Question: Using the Risk-Free + Premium method for calculating the cost of debt (or expected return on debt), what would the answer be? a. 9.6% b.

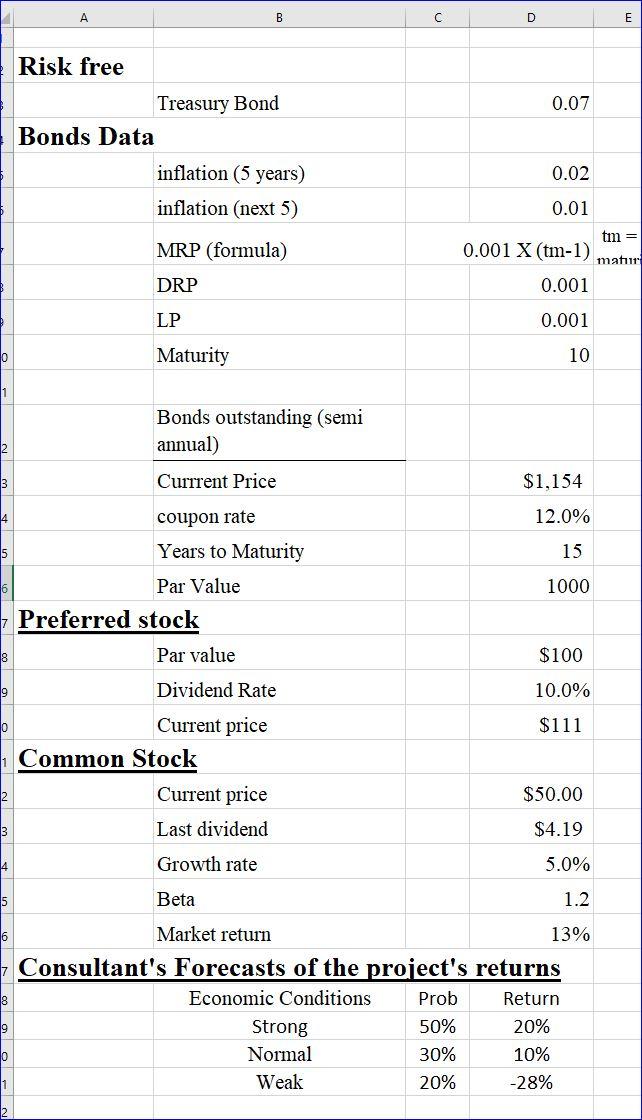

Using the Risk-Free + Premium method for calculating the cost of debt (or expected return on debt), what would the answer be?

a. 9.6%

b. 5.5%

c. 2.2%

d. 12.5%

Risk free Treasury Bond 0.07 Bonds Data Bonds outstanding (semi annual) Currrent Price coupon rate $1,154 Years to Maturity Par Value 12.0% Preferred stock \begin{tabular}{|l|c|} \hline Par value & $100 \\ \hline Dividend Rate & 10.0% \\ \hline Current price & $111 \end{tabular} Common Stock \begin{tabular}{|l|r|} \hline Current price & $50.00 \\ \hline Last dividend & $4.19 \\ \hline Growth rate & 5.0% \\ \hline Beta & 1.2 \\ \hline Market return & 13% \\ \hline \end{tabular} Consultant's Forecasts of the project's returns \begin{tabular}{|c|c|c} \hline Economic Conditions & Prob & Return \\ \hline Strong & 50% & 20% \\ \hline Normal & 30% & 10% \\ \hline Weak & 20% & 28% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts