale 2 Inventory Remaining (units) Total Balance after Sale 2 Totals: calculations, vou must vise a formula in the sell to eet full credit). Cost of Goods Sold (units) Total coGs after sale 3 Inventory Remaining (units) Total Balance after Sale 3 Totels: calculations, you must use a formula in the cell to get full credit). Cost of Goods Sold (units) Total COGS after Sale 4 Inventory Remaining (units) Total Balance after Sale 4 Totals: 5. Calculate the values below (3 points total. For all calculations, must use a formula in the cell to get full credit) Ending inventory units: Ending inventory account balance: Cost of Goods sold account balance: For all calculations must use a formula in the cell to get full credit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts