Question: Using the most recent balance sheet and income statement, calculate the financial ratios for the firm, including the internal and sustainable growth rates. You are

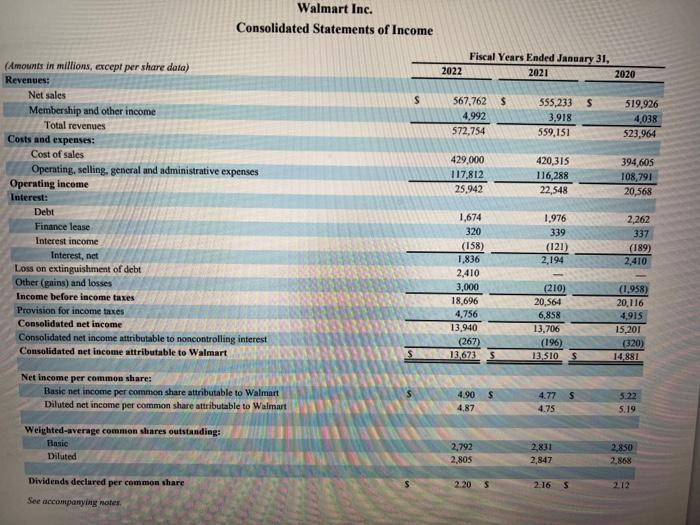

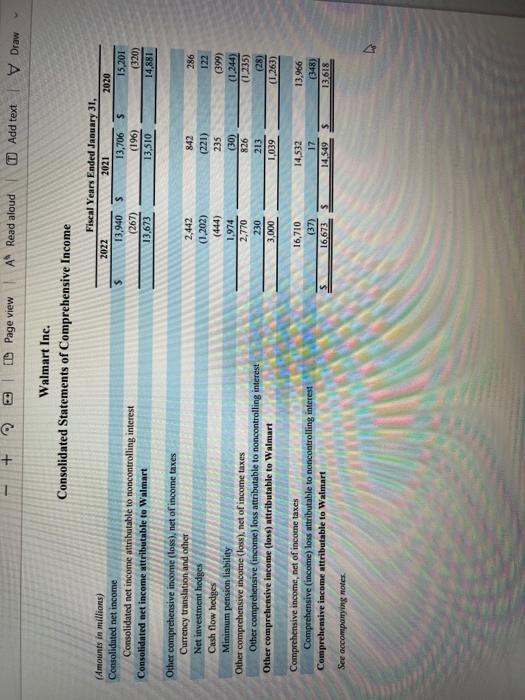

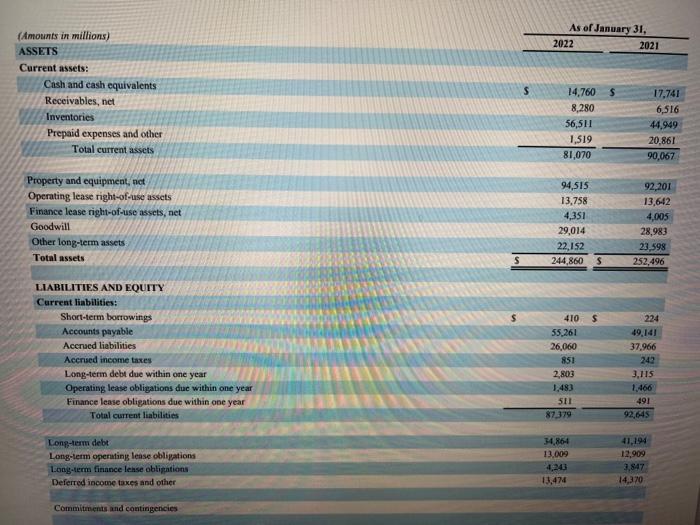

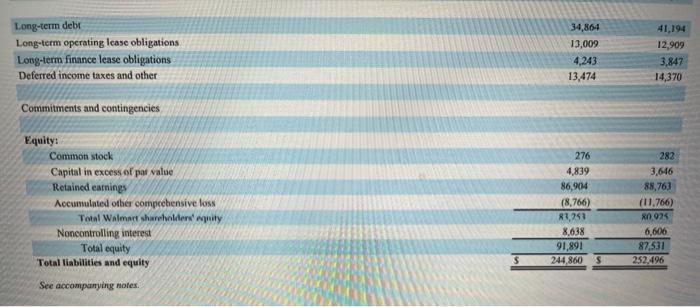

Using the most recent balance sheet and income statement, calculate the financial ratios for the firm, including the internal and sustainable growth rates. You are required to calculate the following ratios:

Sales to working capital

Total asset turnover

Capital intensity

Debt ratio

Debt-to-equity

Walmart Inc. Walmart Inc. Consolidated Statements of Comprehensive Income (Amounts in millions) ASSEIS 2022AsofJanuary31,22021 Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets. Property and equipment, net Operating lease right-of-use assets Finance lease right-of-use assets, net Goodwill Other long-term assets Total assets LIBILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Acersed liabilities Acerised income taxes Long-term debt due within one year Operating lease obligations due within one year Finance lease obligations due within one year Total current liabilities Long-temin debt Long-term operating lease obligations Long-term finance lease obligations Deferred income taxes and other Commitments and contingencies Fiquity: Common stock Capital in excess of pas value Retained eatnings Aceumulated other comprehensive loss Total Walmat shareholilers' equity Noncontrolling interest Total equity Total liabilities and equity See accompanyng notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts