Question: EXM 01: Cost of Capital There are following predictions attainable: Assets needed for the business: 38 000 000 CZK (Fixed Assets + Net Working

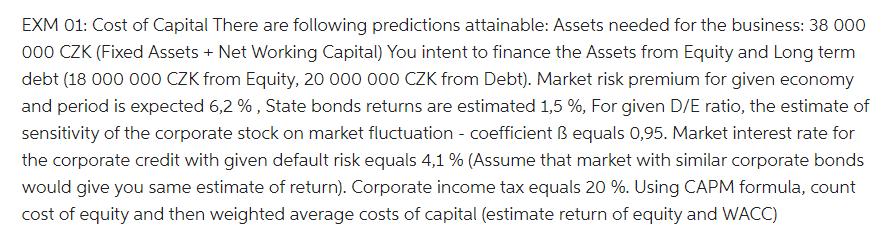

EXM 01: Cost of Capital There are following predictions attainable: Assets needed for the business: 38 000 000 CZK (Fixed Assets + Net Working Capital) You intent to finance the Assets from Equity and Long term debt (18 000 000 CZK from Equity, 20 000 000 CZK from Debt). Market risk premium for given economy and period is expected 6,2 %, State bonds returns are estimated 1,5 %, For given D/E ratio, the estimate of sensitivity of the corporate stock on market fluctuation - coefficient B equals 0,95. Market interest rate for the corporate credit with given default risk equals 4,1 % (Assume that market with similar corporate bonds would give you same estimate of return). Corporate income tax equals 20 %. Using CAPM formula, count cost of equity and then weighted average costs of capital (estimate return of equity and WACC)

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Answer Cost of Equity Riskfree rate Bet... View full answer

Get step-by-step solutions from verified subject matter experts