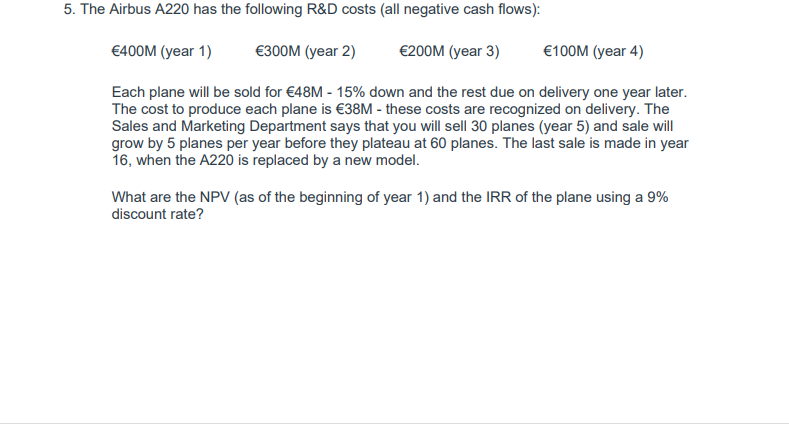

Question: Using the perpetuity formula, the formula automatically present values the perpetuity one period, so if you use the perpetuity formula in year 15, the result

Using the perpetuity formula, the formula automatically present values the perpetuity one period, so if you use the perpetuity formula in year 15, the result is as of the beginning of year 15!

Please help with the following five problem sets with populations, and calculations included so I can better understand the assignment for the final.

After the following pictures is a link containing the template, please follow the template it is open for edits! Thank you! All cells in yellow are supposed to be populated.

Time Value of Money - Derivation of Key Equations may be helpful

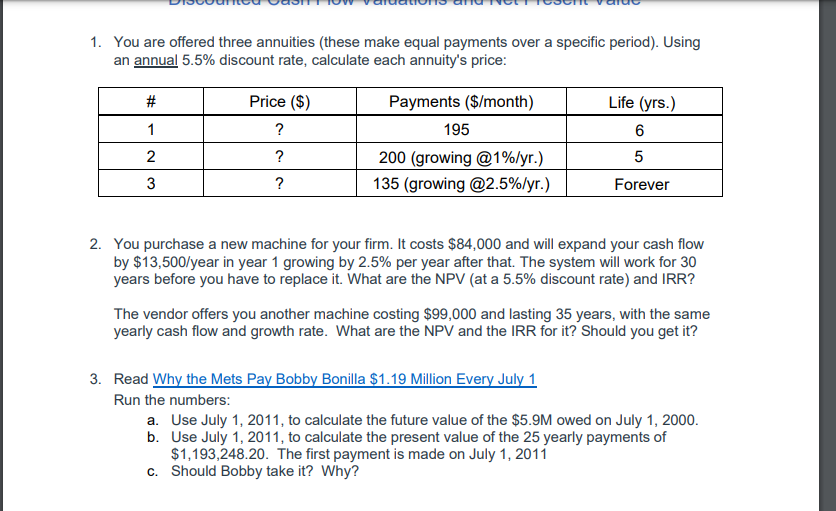

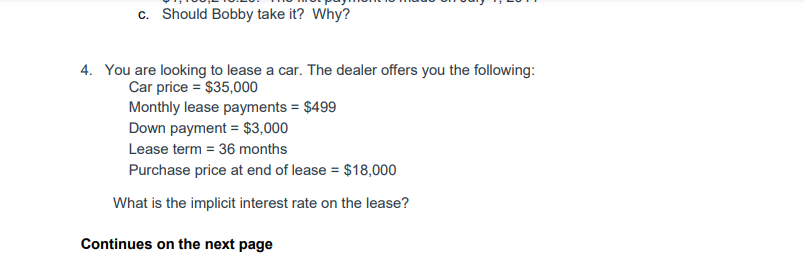

1. You are offered three annuities [these make equal payments over a specific period}. Using an annual 5.5% discount rate. calculate each annuity's price: Payments {$imonth) 200 {growing @1%i'yr.} 3 2 135 {growing @2.5%iyr.] 2. You purchase a new machine for your rm. It costs $34,000 and will expand your cash ow by $13.5001year in year 1 growing by 2.5% per year after that. The system will work for 30 years before you have to replace it. What are the NFV (at a 5.5% discount rate) and IRR? The vendor offers you another machine costing $09,000 and lasting 35 years. with the same yearly cash ow and growth rate. What are the NW and the IRR for it"iI Should you get it'? 3. Read Why the Mets Pay Booby Elonilla1.1t=1I Million Eyegg July 1 Run the numbers; a. Use July 1, 2011, to calculate the future value of the $5.9M owed on July 1, 2000. b. Use July 1, 2011, to calculate the present value of the 25 yearly payments of $1,103,243.20. The rst payment is made on July 11 2011 c. Should Bobby take it? Why? c. Should Bobby take it? Why? 4. You are looking to lease a car. The dealer offers you the following: Car price = $35,000 Monthly lease payments = $499 Down payment = $3,000 Lease term = 36 months Purchase price at end of lease = $18,000 What is the implicit interest rate on the lease? Continues on the next page5. The Airbus A220 has the following R&D costs (all negative cash flows): E400M (year 1) 6300M (year 2) E200M (year 3) E100M (year 4) Each plane will be sold for 648M - 15% down and the rest due on delivery one year later. The cost to produce each plane is E38M - these costs are recognized on delivery. The Sales and Marketing Department says that you will sell 30 planes (year 5) and sale will grow by 5 planes per year before they plateau at 60 planes. The last sale is made in year 16, when the A220 is replaced by a new model. What are the NPV (as of the beginning of year 1) and the IRR of the plane using a 9% discount rate