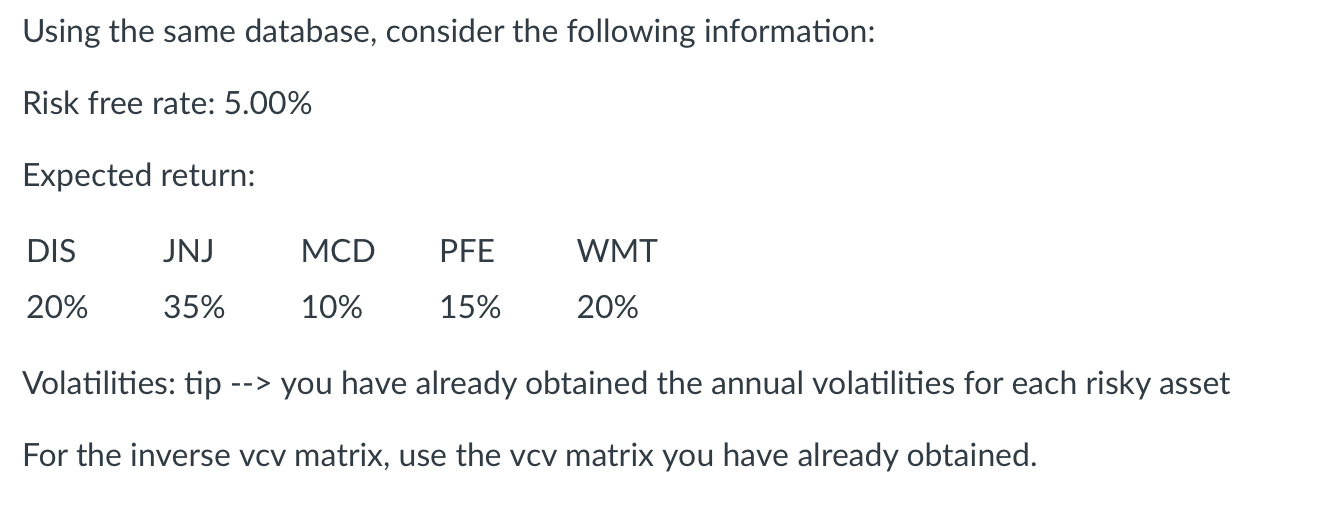

Question: Using the same database, consider the following information: Risk free rate: 5.00% Expected return: DIS JNJ MCD PFE WMT 20% 35% 10% 15% 20% Volatilities:

Using the same database, consider the following information: Risk free rate: 5.00% Expected return: DIS JNJ MCD PFE WMT 20% 35% 10% 15% 20% Volatilities: tip --> you have already obtained the annual volatilities for each risky asset For the inverse vcv matrix, use the vev matrix you have already obtained. What's the surplus return of JNJ? Provide your answer in number (do not put the % sign in the answer, just put the number) rounded to O decimals, for instance: 10 Using the same database, consider the following information: Risk free rate: 5.00% Expected return: DIS JNJ MCD PFE WMT 20% 35% 10% 15% 20% Volatilities: tip --> you have already obtained the annual volatilities for each risky asset For the inverse vcv matrix, use the vev matrix you have already obtained. What's the surplus return of JNJ? Provide your answer in number (do not put the % sign in the answer, just put the number) rounded to O decimals, for instance: 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts