Question: Using the Nike, Inc Problem calculate the current ratio, the quick ratio, the accounts receivable turnover, and the number of days sales in receivables, the

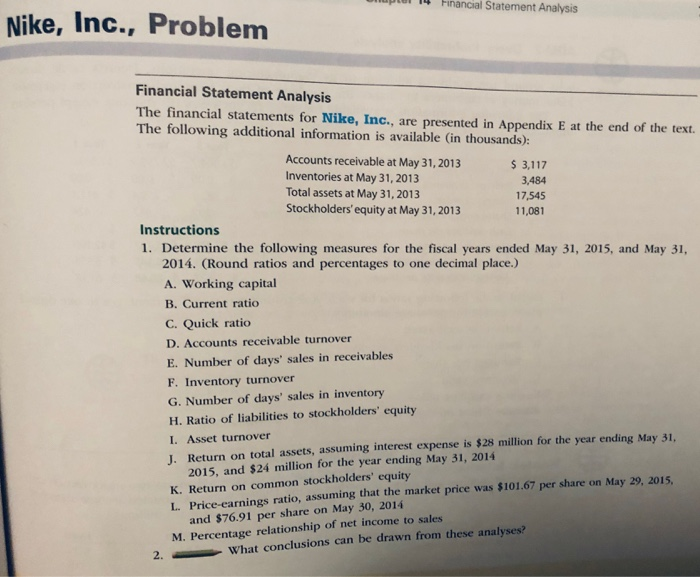

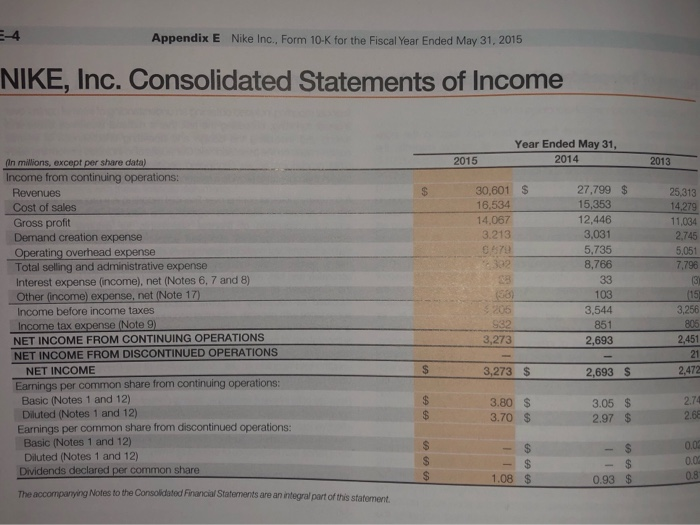

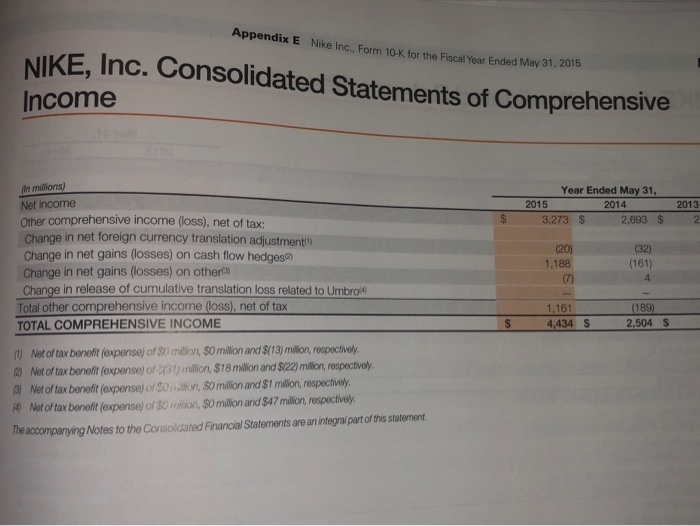

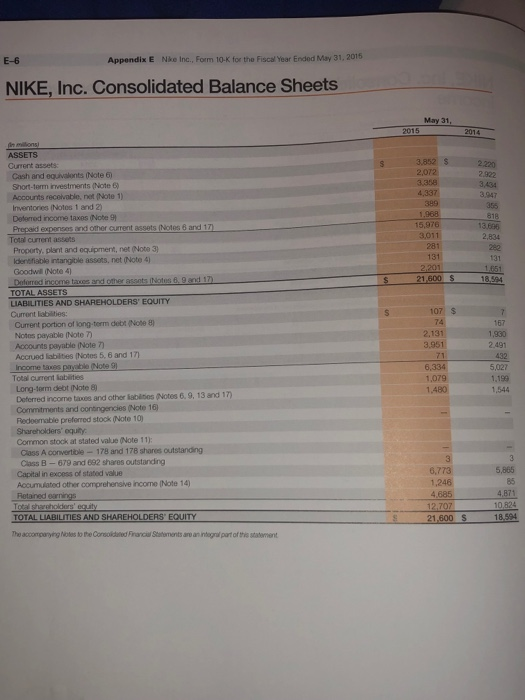

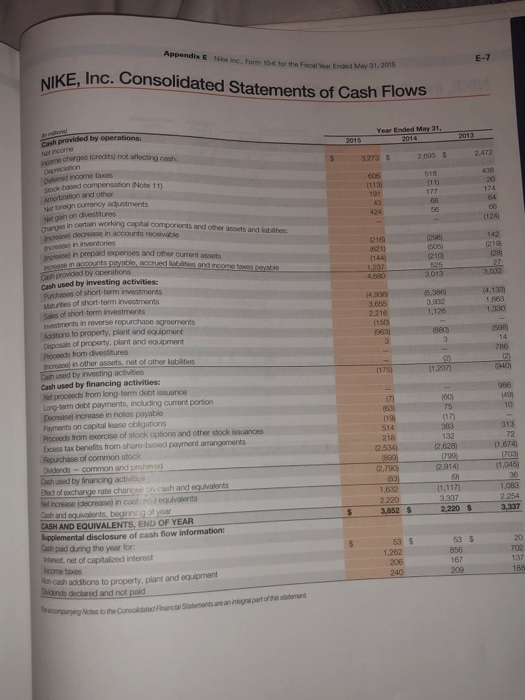

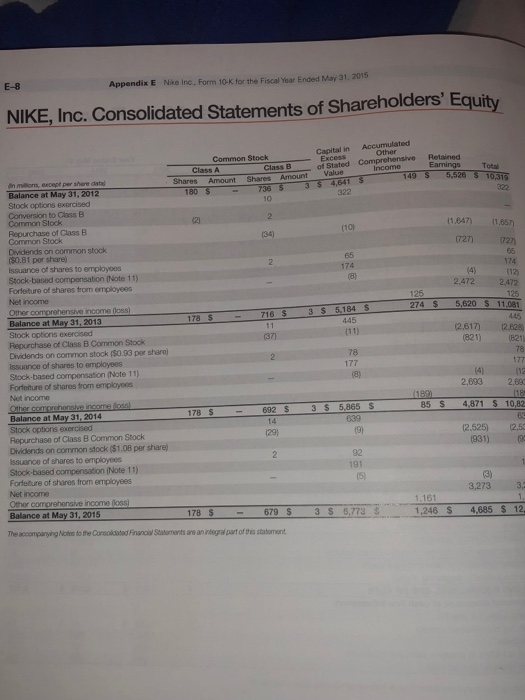

Financial Statement Analysis Nike, Inc., Problem Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Accounts receivable at May 31, 2013 Inventories at May 31, 2013 Total assets at May 31, 2013 Stockholders' equity at May 31, 2013 3,117 3,484 17,545 11,081 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2015, and May 31 2014. (Round ratios and percentages to one decimal place.) A. Working capital B. Current ratio C. Quick ratio D. Accounts receivable turnover E. Number of days' sales in receivables F. Inventory turnover G. Number of days' sales in inventory H. Ratio of liabilities to stockholders' equity I. Asset turnover J. Return on total assets, assuming interest expense is $28 million for the year ending May 31, 2015, and $24 million for the year ending May 31, 2014 K. Return on common stockholders' equity L. Price-earnings ratio, assuming that the market price was $101.67 per share on May 29, 2015, and $76.91 per share on May 30, 2014 M. Percentage relationship of net income to sales What conclusions can be drawn from these analyses? 2. Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2015 Appendix E NIKE, Inc. Consolidated Statements of Income Year Ended May 31, 2014 2015 2013 In millions, except per share data) Income from continuing operations 30,601 $ 16,534 14,067 27,799 $ 25,313 14.279 11,034 2,745 5,051 7,796 15,353 12,446 3,031 5,735 8,766 Cost of sales Gross profit Demand creation expense 3.213 9e79 Total selling and administrative expense Interest expense (income), net (Notes 6, 7 and 8) Other (income) expense, net (Note 17) Income before income taxes 103 3,544 3,256 3,273 2,451 21 2,693 NET INCOME FROM CONTINUING OPERATIONS NET INCOME FROM DISCONTINUED OPERATIONS NET INCOME 2,693 S Earnings per common share from continuing operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) Earnings per common share from discontinued operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) Dividends declared per common share 3.80 $ 3.70 $ 3.05 $ 2.97 $ 2.68 0.02 0.8 1.08 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement Appendix E Nike Inc, Form 10-K for the Fiscal Year Ended May 31, 2015 NIKE, Inc. Consolidated Statements of Comprehensive Income Year Ended May 31, Net income Other comprehensive income (loss), net of tax: Change in net foreign currency translation adjustmentn Change in net gains (losses) on cash flow hedgesa Change in net gains (losses) on other3) Change in release of cunulative translation loss related to Umbro 2014 2013 3,273 $ 2,693 $ 2 (32) (161) (20) 1,188 income 1,161 4,434 S 2,504 $ TOTAL COMPREHENSIVE INCOME 1)Net of tax benefit (expense) of 0 ilion, $0 milion and $(13) milion, respectively Net of tax beneft (expense) of 2snillion $18 milion and 822) milion, respectvoly NetOf tax benefit (expense) of SOndkn. Somition and$1 milon, respectively. 4 Net of tax beneft (expense) of 0ntion, $O milion and $47 milion, respectivel The accompanying Notes to the Consoldated Financial Statements are an integral part of this statenent Nke Inc., Form 10-K for the Fiscal Year Ended May 31, 2015 Appendix E E-6 NIKE, Inc. Consolidated Balance Sheets May 31 2015 ASSETS Gurrent assets: Cash and eorvaknts Nte6) Short-terrnm investments (Note 6) Accounts recelvable, net Note 1) Inventories (Notes 1 and 2) Defemed irncome taxes (Note 9 Prepaid expenses and oner current assets (Notes 8 and 17 Total current assets Proporty, plent and equipment, net (Note 3) Idenifiable intangible assets, net (Note 4) Goodwl Note 4 2,072 2.922 ,337 3.947 1,968 15,976 3,011 281 13.686 2,834 131 S 21.600 S18.594 nd other assets (Notos 6. 9 and 17 LIABILITIES AND SHAREHOLDERS' EQUITY Current labilties: 107 $ Current portion of long-tern debt (Note 8) Notes payable (Note 7) Accounts peyable (Note 7Y Accrued labilities (Notes 5, 6 and 17) Income taxes payable(Note 9 Totail current labilities Long-lerm debt (Note 8) Deferred icone taxes and other isttes Notes 6, 9, l3rd 17) Commitments and contingencies (Note 16 Redeemable preferred stock (Note 10) Shareholders equity Common stock at stated value (Note 11) 167 1,930 2491 2,131 3.951 6,334 1,079 1.480 5,027 1.199 1,544 Class A convertible- 178 and 178 shares outstanding Class B 679 and 692 shares outstanding Capital in excess of stated value Accumdated other comprehensive income (Note 14) 5,865 85 6,773 1,246 The accompanying Noles to the Conoldd Financa Sttements ane an.indegnal part of t sttement pendix E Nka Ine. Form 10 for the Fiscal Year Ended May 31.20 E-7 NIKE, Inc. Consolidated Statements of Cash Flows changos (credita) not aflecting cash: 2.472 3.23 s 2.003 Delored income taxes 518 sock-based compensation Note 11) (1130 191 Amortzation and other vet toreign currency adjustments Net gain on divesttures Changes i 68 n certain working capital compononts and other assets and iablties. 124 rcoaei i in prepaid expenses and ofthor current assets ceecounts payablo accrued list alities and income taueg payable (144 210) Cash provided by operations Cash used by investing activities: Purchases of short-term investments Maturtes of short-term investments Saks of short-term investments 133 1,663 1,330 4,336 3,655 2.216 3.932 1,126 (150) Aditions to property, plant and equipment Deposals of property, plant and equipment Proceeds rom divesttures ncreasel in other assets, net of other labilities used by investing activities Cash used by financing activities: Net proceeds from long-term debt issuance Long-1erm debt paryments, including current portion Decreasel increase in notes payable Payments on capital lease obligations Proceeds from exercise of stock options and other stock issuances Excess tax benefits from share-based payment arangements Repurchase of common stock Didends-common and prefor Cash used by financing activs fect of exchange rate chance cash and equivalents Net increase (decrease) in carienJ equivaients Cash and equivalents, beginnn of yoar CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for nterest, net of capitalized interest hcome taces lon cash additions to property, plant and equipment Didends declared and not paid 1,207) 986 (17) (19) 514 218 2,534) 132 12.628)(1,674 (1,045) ,083 3852 S 2220 3,337 2,790) 2.914 1,632 2,220 3,337 3,852 $ 53 $ 856 167 20 702 137 53 $ 1,262 206 Appendix E Nike Inc, Form 10-K for the Fiscal Year Ended May 31, 2015 E-8 NIKE, Inc. Consolidated Statements of Shareholders' Equity Capital in Accumulated Common Stock Class A Class B of Stated Comprehensive Retained Eanings Total n mallions, except per share data Balance at May 31, 2012 Shares Amount Shares Amount Value 180 s Stock options exorcised Conversion to Class B Common Stock Repurchase of Class B Common Stock 10 1.847 (1.657) (727 72 (1 Dividends on common stock ($0.81 per share) Issuance of shares to employoes 174 174 Stock-based componsation (Note 11) Forleiture of shares trom employees Net income 2.4722472 274 S 5,620 S 11.081 445 (2817) 12.628 3 $ 5,184 $ 716 S at May 31, 2013 178$ - 445 Stock options exercised Repurchase of Class B Common Stock Dividends on common stock ($0.93 per share) ssuance of shares to employees Stock-based compensation (Note 11) Forfeiture of shares from employoes Net income (37) (821) 78 78 2,693 85 S4,871 S 10,82 692 $ 14 178 S Stock options exercised Repurchase of Class B Common Stock Dhidends on common stock ($1.08 per share) ssuance of shares to employees Stock-based compensation (Note 11) Forfeture of shares from employees Net income 2.525) (2,53 (931) 92 191 3,273 3 1.161 Balance at May 31, 2015 178 S -679 S 773 1.246 S 4685 S 12 The accompanying Notes to the Corsolidated Financiw Statements ane an integrl part of this statoment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts