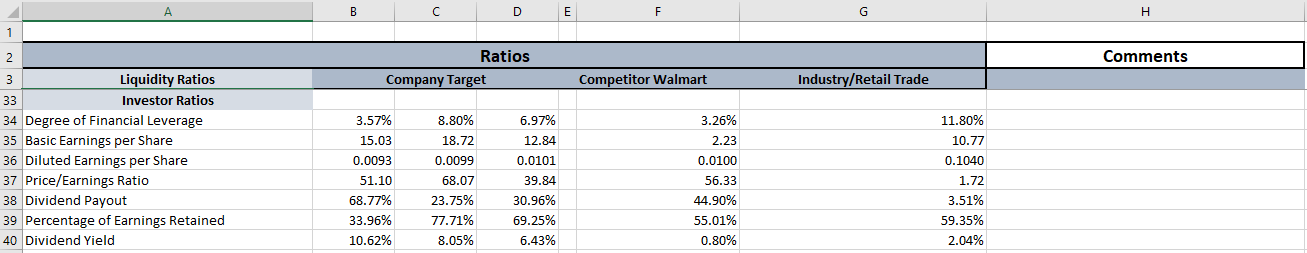

Question: Using the ratios above, describe how changes impact the company's performance. A 1 2 3 33 34 Degree of Financial Leverage 35 Basic Earnings per

Using the ratios above, describe how changes impact the company's performance.

A 1 2 3 33 34 Degree of Financial Leverage 35 Basic Earnings per Share 36 Diluted Earnings per Share 37 Price/Earnings Ratio 38 Dividend Payout 39 Percentage of Earnings Retained 40 Dividend Yield Liquidity Ratios Investor Ratios B 3.57% 15.03 0.0093 51.10 68.77% 33.96% 10.62% Company Target 8.80% 18.72 0.0099 68.07 23.75% 77.71% 8.05% D Ratios 6.97% 12.84 0.0101 39.84 30.96% 69.25% 6.43% E F Competitor Walmart 3.26% 2.23 0.0100 56.33 44.90% 55.01% 0.80% G Industry/Retail Trade 11.80% 10.77 0.1040 1.72 3.51% 59.35% 2.04% H Comments

Step by Step Solution

There are 3 Steps involved in it

Answer Based on the provided ratios we can analyze how changes in these ratios impact the performance of the company compared to its competitor Walmar... View full answer

Get step-by-step solutions from verified subject matter experts