Question: Using the price-sales ratio - Excel 2 - X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 A A 96

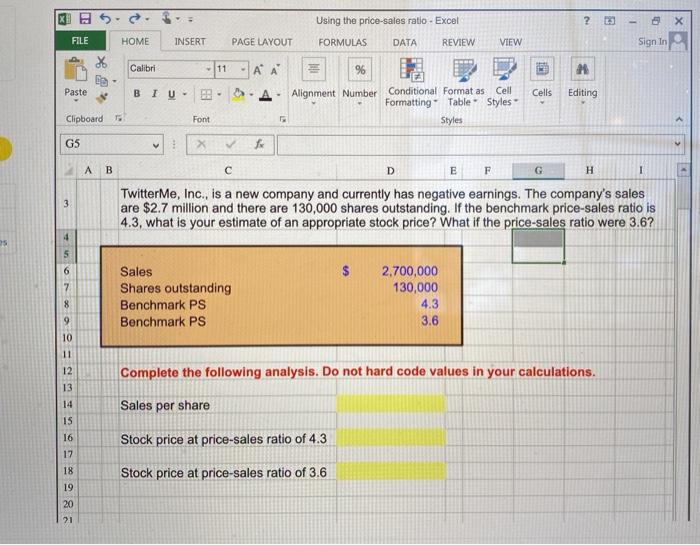

Using the price-sales ratio - Excel 2 - X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 A A 96 Paste BIU- B- . Cells Editing Alignment Number Conditional Format as Cell Formatting" Table Styles Styles Clipboard Font G5 v A B D E F G H 1 3 TwitterMe, Inc., is a new company and currently has negative earnings. The company's sales are $2.7 million and there are 130,000 shares outstanding. If the benchmark price-sales ratio is 4.3, what is your estimate of an appropriate stock price? What if the price-sales ratio were 3.6? 4 es 5 6 7 $ Sales Shares outstanding Benchmark PS Benchmark PS 2,700,000 130,000 4.3 3.6 8 9 10 11 12 13 Complete the following analysis. Do not hard code values in your calculations. Sales per share IS 16 Stock price at price-sales ratio of 4.3 Stock price at price-sales ratio of 3.6 17 18 19 20 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts