Question: Using the loanable funds model (from chapter 10 ) of interest rate determination (draw a graph), show the effect on the equilibrium interest rate and

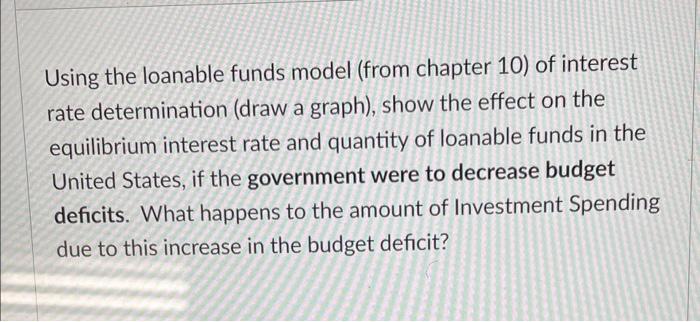

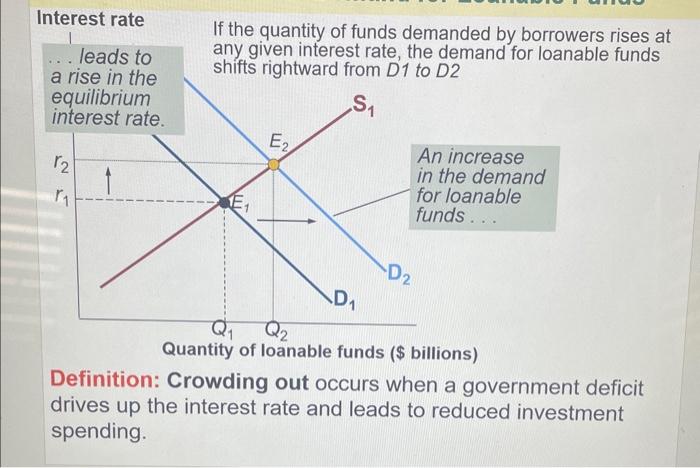

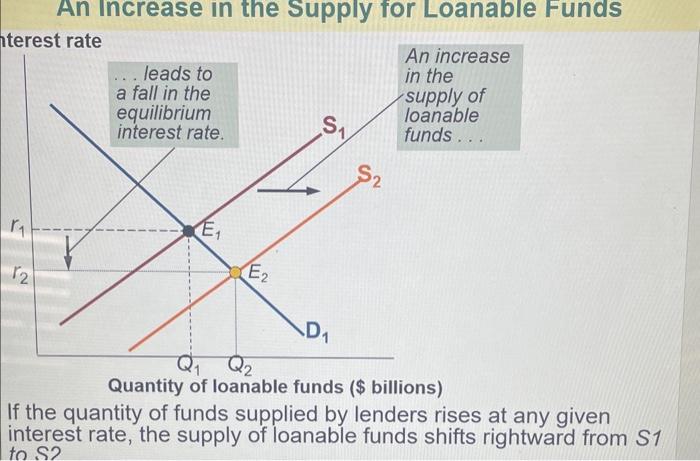

Using the loanable funds model (from chapter 10 ) of interest rate determination (draw a graph), show the effect on the equilibrium interest rate and quantity of loanable funds in the United States, if the government were to decrease budget deficits. What happens to the amount of Investment Spending due to this increase in the budget deficit? Irs rises at ble funds Definition: Crowding out occurs when a government deficit drives up the interest rate and leads to reduced investment spending. An Increase in the Supply for Loanable Funds If the quantity of funds supplied by lenders rises at any given interest rate, the supply of loanable funds shifts rightward from S1 Equilibrium in the Loanable Funds Marke At the equilibrium interest rate, the quantity of loanable funds supplied equals the quantity of loanable funds demanded. Here, the equilibrium interest rate is 6%, with $400 billion of funds lent and borrowed

Step by Step Solution

There are 3 Steps involved in it

To understand the impact of a decrease in government budget deficits on the loanable funds market lets use a graph and analyze the situation step by s... View full answer

Get step-by-step solutions from verified subject matter experts