Question: Using the SAME information as from the previous question (use the values you calculated there): The bonds your company just issued carry a yield to

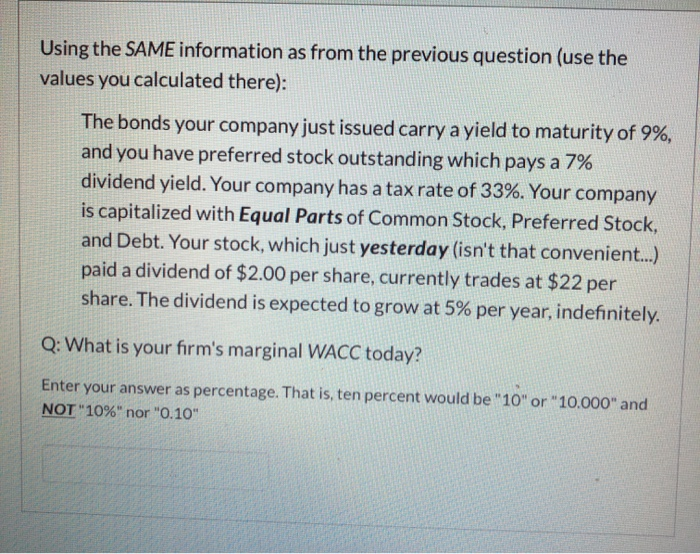

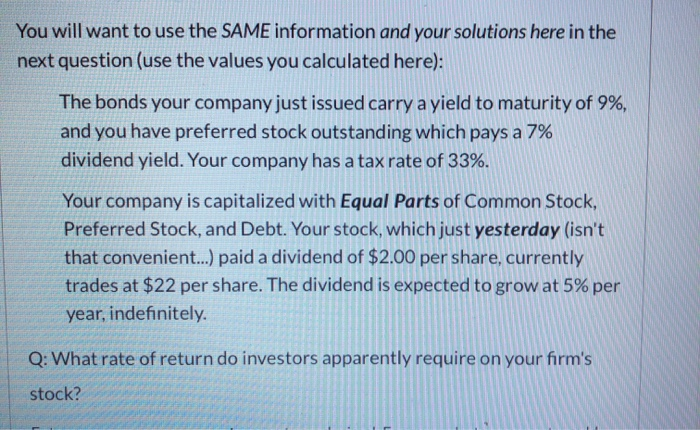

Using the SAME information as from the previous question (use the values you calculated there): The bonds your company just issued carry a yield to maturity of 9%, and you have preferred stock outstanding which pays a 7% dividend yield. Your company has a tax rate of 33%. Your company is capitalized with Equal Parts of Common Stock, Preferred Stock, and Debt. Your stock, which just yesterday (isn't that convenient...) paid a dividend of $2.00 per share, currently trades at $22 per share. The dividend is expected to grow at 5% per year, indefinitely. Q: What is your firm's marginal WACC today? Enter your answer as percentage. That is, ten percent would be "10" or "10.000" and NOT "10%" nor "0.10" You will want to use the SAME information and your solutions here in the next question (use the values you calculated here): The bonds your company just issued carry a yield to maturity of 9%, and you have preferred stock outstanding which pays a 7% dividend yield. Your company has a tax rate of 33%. Your company is capitalized with Equal Parts of Common Stock, Preferred Stock, and Debt. Your stock, which just yesterday (isn't that convenient...) paid a dividend of $2.00 per share, currently trades at $22 per share. The dividend is expected to grow at 5% per year, indefinitely Q: What rate of return do investors apparently require on your firm's SON stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts