Question: Using the provided Balance Sheet and Income Statement for Cartwright Lumber, please create a simple Cash Flow statement for the years 2002, 2003, and Q1

Using the provided Balance Sheet and Income Statement for Cartwright Lumber, please create a simple Cash Flow statement for the years 2002, 2003, and Q1 of 2004, separating out the items into Cashflow from Operations, Cashflow from Investing, and Cashflow from Financing. For simplicity treat the various Notes payable and all the Long-term debt as a single debt-financing cashflow item, including the original loan payable to Henry Stark. Break out the changes in inventory, accounts receivables, accounts payable, and accrued expenses as separate cash items (rather than grouping them into a single working capital item). In case you are unfamiliar with spreadsheet modeling, note that the fastest way to calculate the cashflow items for all periods is to reference the cells from the income statement and balance sheet directly for your 2002 calculations using a "relative reference" (i.e. without the dollar signs) and then copy those operations to the right. Thus you should only need to impute the resulting cashflow items once

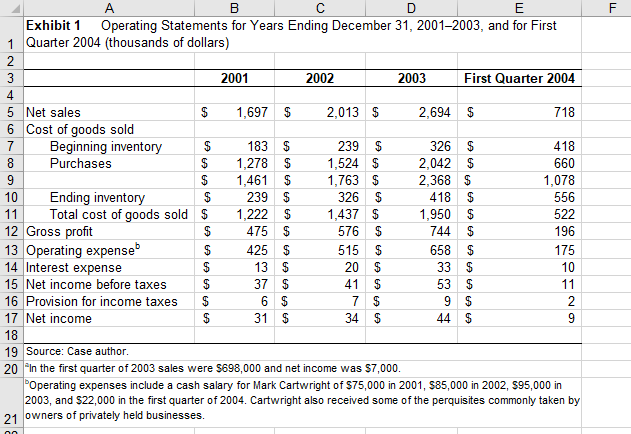

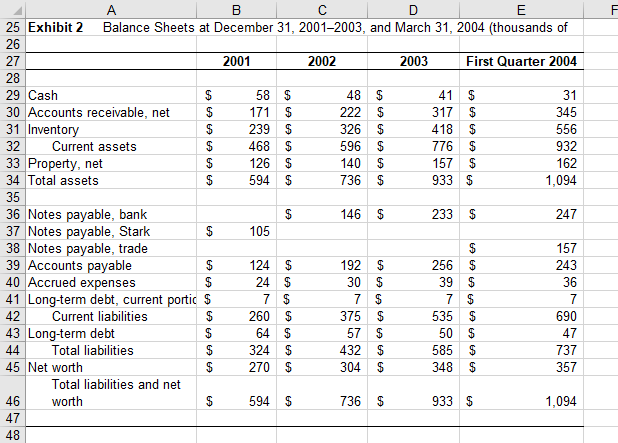

F 00 OUN- CA B D E Exhibit 1 Operating Statements for Years Ending December 31, 2001-2003, and for First 1 Quarter 2004 (thousands of dollars) 2 3 2001 2002 2003 First Quarter 2004 4 5 Net sales 1,697 $ 2,013 $ 2,694 $ 718 6 Cost of goods sold 7 Beginning inventory $ 183 $ 239 $ 326 $ 418 8 Purchases $ 1,278 $ 1,524 $ 2,042 $ 660 9 1,461 $ 1,763 $ 2,368 $ 1,078 10 Ending inventory $ 239 $ 326 $ 418 $ 556 11 Total cost of goods sold $ 1,222 $ 1,437 $ 1,950 $ 522 12 Gross profit $ 475 576 744 $ 196 13 Operating expense 425 $ 515 $ 658 $ 175 14 Interest expense $ 13 $ 20 $ 33 $ 10 15 Net income before taxes $ 37 $ 41 $ 53 $ 11 16 Provision for income taxes $ 6 $ 7 $ 9 $ 2 17 Net income $ 31 $ 34 $ 44 $ 9 18 19 Source: Case author. 20 in the first quarter of 2003 sales were $698,000 and net income was $7,000. Operating expenses include a cash salary for Mark Cartwright of $75,000 in 2001, 585,000 in 2002, 595,000 in 2003, and $22,000 in the first quarter of 2004. Cartwright also received some of the perquisites commonly taken by 21 owners of privately held businesses. no A A A A A A $ A B D E 25 Exhibit 2 Balance Sheets at December 31, 2001-2003, and March 31, 2004 (thousands of 26 27 2001 2002 2003 First Quarter 2004 28 29 Cash $ 58 $ 48 $ 41 $ 31 30 Accounts receivable, net $ 171 $ 222 317 $ 345 31 Inventory 239 326 $ 418 $ 556 32 Current assets 468 $ 596 $ 776 932 33 Property, net 126 $ 140 $ 157 $ 162 34 Total assets 594 $ 736 $ 933 $ 1,094 35 36 Notes payable, bank $ 146 $ 233 $ 247 37 Notes payable, Stark 105 38 Notes payable, trade $ 157 39 Accounts payable $ 124 $ 192 $ 256 243 40 Accrued expenses 24 $ 30 $ 39 $ 36 41 Long-term debt, current portic $ 7 $ 7 $ 7 $ 7 42 Current liabilities $ 260 $ 375 $ 535 $ 690 43 Long-term debt $ 64 $ 57 $ 50 $ 47 44 Total liabilities $ 324 $ 432 $ 585 $ 737 45 Net worth $ 270 $ 304 $ 348 $ 357 Total liabilities and net 46 worth $ 594 $ 736 $ 933 $ 1,094 47 48 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts