Question: Using the notation of (3.2), a floating-rate security (a floater) pays coupons c; = 100ri + s, where ri is a benchmark rate that will

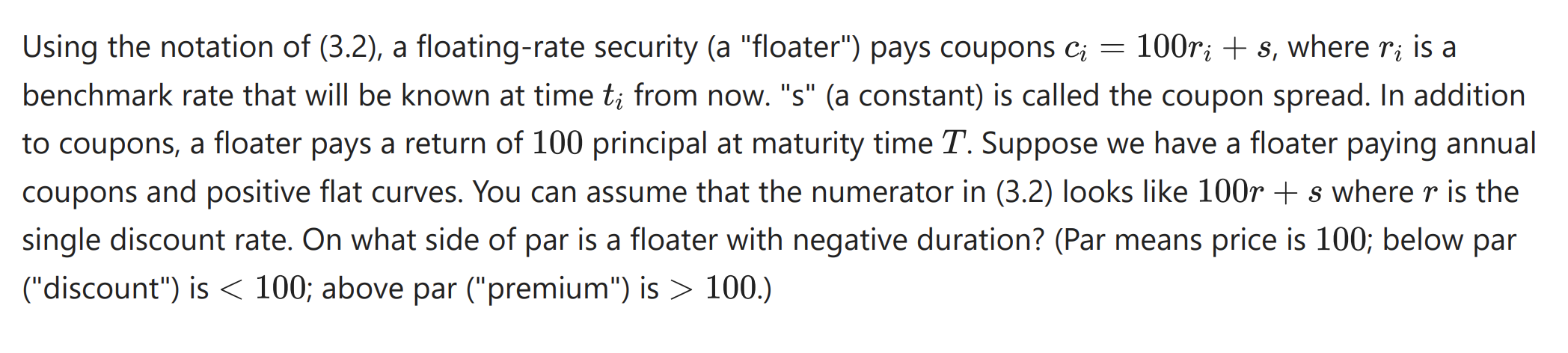

Using the notation of (3.2), a floating-rate security (a "floater") pays coupons c; = 100ri + s, where ri is a benchmark rate that will be known at time ti from now. "s" (a constant) is called the coupon spread. In addition to coupons, a floater pays a return of 100 principal at maturity time T. Suppose we have a floater paying annual coupons and positive flat curves. You can assume that the numerator in (3.2) looks like 100r + s where r is the single discount rate. On what side of par is a floater with negative duration? (Par means price is 100; below par ("discount") is 100.) Using the notation of (3.2), a floating-rate security (a "floater") pays coupons c; = 100ri + s, where ri is a benchmark rate that will be known at time ti from now. "s" (a constant) is called the coupon spread. In addition to coupons, a floater pays a return of 100 principal at maturity time T. Suppose we have a floater paying annual coupons and positive flat curves. You can assume that the numerator in (3.2) looks like 100r + s where r is the single discount rate. On what side of par is a floater with negative duration? (Par means price is 100; below par ("discount") is 100.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts