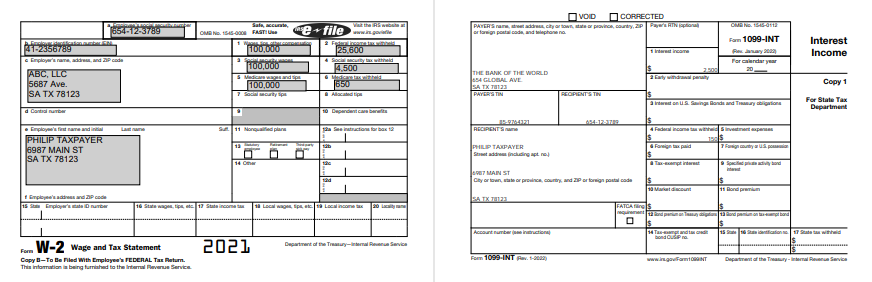

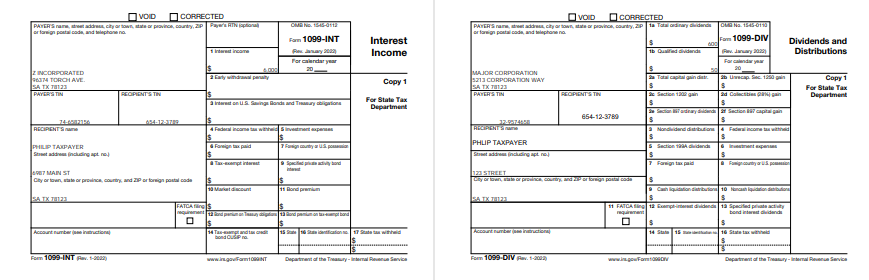

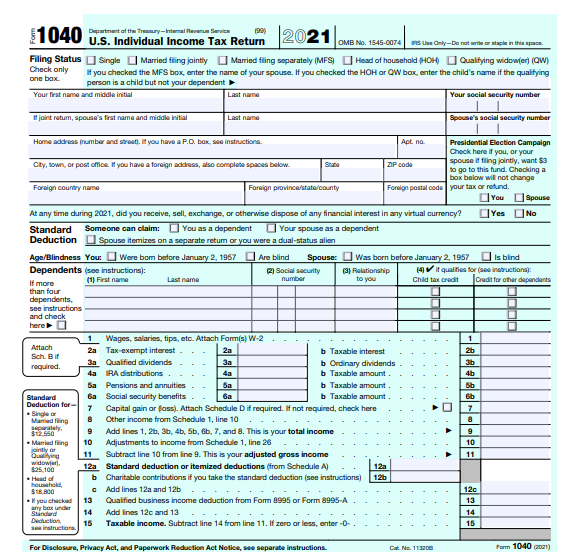

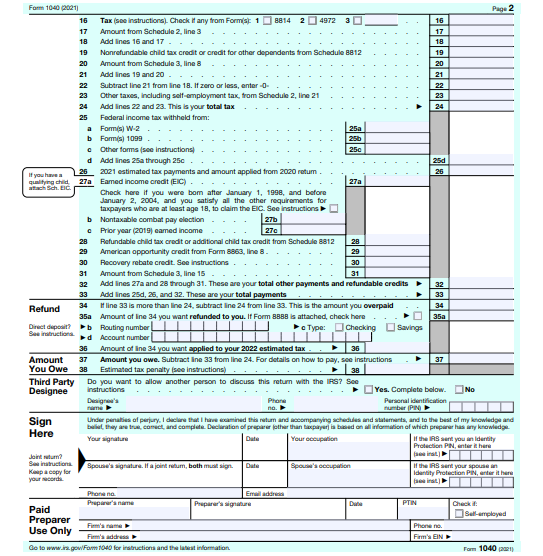

Question: Using the provided source documents, complete the 2021 F1040 for Philip Taxpayer. Philip files Single and has no dependents. Philips social security number is: 654-12-3789

Using the provided source documents, complete the 2021 F1040 for Philip Taxpayer.

Philip files Single and has no dependents.

Philips social security number is: 654-12-3789

Philips address is: 6987 Main St. San Antonio, TX 78123

Philip did not buy, sell, or trade any virtual currency during the tax year. Philip made no estimated tax payments during the tax year.

To calculate Philips total tax, use the bracket provided.

Round all calculations to the nearest dollar.

For your final submission, be sure to print the fillable files to a .pdf format.

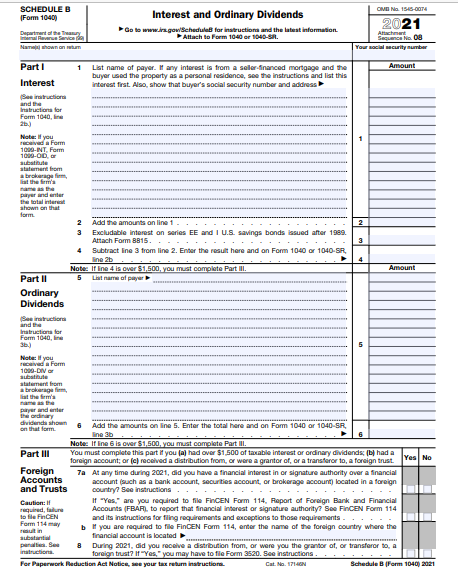

Capy D-To De Riled With Erriplayew'a PeDeAL Tax Raturn. Thin infarrution ia being farnithed ta the lrtiernal Revenus Bervica. Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or CW box, enter the child's name if the qualfying one bax. person is a child but not your dependent At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Standard Someone can claim: D You as a dependent D Your spouse as a dependent Deduction Spouse itemizes on a separate retum or you were a dual-status alion Dependents (see instructions): If more than four dependents, see instructions and check here (1) First name Last name b Taxable interest b Ordinary dividends b Taxable amount. b Taxable amount. b Taxable amount. Deduction fer- 7 Capital gain or (lass). Attach Schedule D if required. If not required, cheok here - Bingle a Mariad fing 8 Other income from Schedule 1, line 10 3iparalety, 9 Add lines 1, 2b, 3b, 4b, 5b, 6b,7,7, and 8 . This is your total income housahole, a Add lines 12a and 12b \$1B,800 13 Cualfied business income deduction from Form 8995 or Form 8995A. \begin{tabular}{l|l} ampingux undar \\ Slandird \end{tabular} Ductuetias, 15 Taxable income. Subtract line 14 from line 11. If zero ar less, enter 0 - . For Disclosure, Privacy Act, and Paperwerk Reduetion Act Notice, sete separate instructions. \begin{tabular}{|c|c} \hline 1 & \\ \hline 2b & \\ \hline 3b & \\ \hline 4b & \\ \hline 6b & \\ \hline 6b & \\ \hline 7 & \\ \hline 8 & \\ \hline 9 & \\ \hline 10 & \\ \hline 11 & \\ \hline & \\ \hline 12c & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline & \\ \hline \end{tabular} Form 10e0 (2021] Capy D-To De Riled With Erriplayew'a PeDeAL Tax Raturn. Thin infarrution ia being farnithed ta the lrtiernal Revenus Bervica. Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or CW box, enter the child's name if the qualfying one bax. person is a child but not your dependent At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Standard Someone can claim: D You as a dependent D Your spouse as a dependent Deduction Spouse itemizes on a separate retum or you were a dual-status alion Dependents (see instructions): If more than four dependents, see instructions and check here (1) First name Last name b Taxable interest b Ordinary dividends b Taxable amount. b Taxable amount. b Taxable amount. Deduction fer- 7 Capital gain or (lass). Attach Schedule D if required. If not required, cheok here - Bingle a Mariad fing 8 Other income from Schedule 1, line 10 3iparalety, 9 Add lines 1, 2b, 3b, 4b, 5b, 6b,7,7, and 8 . This is your total income housahole, a Add lines 12a and 12b \$1B,800 13 Cualfied business income deduction from Form 8995 or Form 8995A. \begin{tabular}{l|l} ampingux undar \\ Slandird \end{tabular} Ductuetias, 15 Taxable income. Subtract line 14 from line 11. If zero ar less, enter 0 - . For Disclosure, Privacy Act, and Paperwerk Reduetion Act Notice, sete separate instructions. \begin{tabular}{|c|c} \hline 1 & \\ \hline 2b & \\ \hline 3b & \\ \hline 4b & \\ \hline 6b & \\ \hline 6b & \\ \hline 7 & \\ \hline 8 & \\ \hline 9 & \\ \hline 10 & \\ \hline 11 & \\ \hline & \\ \hline 12c & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline & \\ \hline \end{tabular} Form 10e0 (2021]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts