Question: Using the prices below (which are closing prices on 9/13/02 were taken from the WSJ on 9/16/02) check that if put-call parity holds for

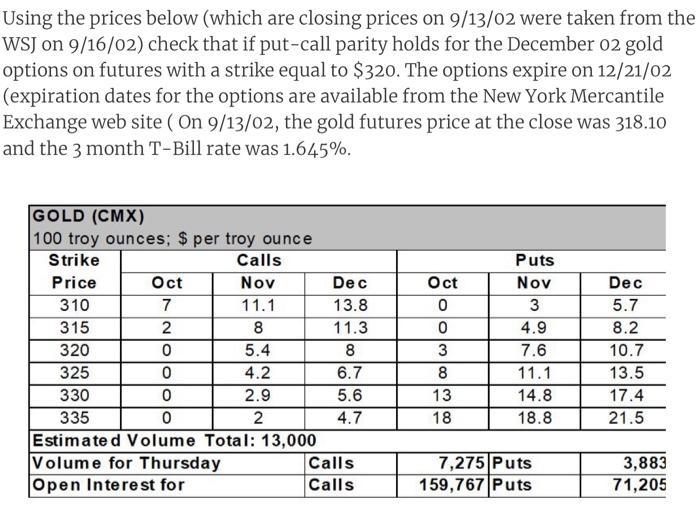

Using the prices below (which are closing prices on 9/13/02 were taken from the WSJ on 9/16/02) check that if put-call parity holds for the December 02 gold options on futures with a strike equal to $320. The options expire on 12/21/02 (expiration dates for the options are available from the New York Mercantile Exchange web site (On 9/13/02, the gold futures price at the close was 318.10 and the 3 month T-Bill rate was 1.645%. GOLD (CMX) 100 troy ounces; $ per troy ounce Strike Calls Puts Price Oct Nov Oct Nov Dec 310 7 11.1 0 3 5.7 315 2 8 0 4.9 8.2 320 0 5.4 3 7.6 10.7 325 0 4.2 8 11.1 13.5 330 0 2.9 13 14.8 17.4 335 0 2 18 18.8 21.5 Estimated Volume Total: 13,000 Volume for Thursday 7,275 Puts Open Interest for 159,767 Puts Dec 13.8 11.3 8 6.7 5.6 4.7 Calls Calls 3,883 71,205

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

According to the put call parity PS CKert LHS PS0 10... View full answer

Get step-by-step solutions from verified subject matter experts