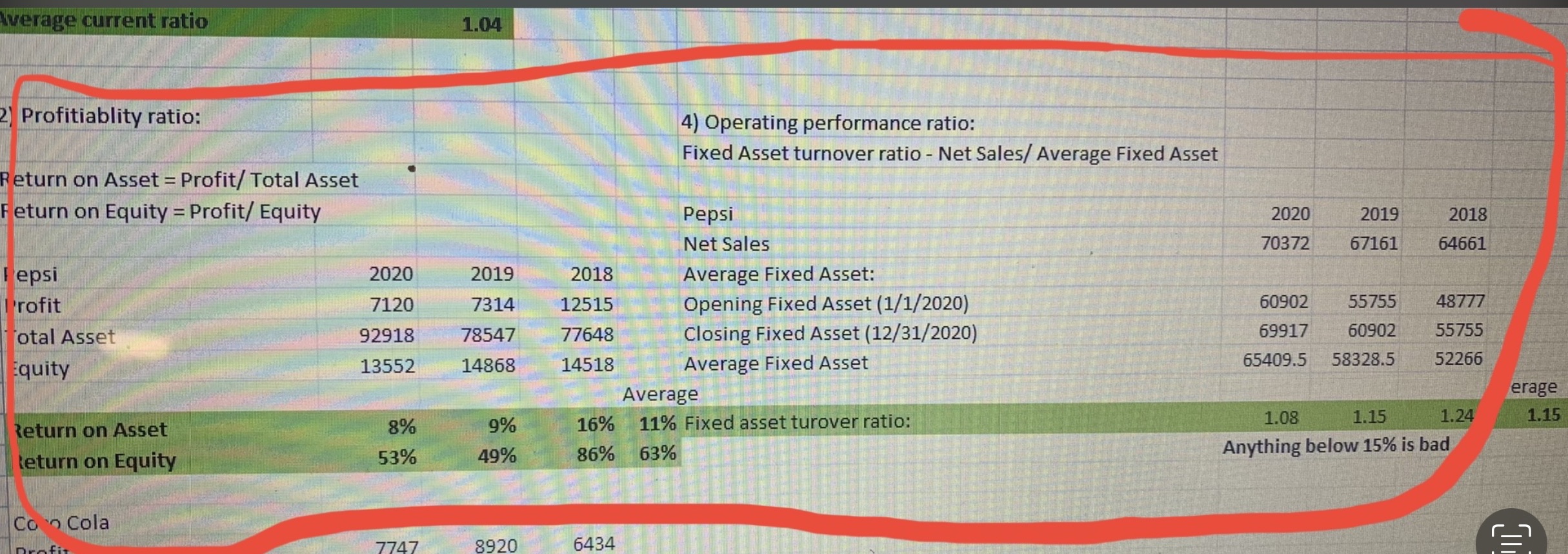

Question: Using the profitability and operating performance ratios, discuss what conclusions you can make about each company's profits over the past three years. Support your conclusions.

Using the profitability and operating performance ratios, discuss what conclusions you can make about each company's profits over the past three years. Support your conclusions. Which company is doing better, why or why not?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts