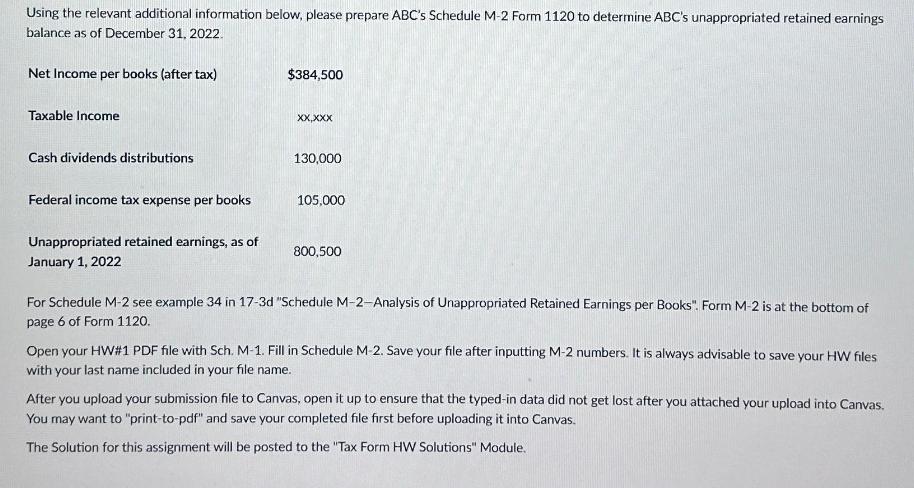

Question: Using the relevant additional information below, please prepare ABC's Schedule M-2 Form 1120 to determine ABC's unappropriated retained earnings balance as of December 31,

Using the relevant additional information below, please prepare ABC's Schedule M-2 Form 1120 to determine ABC's unappropriated retained earnings balance as of December 31, 2022. Net Income per books (after tax) Taxable Income Cash dividends distributions Federal income tax expense per books Unappropriated retained earnings, as of January 1, 2022 $384,500 XX,XXX 130,000 105,000 800,500 For Schedule M-2 see example 34 in 17-3d "Schedule M-2-Analysis of Unappropriated Retained Earnings per Books". Form M-2 is at the bottom of page 6 of Form 1120. Open your HW# 1 PDF file with Sch. M-1. Fill in Schedule M-2. Save your file after inputting M-2 numbers. It is always advisable to save your HW files with your last name included in your file name. After you upload your submission file to Canvas, open it up to ensure that the typed-in data did not get lost after you attached your upload into Canvas. You may want to "print-to-pdf" and save your completed file first before uploading it into Canvas. The Solution for this assignment will be posted to the "Tax Form HW Solutions" Module.

Step by Step Solution

There are 3 Steps involved in it

Schedule M2 Analysis of Unappropriated Retained Earnings per Books 1 Unappropriated retained earnin... View full answer

Get step-by-step solutions from verified subject matter experts