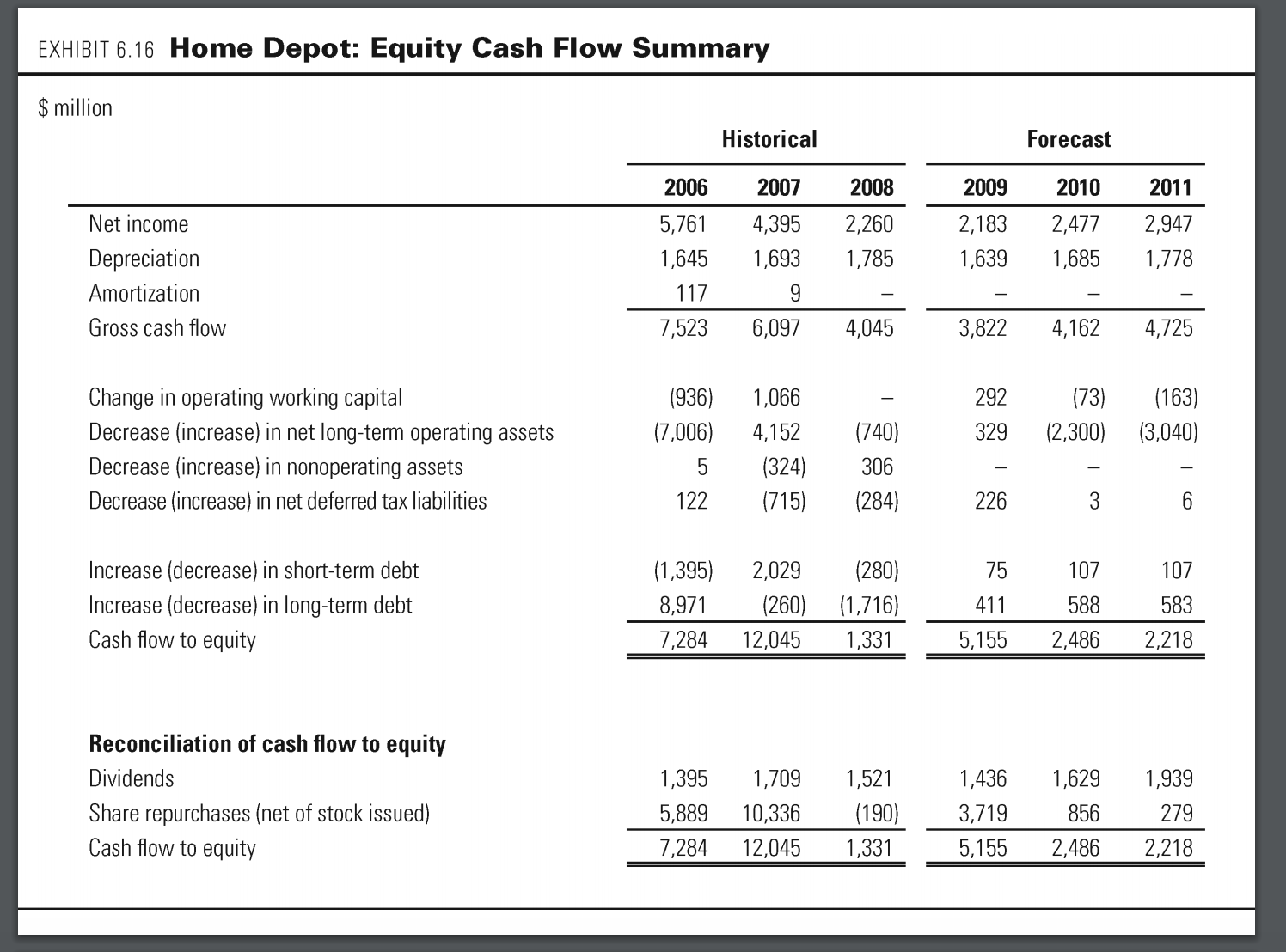

Question: Using the methodology outlined in Exhibit 6.16, (chapter 6) determine equity cash flow for year 1. Use the growing -perpetuity formula based on equity cash

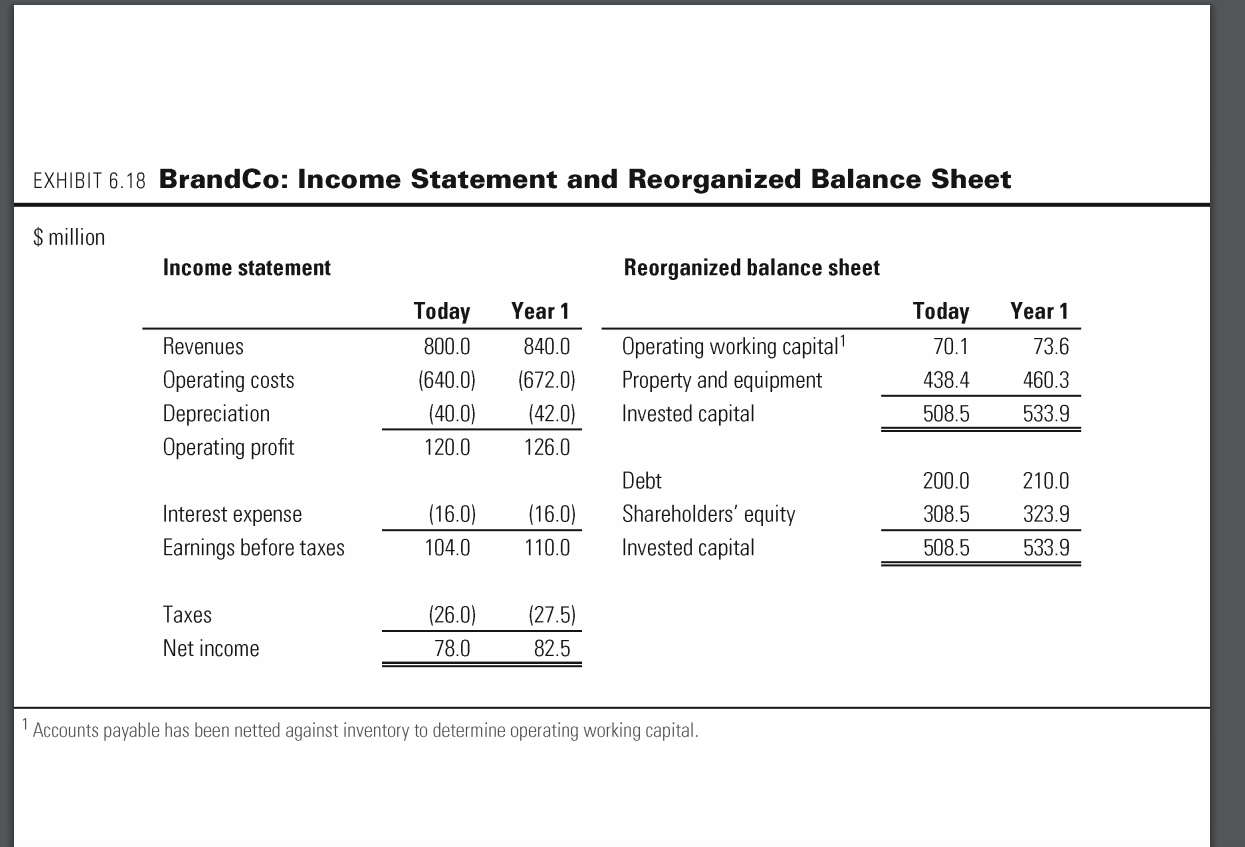

Using the methodology outlined in Exhibit 6.16, (chapter 6) determine equity cash flow for year 1. Use the growing -perpetuity formula based on equity cash flow) to compute BrandCo's equity value. Assume cost of capital is 12% and cash flows are growing at 5%.

Using the methodology outlined in Exhibit 6.16, (chapter 6) determine equity cash flow for year 1. Use the growing -perpetuity formula based on equity cash flow) to compute BrandCo's equity value. Assume cost of capital is 12% and cash flows are growing at 5%.

EXHIBIT 6.16 Home Depot: Equity Cash Flow Summary $ million Historical Forecast 2006 2007 2008 5,7614,3952,260 1,645 1,693 1,785 20092010 2011 2,1832,4772,947 1,639 1,6851,778 Net income Depreciation Amortization Gross cash flow 7,5236,097 4,045 3,8224,1624,725 Change in operating working capital Decrease (increase) in net long-term operating assets Decrease (increase) in nonoperating assets Decrease (increase) in net deferred tax liabilities (936) 1,066 292(73)(163) 329 (2,300) (3,040) (7,006) 4,152(740) 5(324) 306 122 715) 284) 226 (1,395) 2,029(280) 8,971(260) (1,716) 7,28412,0451,331 107 Increase (decrease) in short-term debt Increase (decrease) in long-term debt Cash flow to equity 107 583 5,1552,4862,218 75 Reconciliation of cash flow to equity Dividends Share repurchases (net of stock issued) Cash flow to equity 1,3951,7091,521 5,88910,336 (190)3,719856 279 7,284 12,045 1,331 1,436 1,6291,939 5,1552,4862,218

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts