Question: USING the number which under the answer box. DO NOT USING THE NUMBER IN THE ENTER BOX! Thank you. Yukon Corp. has issued a convertible

USING the number which under the answer box. DO NOT USING THE NUMBER IN THE ENTER BOX! Thank you.

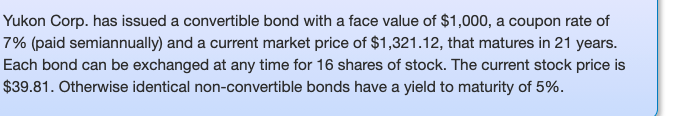

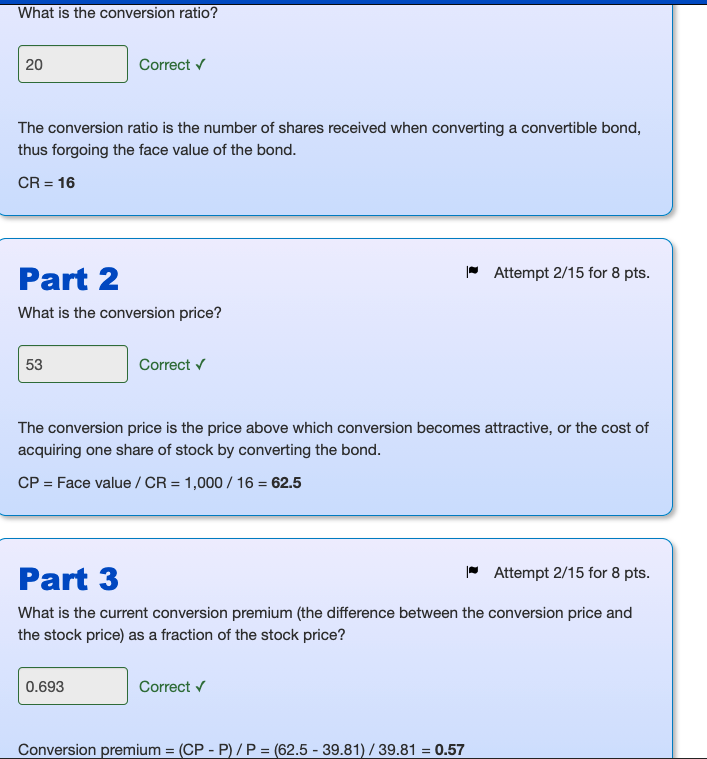

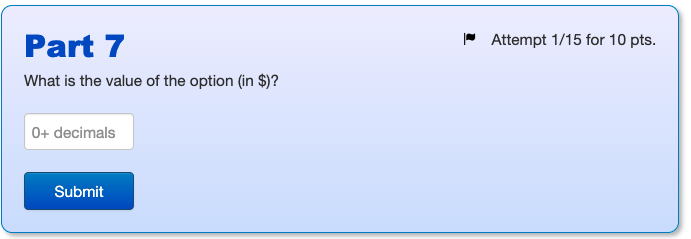

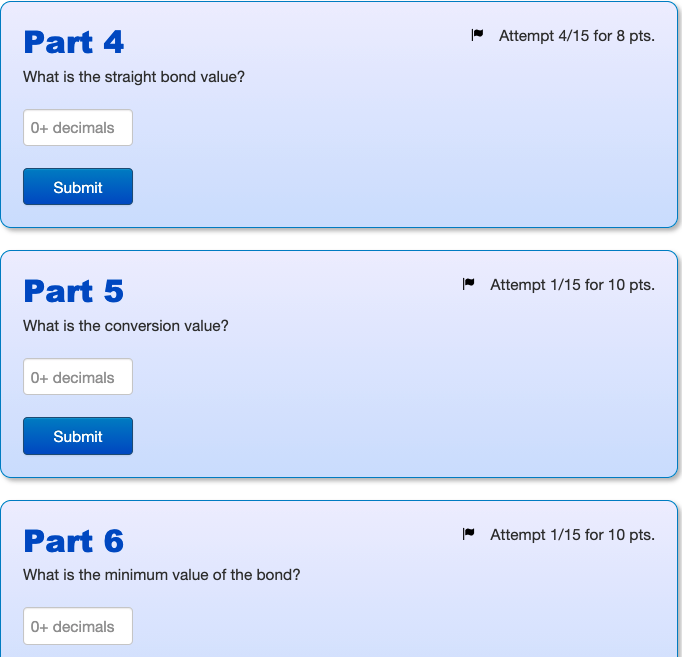

Yukon Corp. has issued a convertible bond with a face value of $1,000, a coupon rate of 7% (paid semiannually) and a current market price of $1,321.12, that matures in 21 years. Each bond can be exchanged at any time for 16 shares of stock. The current stock price is $39.81. Otherwise identical non-convertible bonds have a yield to maturity of 5%. What is the conversion ratio? 20 Correct The conversion ratio is the number of shares received when converting a convertible bond, thus forgoing the face value of the bond. CR = 16 Attempt 2/15 for 8 pts. Part 2 What is the conversion price? 53 Correct The conversion price is the price above which conversion becomes attractive, or the cost of acquiring one share of stock by converting the bond. CP = Face value / CR = 1,000 / 16 = 62.5 Part 3 Attempt 2/15 for 8 pts. What is the current conversion premium (the difference between the conversion price and the stock price) as a fraction of the stock price? 0.693 Correct Conversion premium = (CP-P)/P = (62.5 - 39.81)/39.81 = 0.57 | Attempt 1/15 for 10 pts. Part 7 What is the value of the option (in $)? 0+ decimals Submit Yukon Corp. has issued a convertible bond with a face value of $1,000, a coupon rate of 7% (paid semiannually) and a current market price of $1,321.12, that matures in 21 years. Each bond can be exchanged at any time for 16 shares of stock. The current stock price is $39.81. Otherwise identical non-convertible bonds have a yield to maturity of 5%. What is the conversion ratio? 20 Correct The conversion ratio is the number of shares received when converting a convertible bond, thus forgoing the face value of the bond. CR = 16 Attempt 2/15 for 8 pts. Part 2 What is the conversion price? 53 Correct The conversion price is the price above which conversion becomes attractive, or the cost of acquiring one share of stock by converting the bond. CP = Face value / CR = 1,000 / 16 = 62.5 Part 3 Attempt 2/15 for 8 pts. What is the current conversion premium (the difference between the conversion price and the stock price) as a fraction of the stock price? 0.693 Correct Conversion premium = (CP-P)/P = (62.5 - 39.81)/39.81 = 0.57 | Attempt 1/15 for 10 pts. Part 7 What is the value of the option (in $)? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts