Question: Using the percentage method for manual payroll with W-4s from 2020 or later in Appendix C calculate the federal withholding amounts for the following

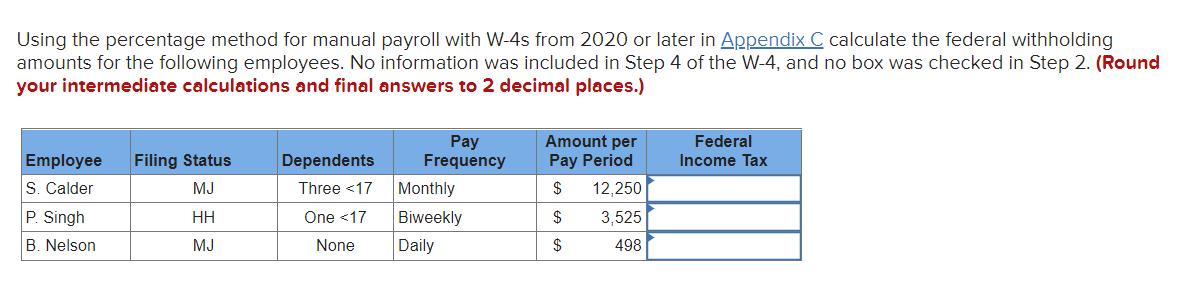

Using the percentage method for manual payroll with W-4s from 2020 or later in Appendix C calculate the federal withholding amounts for the following employees. No information was included in Step 4 of the W-4, and no box was checked in Step 2. (Round your intermediate calculations and final answers to 2 decimal places.) Pay Frequency Amount per Pay Period Federal Employee Filing Status Dependents Income Tax S. Calder MJ Three

Step by Step Solution

3.26 Rating (152 Votes )

There are 3 Steps involved in it

S Calder 12250 x 01 1225 ... View full answer

Get step-by-step solutions from verified subject matter experts