Question: Using the rollforward schedule and subledgers for various rollforward components, you are performing reconciliation of PPE to general ledger. Asset Name, Description, and Reference Asset

Using the rollforward schedule and subledgers for various rollforward components, you are performing reconciliation of PPE to general ledger.

Asset Name, Description, and Reference

Asset Classification (i.e Machinery, Vehicles, Building, etc.)

Beginning Balance- Cost

Additions- Cost

Deduction impairment- Cost

Transfers from AUC/CWIP to fixed assets- cost

Other adjustments-cost

Ending balance- cost

Beginning and closing balance of accumulated depreciation

Depreciation Expense

Net beginning balance

Net additions

Net transfer from AUC/CWIP to Fixed Assets

Net deduction- Impairment

Net deduction Disposals

Net other Adjustments

Net Closing Value of the Asset (Original Cost Less Total Accumulated Depreciation)

What details are missing from the rollforward schedule to enable you to complete the testing?

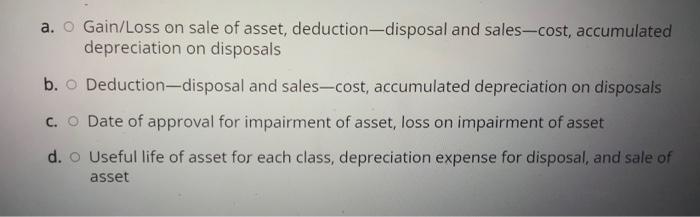

a. Gain/Loss on sale of asset, deduction-disposal and sales-cost, accumulated depreciation on disposals b. Deduction-disposal and sales-cost, accumulated depreciation on disposals c. Date of approval for impairment of asset, loss on impairment of asset d. Useful life of asset for each class, depreciation expense for disposal, and sale of asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts