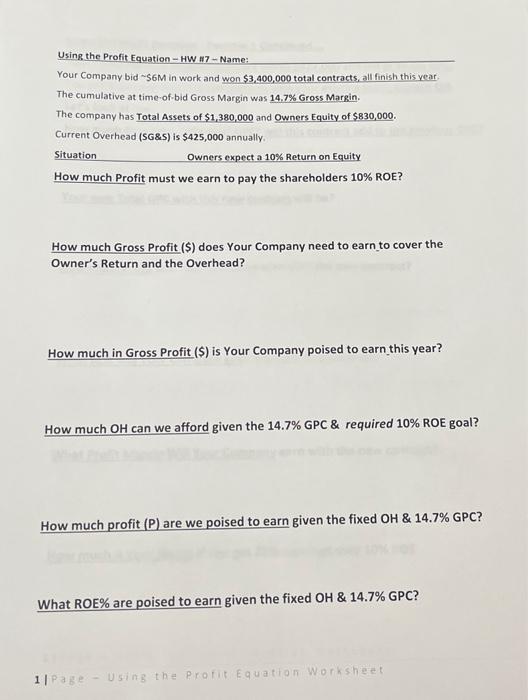

Question: Using the Profit Equation - HW #7 - Name: Your Company bid ~$6M in work and won $3,400,000 total contracts, all finish this year. The

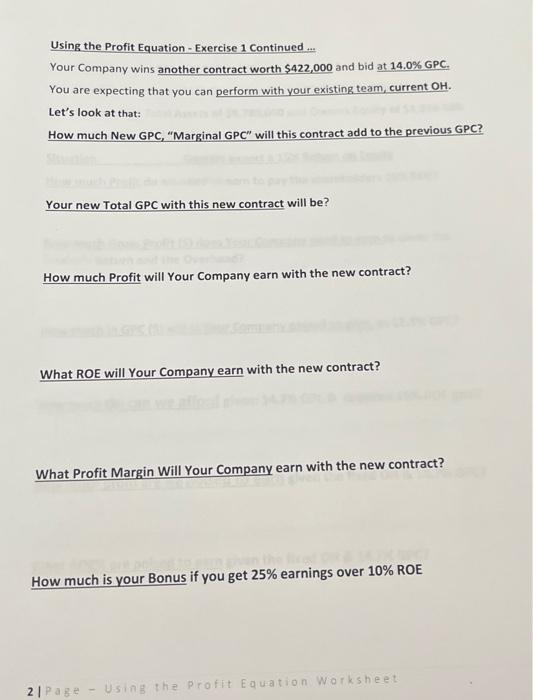

Using the Profit Equation - HW 17 - Name: Your Company bid $6M in work and won $3,400,000 total contracts, all finish this vearThe cumulative at time-of-bid Gross Margin was 14.7% Gross Margin. The company has Total Assets of $1,380,000 and Owners Equity of $830,000. Current Overhead (SG\&S) is $425,000 annually. Situation Owners expect a 10% Return on Equity How much Profit must we earn to pay the shareholders 10% ROE? How much Gross Profit (\$) does Your Company need to earn to cover the Owner's Return and the Overhead? How much in Gross Profit (\$) is Your Company poised to earn this year? How much OH can we afford given the 14.7% GPC \& required 10% ROE goal? How much profit (P) are we poised to earn given the fixed OH&14.7% GPC? What ROE\% are poised to earn given the fixed OH&14.7% GPC? Using the Profit Equation - Exercise 1 Continued ... Your Company wins another contract worth $422,000 and bid at 14.0%GPC. You are expecting that you can perform with your existing team, current OH. Let's look at that: How much New GPC, "Marginal GPC" will this contract add to the previous GPC? Your new Total GPC with this new contract will be? How much Profit will Your Company earn with the new contract? What ROE will Your Company earn with the new contract? What Profit Margin Will Your Company earn with the new contract? How much is your Bonus if you get 25% earnings over 10% ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts