Question: Using the premium schedules provided in Exhibit 8.2, Exhibit 8.3, and Exhibit 8.5, how much in annual premium would a 25-year-old male have to pay

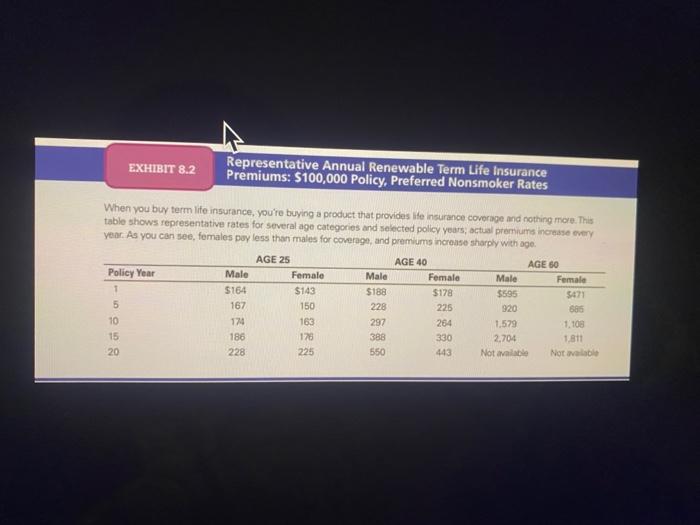

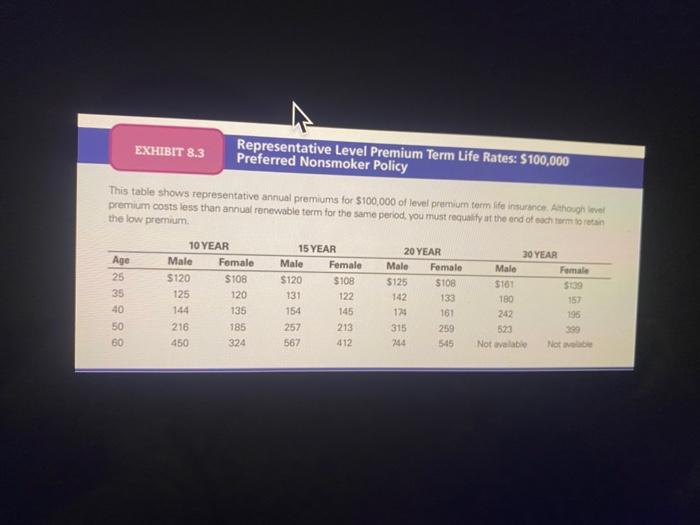

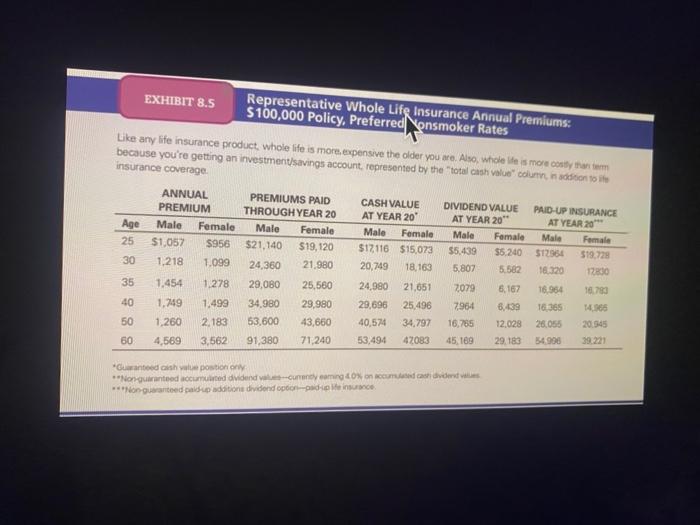

Using the premium schedules provided in Exhibit 8.2, Exhibit 8.3, and Exhibit 8.5, how much in annual premium would a 25-year-old male have to pay for $100,000 of an renewable term, level premium term, and whole life Insurance? (Assume a 15-year term or period of coverage.) How much would a 25-year-old woman have to pay for the same coverage? (Hint: Use the average of the first and the last years premiums in your calculations for the annual renewable term life insurance.) Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male $ Female $ Consider a 40-year-old male (or female): Using annual premiums, compute the total cost of 10 years of coverage under annual renewable and level premium term options and whole life insurance coverage (Hint: Use the average of the first and the last years' premiums in your calculations for the annual renewable term life insurance. Round your answers to the nearest dollar Annual Renewable Term Level-Premium Term Whole Life Male Female Relate the advantages and disadvantages of each policy type to their price differences, EXHIBIT 8.2 Representative Annual Renewable Term Life Insurance Premiums: S100,000 Policy. Preferred Nonsmoker Rates When you buy term life insurance, you're buying a product that provides ite insurance coverage and nothing more. This table shows representative rates for several age categories and selected polley years, actual premiums increase every year. As you can see, females pay less than males for coverage, and premiums increase sharply with age. AGE 25 AGE 40 AGE 60 Policy Year Male Female Mala Female Male Female 1 5164 $143 S188 5178 $595 5471 5 167 150 228 225 920 685 10 174 163 297 264 1.579 1.108 15 186 178 388 330 2,704 1.811 20 228 225 550 443 Not available Not valable EXHIBIT 8.3 Representative Level Premium Term Life Rates: $100,000 Preferred Nonsmoker Policy This table shows representative annual premiums for S100,000 of level premium term life insurance. Atough level premium costs less than annual renewable term for the same period you must requality at the end of each orm to retain the low premium 10 YEAR 15 YEAR 20 YEAR 30 YEAR Age Male Female Male Female Male Female Male Female 25 $120 S108 $120 $108 5125 $108 5181 S439 35 125 131 122 142 133 180 157 40 144 135 154 145 124 161 242 195 50 216 585 257 213 315 259 523 399 60 450 324 567 412 744 545 Not available Noteb 120 EXHIBIT 8.5 Representative Whole Life Insurance Annual Premiums: $100,000 Policy. Preferred Konsmoker Rates Like any life insurance product, whole life is more expensive the older you are. Also, while te is more contato because you're getting an investmentsavings account, represented by the total cash value column, niin toi insurance coverage ANNUAL PREMIUMS PAID CASH VALUE PREMIUM DIVIDEND VALUE THROUGH YEAR 20 PAID-UP INSURANCE AT YEAR 20 AT YEAR 20" AT YEAR 20" Age Male Female Male Female Male Female Male Female Male Female 25 $1,057 $956 $21,140 $19,120 $12116 $15,073 $5.439 55.240 $12564 $19,728 30 1,218 1.099 24,360 21.980 20,749 18,163 5.807 5.582 18,320 12800 35 1.454 1.278 29,080 25,560 24.990 21,651 2079 6.167 16.954 16.790 40 1.79 1.499 34.980 29,980 29,696 25.496 7964 8,439 18.365 14:36 50 1,260 2.183 53.600 43,650 40,574 34.797 16,785 12.028 26.055 20.545 60 4,569 3,562 91,380 71.240 53,494 42083 29.183 45.189 54.998 "Guated as a position or ""Non guaranteed accumuwted dividend en coming on cash va Moguaranteed additions dividend options Using the premium schedules provided in Exhibit 8.2, Exhibit 8.3, and Exhibit 8.5, how much in annual premium would a 25-year-old male have to pay for $100,000 of an renewable term, level premium term, and whole life Insurance? (Assume a 15-year term or period of coverage.) How much would a 25-year-old woman have to pay for the same coverage? (Hint: Use the average of the first and the last years premiums in your calculations for the annual renewable term life insurance.) Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male $ Female $ Consider a 40-year-old male (or female): Using annual premiums, compute the total cost of 10 years of coverage under annual renewable and level premium term options and whole life insurance coverage (Hint: Use the average of the first and the last years' premiums in your calculations for the annual renewable term life insurance. Round your answers to the nearest dollar Annual Renewable Term Level-Premium Term Whole Life Male Female Relate the advantages and disadvantages of each policy type to their price differences, EXHIBIT 8.2 Representative Annual Renewable Term Life Insurance Premiums: S100,000 Policy. Preferred Nonsmoker Rates When you buy term life insurance, you're buying a product that provides ite insurance coverage and nothing more. This table shows representative rates for several age categories and selected polley years, actual premiums increase every year. As you can see, females pay less than males for coverage, and premiums increase sharply with age. AGE 25 AGE 40 AGE 60 Policy Year Male Female Mala Female Male Female 1 5164 $143 S188 5178 $595 5471 5 167 150 228 225 920 685 10 174 163 297 264 1.579 1.108 15 186 178 388 330 2,704 1.811 20 228 225 550 443 Not available Not valable EXHIBIT 8.3 Representative Level Premium Term Life Rates: $100,000 Preferred Nonsmoker Policy This table shows representative annual premiums for S100,000 of level premium term life insurance. Atough level premium costs less than annual renewable term for the same period you must requality at the end of each orm to retain the low premium 10 YEAR 15 YEAR 20 YEAR 30 YEAR Age Male Female Male Female Male Female Male Female 25 $120 S108 $120 $108 5125 $108 5181 S439 35 125 131 122 142 133 180 157 40 144 135 154 145 124 161 242 195 50 216 585 257 213 315 259 523 399 60 450 324 567 412 744 545 Not available Noteb 120 EXHIBIT 8.5 Representative Whole Life Insurance Annual Premiums: $100,000 Policy. Preferred Konsmoker Rates Like any life insurance product, whole life is more expensive the older you are. Also, while te is more contato because you're getting an investmentsavings account, represented by the total cash value column, niin toi insurance coverage ANNUAL PREMIUMS PAID CASH VALUE PREMIUM DIVIDEND VALUE THROUGH YEAR 20 PAID-UP INSURANCE AT YEAR 20 AT YEAR 20" AT YEAR 20" Age Male Female Male Female Male Female Male Female Male Female 25 $1,057 $956 $21,140 $19,120 $12116 $15,073 $5.439 55.240 $12564 $19,728 30 1,218 1.099 24,360 21.980 20,749 18,163 5.807 5.582 18,320 12800 35 1.454 1.278 29,080 25,560 24.990 21,651 2079 6.167 16.954 16.790 40 1.79 1.499 34.980 29,980 29,696 25.496 7964 8,439 18.365 14:36 50 1,260 2.183 53.600 43,650 40,574 34.797 16,785 12.028 26.055 20.545 60 4,569 3,562 91,380 71.240 53,494 42083 29.183 45.189 54.998 "Guated as a position or ""Non guaranteed accumuwted dividend en coming on cash va Moguaranteed additions dividend options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts