Question: Using the provided financial statements as a starting point: 1. The DCF valuation and pro forma financials with five years of forecasted growth rates are

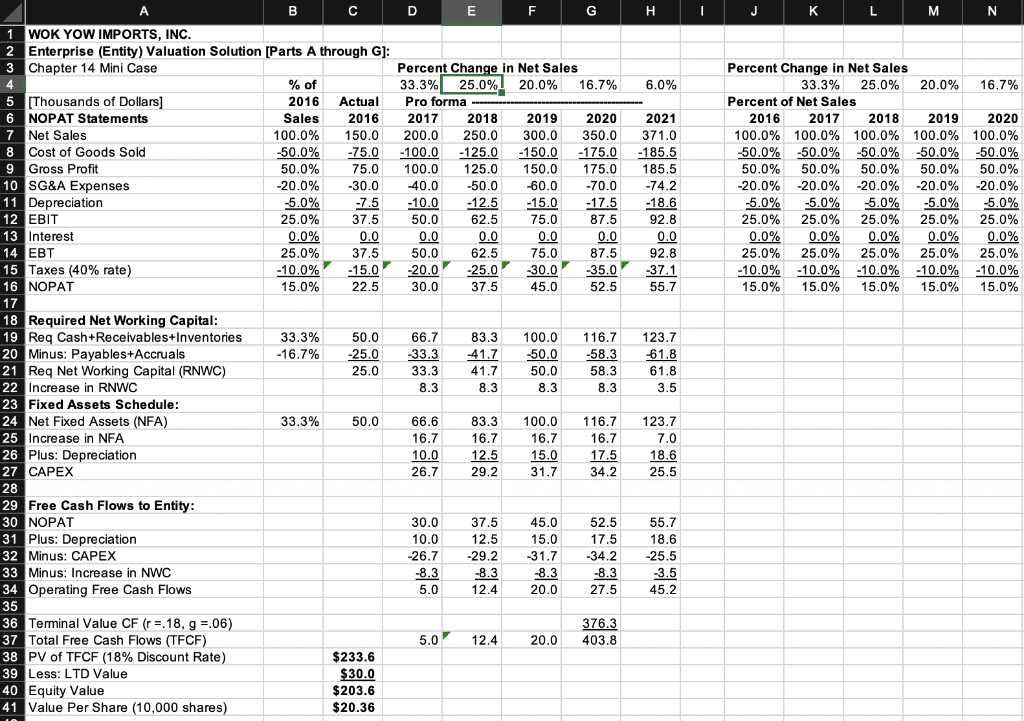

Using the provided financial statements as a starting point: 1. The DCF valuation and pro forma financials with five years of forecasted growth rates are provided in the original model. Please modify the model to consider a more successful scenario where Wok Yow's sales grow at a more aggressive pace of 40% for five years and then flatten to a more sustainable growth rate of 7%. What would the stock value per share be under the new scenario? What kind of strategic changes you would make in the business model to justify the growth assumption? How would you do things differently? You can use fictional events to justify your assumptions. H I J K L M 6.0% 20.0% 16.7% 2021 371.0 -185.5 185.5 -74.2 -18.6 92.8 0.0 92.8 -37.1 55.7 Percent Change in Net Sales 33.3% 25.0% Percent of Net Sales 2016 2017 2018 100.0% 100.0% 100.0% -50.0% -50.0% -50.0% 50.0% 50.0% 50.0% -20.0% -20.0% -20.0% -5.0% -5.0% 5.0% 25.0% 25.0% 25.0% 0.0% 0.0% 0.0% 25.0% 25.0% 25.0% -10.0% -10.0% -10.0% 15.0% 15.0% 15.0% 2019 100.0% -50.0% 50.0% 20.0% -5.0% 25.0% 0.0% 25.0% -10.0% 15.0% 2020 100.0% -50.0% 50.0% -20.0% 5.0% 25.0% 0.0% 25.0% -10.0% 15.0% 0.0 B C D E F G 1 WOK YOW IMPORTS, INC. 2 Enterprise (Entity) Valuation Solution [Parts A through G]: 3 Chapter 14 Mini Case Percent Change in Net Sales % of 33.3% 25.0% 20.0% 16.7% 5 [Thousands of Dollars] 2016 Actual Pro forma ---- 6 NOPAT Statements Sales 2016 2017 2018 2019 2020 7 Net Sales 100.0% 150.0 200.0 250.0 300.0 350.0 8 Cost of Goods Sold -50.0% -75.0 -100.0 -125.0 -150.0 -175.0 9 Gross Profit 50.0% 75.0 100.0 125.0 150.0 175.0 10 SG&A Expenses -20.0% -30.0 40.0 -50.0 60.0 -70.0 11 Depreciation -5.0% -7.5 -10.0 -12.5 -15.0 -17.5 12 EBIT 25.0% 37.5 50.0 62.5 75.0 87.5 13 Interest 0.0% 0.0 0.0 0.0 0.0 14 EBT 25.0% 37.5 50.0 62.5 75.0 87.5 15 Taxes (40% rate) -10.0% -15.0 -20.0 -25.0 30.0 35.0 16 NOPAT 15.0% 22.5 30.0 37.5 45.0 52.5 17 18 Required Net Working Capital: 19 Reg Cash+Receivables+Inventories 33.3% 50.0 66.7 83.3 100.0 116.7 20 Minus: Payables+Accruals -16.7% -25.0 33.3 41.7 -50.0 -58.3 21 Req Net Working Capital (RNWC) 25.0 33.3 41.7 50.0 58.3 22 Increase in RNWC 8.3 8.3 8.3 8.3 23 Fixed Assets Schedule: 24 Net Fixed Assets (NFA) 33.3% 50.0 66.6 83.3 100.0 116.7 25 Increase in NFA 16.7 16.7 16.7 16.7 26 Plus: Depreciation 10.0 12.5 15.0 17.5 27 CAPEX 26.7 29.2 31.7 34.2 28 29 Free Cash Flows to Entity: 30 NOPAT 30.0 37. 5 45.0 52.5 31 Plus: Depreciation 10.0 12.5 15.0 17.5 32 Minus: CAPEX -26.7 -29.2 31.7 -34.2 33 Minus: Increase in NWC -8.3 -8.3 -8.3 -8.3 34 Operating Free Cash Flows 5.0 12.4 20.0 27.5 35 36 Terminal Value CF (r = 18, g =.06) 376.3 37 Total Free Cash Flows (TFCF) 5.0 12.4 20.0 403.8 38 PV of TFCF (18% Discount Rate) $233.6 39 Less: LTD Value $30.0 40 Equity Value $203.6 41 Value Per Share (10,000 shares) $20.36 123.7 -61.8 61.8 3.5 123.7 7.0 18.6 25.5 55.7 18.6 -25.5 3.5 45.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts