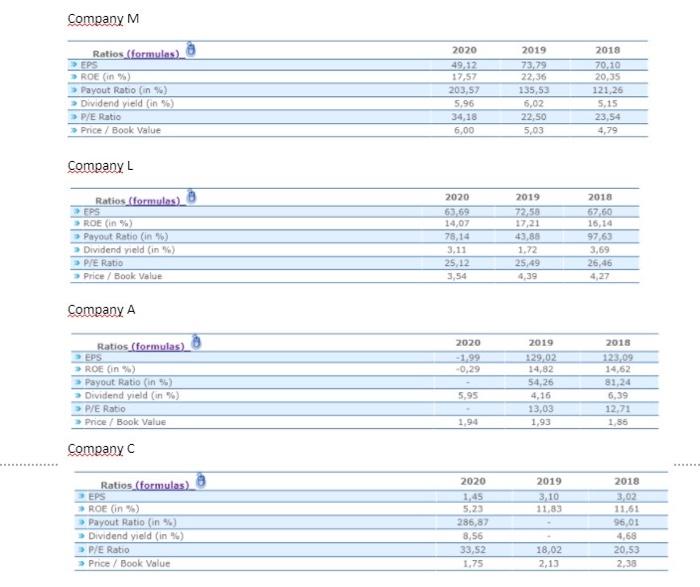

Question: using the P/E and divident yield ratio give a comparison to see if company X is under or overvalued Company M Ratios (formulas) > EPS

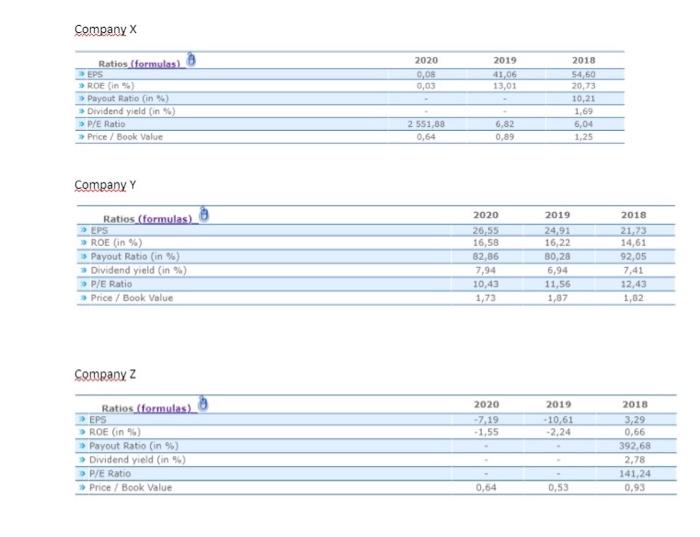

Company M Ratios (formulas) > EPS >> ROE (in %) > Payout Ratio (in %) > Dividend yield (in) P/E Ratio Price / Book Value 2020 49.12 17,57 203,57 5,96 34,18 6,00 2019 73.79 22,36 135,53 6,02 22,50 5,03 2018 70.10 20,35 121,26 5,15 23.54 4,79 Company L 2020 Ratios (formules) EPS > ROE (in %) Payout Ratio (in %) Dividend yield (in) > Pre Ratio > Price / Book Value 14,07 78,14 3.11 25,12 3,54 2019 72,50 17,21 43,88 1.72 25,49 4.39 2018 67.60 16,14 97.63 3,69 26,46 Company A 2020 -1.99 -0,29 Ratios_(formulas) EPS ROE (%) Payout Ratio (in 5) Dividend yield (in %) >> P/E Ratio Price / Book Value 2019 129,02 14,82 54,26 4,16 13,03 1,93 2018 123,09 14,62 81,24 6.39 12.71 1.35 5,95 1,94 Company 2020 1.45 2019 3.10 11.83 Ratios (formulos) EPS ROE (in %) Payout Ratio (in %) Dividend yield (in %) P/E Ratio Price / Book Value 5,23 286,87 8,56 33,52 1.75 2018 3,02 11.61 96,01 4,68 20,53 2.38 18,02 2,13 Company X 2020 9,03 0,03 2019 4105 13,01 Ratios formulas EPS ROE in ) Payout Ratio (in) Dividend yield (in %) > P/E Ratio Price / Book Value 2018 54.50 20,73 10,21 1,69 6,04 1,25 2 551,83 6,82 0,89 0,64 Company Ratios (formulas) EPS ROE (in %) > Payout Ratio (in 1963 Dividend yield (in %) P/E Ratio * Price / Book Value 2020 26,55 16,58 82,85 7,94 10.43 1,73 2019 24,91 16,22 30,28 6,94 11,56 1,87 2018 21.73 14,61 92,05 7,41 32,43 1,62 Company z 2020 -719 -1,55 2019 -10.61 -2.24 Ratios (formulas) EPS ROE (5) > Payout Ratio (in %) Dividend yield (in %) > P/E Ratio Price/Book Value 2018 3,29 0.66 392.68 2,78 141,24 0,93 0,64 0,53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts