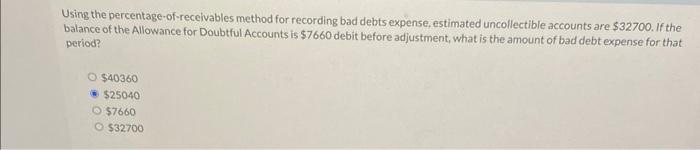

Question: Using the percentage-of-receivables method for recording bad debts expense, estimated uncollectible accounts are $32700. If the balance of the Allowance for Doubtful Accounts is $7660

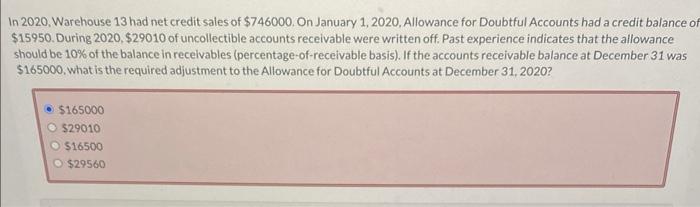

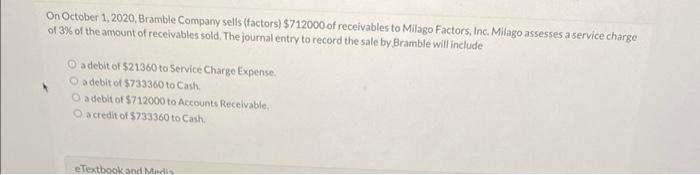

Using the percentage-of-receivables method for recording bad debts expense, estimated uncollectible accounts are $32700. If the balance of the Allowance for Doubtful Accounts is $7660 debit before adjustment, what is the amount of bad debt expense for that period? $40360$25040$7660$32700 In 2020, Warehouse 13 had net credit sales of $746000. On January 1,2020. Allowance for Doubtful Accounts had a credit balance c $15950. During 2020,$29010 of uncollectible accounts receivable were written off. Past experience indicates that the allowance should be 10% of the balance in recelvables (percentage-of-receivable basis). If the accounts receivable balance at December 31 was $165000, what is the required adjustment to the Allowance for Doubtful Accounts at December 31, 2020? On October 1,2020, Bramble Company sells (factors) \$712000 of receivables to Milago Factors, Inc. Milago assesses a service charge of 3% of the amount of receivables sold. The journal entry to record the sale by Bramble will include a debit of $21360 to Service Charge Expense. a debit of $733360 to Cash. a debit of $712000 to Accounts Receivable. a credit of $733360 to Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts