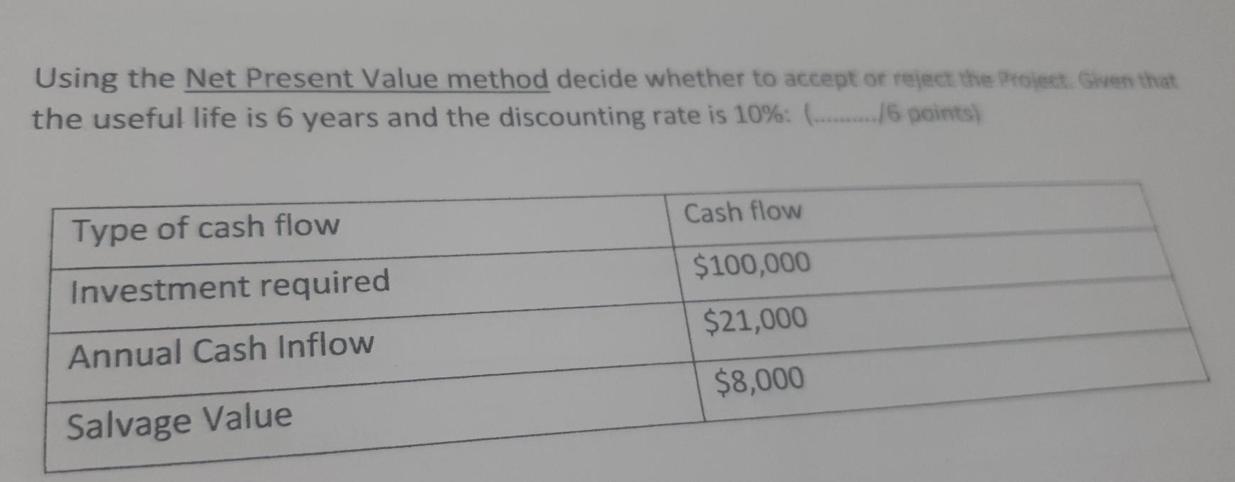

Question: Using the Net Present Value method decide whether to accept or reject the Project. Given that the useful life is 6 years and the

Using the Net Present Value method decide whether to accept or reject the Project. Given that the useful life is 6 years and the discounting rate is 10%: (/6 points) Type of cash flow Investment required Annual Cash Inflow Salvage Value Cash flow $100,000 $21,000 $8,000

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Given Useful life 6 years Discounting rate 10 Cash flow Initial investment required 100000 Annual ca... View full answer

Get step-by-step solutions from verified subject matter experts