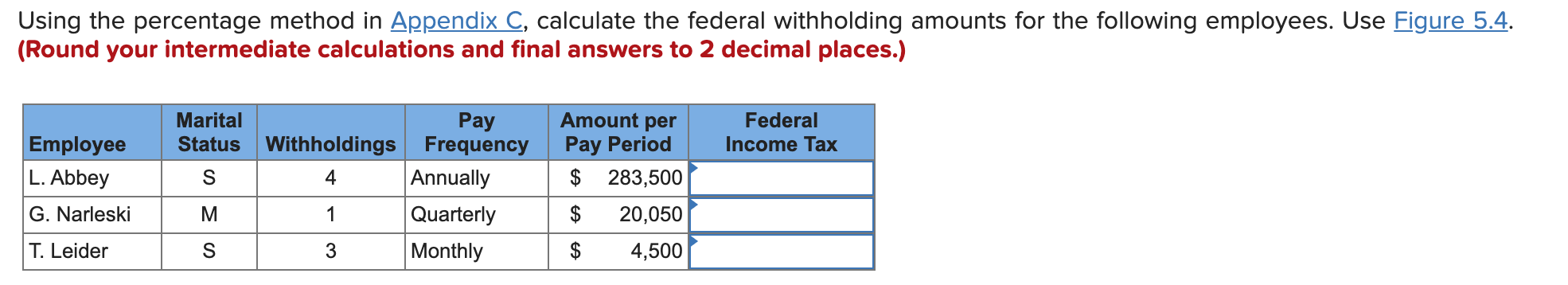

Question: Using the percentage method in Appendix C, calculate the federal withholding amounts for the following employees. Use Figure 5.4. (Round your intermediate calculations and final

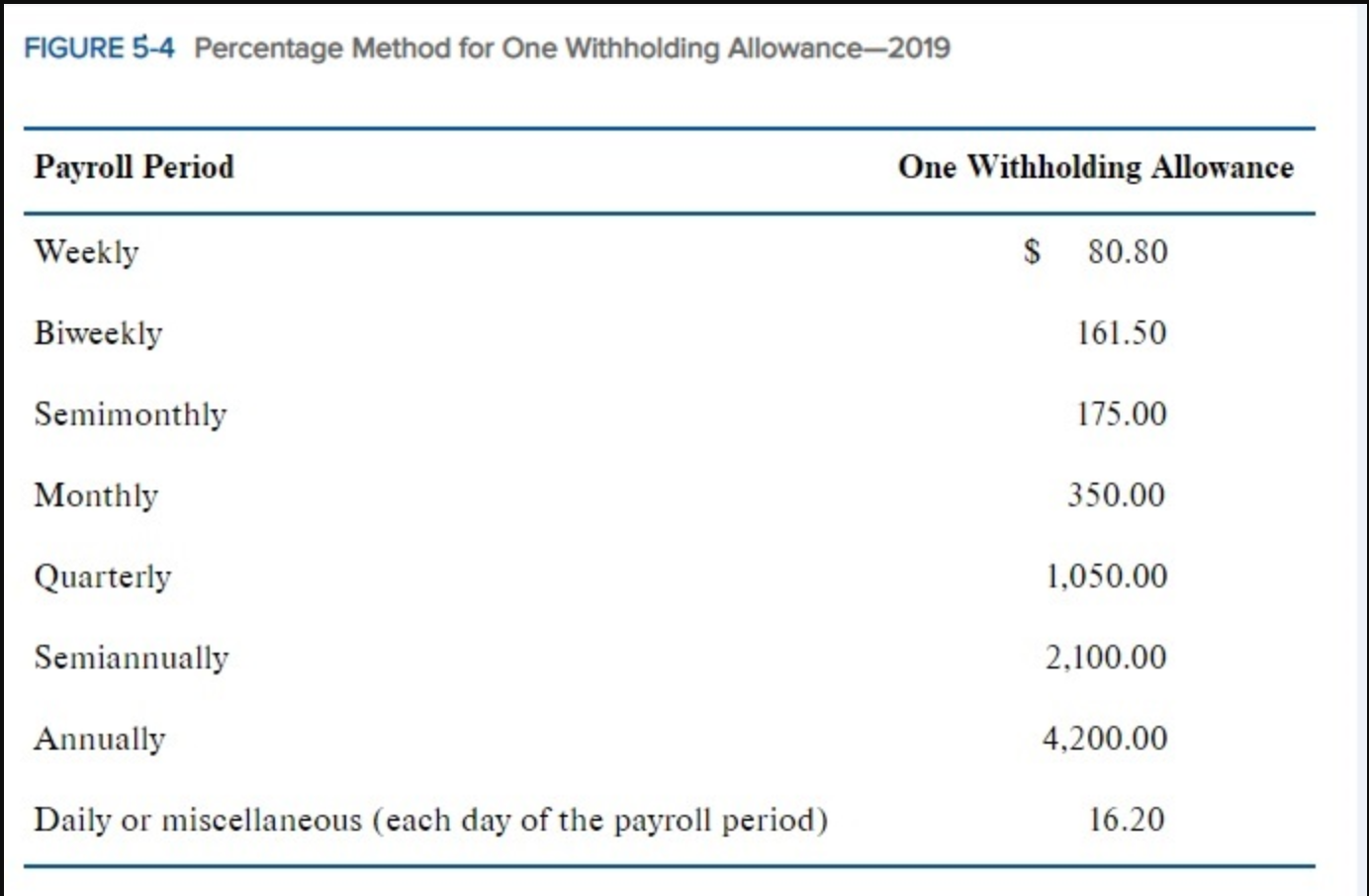

Using the percentage method in Appendix C, calculate the federal withholding amounts for the following employees. Use Figure 5.4. (Round your intermediate calculations and final answers to 2 decimal places.) Federal Income Tax Employee L. Abbey G. Narleski Marital Pay Status Withholdings Frequency S 4 Annually M Quarterly S 3 Monthly Amount per Pay Period $ 283,500 $ 20,050 4,500 1 T. Leider FIGURE 5-4 Percentage Method for One Withholding Allowance-2019 Payroll Period One Withholding Allowance Weekly $ 80.80 Biweekly 161.50 Semimonthly 175.00 Monthly 350.00 Quarterly 1,050.00 Semiannually 2,100.00 Annually 4,200.00 Daily or miscellaneous (each day of the payroll period) 16.20 Using the percentage method in Appendix C, calculate the federal withholding amounts for the following employees. Use Figure 5.4. (Round your intermediate calculations and final answers to 2 decimal places.) Federal Income Tax Employee L. Abbey G. Narleski Marital Pay Status Withholdings Frequency S 4 Annually M Quarterly S 3 Monthly Amount per Pay Period $ 283,500 $ 20,050 4,500 1 T. Leider FIGURE 5-4 Percentage Method for One Withholding Allowance-2019 Payroll Period One Withholding Allowance Weekly $ 80.80 Biweekly 161.50 Semimonthly 175.00 Monthly 350.00 Quarterly 1,050.00 Semiannually 2,100.00 Annually 4,200.00 Daily or miscellaneous (each day of the payroll period) 16.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts